Presentation to Vermont Pension Investment Committee

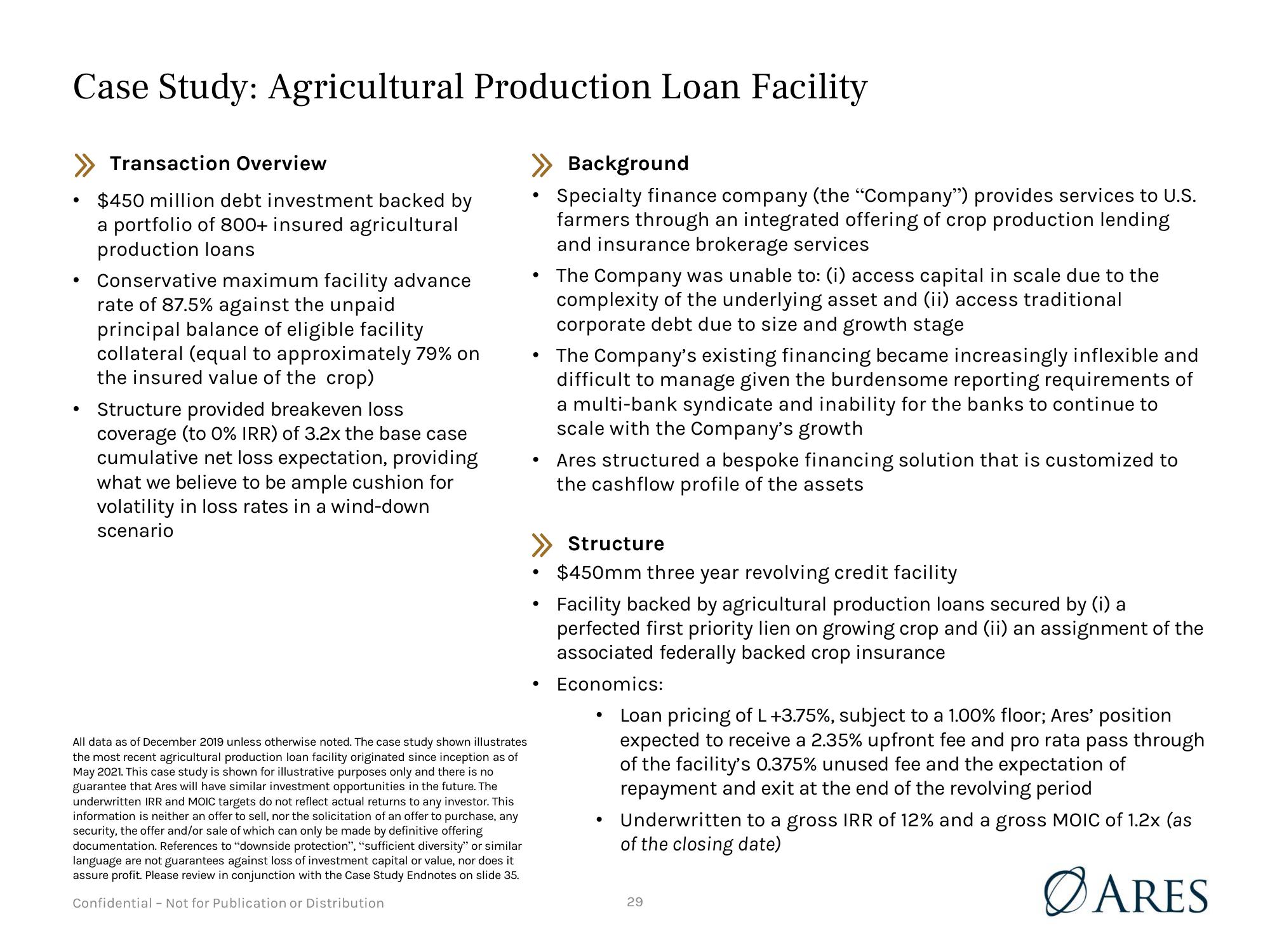

Case Study: Agricultural Production Loan Facility

●

●

Transaction Overview

$450 million debt investment backed by

a portfolio of 800+ insured agricultural

production loans

Conservative maximum facility advance

rate of 87.5% against the unpaid

principal balance of eligible facility

collateral (equal to approximately 79% on

the insured value of the crop)

Structure provided breakeven loss

coverage (to 0% IRR) of 3.2x the base case

cumulative net loss expectation, providing

what we believe to be ample cushion for

volatility in loss rates in a wind-down

scenario

All data as of December 2019 unless otherwise noted. The case study shown illustrates

the most recent agricultural production loan facility originated since inception as of

May 2021. This case study is shown for illustrative purposes only and there is no

guarantee that Ares will have similar investment opportunities in the future. The

underwritten IRR and MOIC targets do not reflect actual returns to any investor. This

information is neither an offer to sell, nor the solicitation of an offer purchase, any

security, the offer and/or sale of which can only be made by definitive offering

documentation. References to "downside protection", "sufficient diversity" or similar

language are not guarantees against loss of investment capital or value, nor does it

assure profit. Please review in conjunction with the Case Study Endnotes on slide 35.

Confidential - Not for Publication or Distribution

●

●

●

●

●

Background

Specialty finance company (the "Company") provides services to U.S.

farmers through an integrated offering of crop production lending

and insurance brokerage services

The Company was unable to: (i) access capital in scale due to the

complexity of the underlying asset and (ii) access traditional

corporate debt due to size and growth stage

The Company's existing financing became increasingly inflexible and

difficult to manage given the burdensome reporting requirements of

a multi-bank syndicate and inability for the banks to continue to

scale with the Company's growth

Ares structured a bespoke financing solution that is customized to

the cashflow profile of the assets

Structure

$450mm three year revolving credit facility

Facility backed by agricultural production loans secured by (i) a

perfected first priority lien on growing crop and (ii) an assignment of the

associated federally backed crop insurance

Economics:

●

Loan pricing of L +3.75%, subject to a 1.00% floor; Ares' position

expected to receive a 2.35% upfront fee and pro rata pass through

of the facility's 0.375% unused fee and the expectation of

repayment and exit at the end of the revolving period

Underwritten to a gross IRR of 12% and a gross MOIC of 1.2x (as

of the closing date)

ØARES

29View entire presentation