Experian Investor Presentation Deck

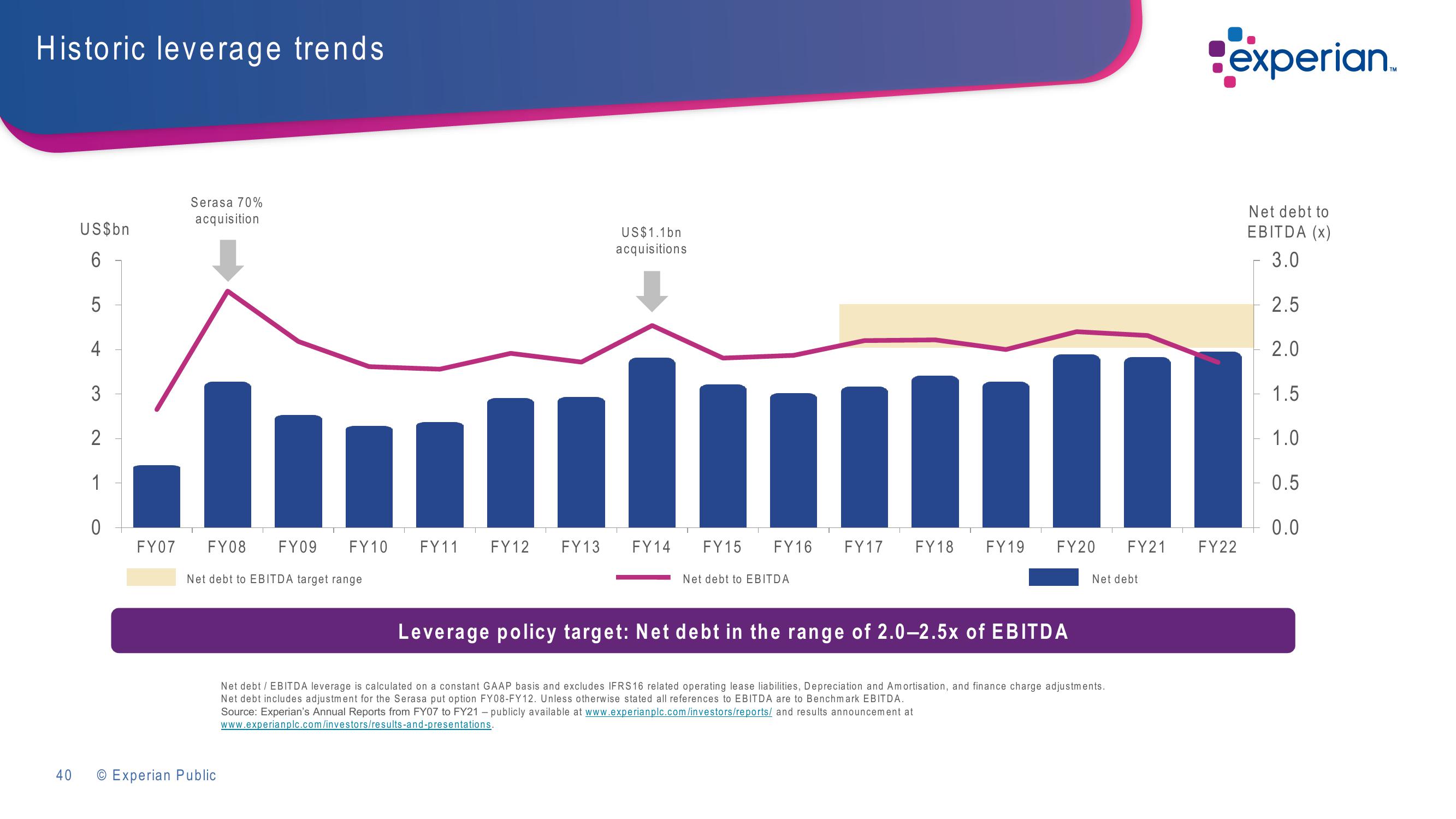

Historic leverage trends

40

US$bn

6

LO

5

4

3

2

1

0

Serasa 70%

acquisition

In

FY08

FY09 FY10

Net debt to EBITDA target range

FY07

O Experian Public

FY11

US$1.1bn

acquisitions

1

FY12 FY13 FY14

FY15 FY16 FY17

Net debt to EBITDA

FY18 FY19

FY20 FY21

Net debt

Leverage policy target: Net debt in the range of 2.0-2.5x of EBITDA

Net debt / EBITDA leverage is calculated on a constant GAAP basis and excludes IFRS16 related operating lease liabilities, Depreciation and Amortisation, and finance charge adjustments.

Net debt includes adjustment for the Serasa put option FY08-FY12. Unless otherwise stated all references to EBITDA are to Benchmark EBITDA.

Source: Experian's Annual Reports from FY07 to FY21 - publicly available at www.experianplc.com/investors/reports/ and results announcement at

www.experianplc.com/investors/results-and-presentations.

experian..

FY22

Net debt to

EBITDA (x)

3.0

2.5

2.0

1.5

1.0

0.5

0.0View entire presentation