Fiscal 2022 1st Quarter Supplemental Slides

UNFI

Capital Structure

7

FUTURE

FUTURE

UNFL fuel the

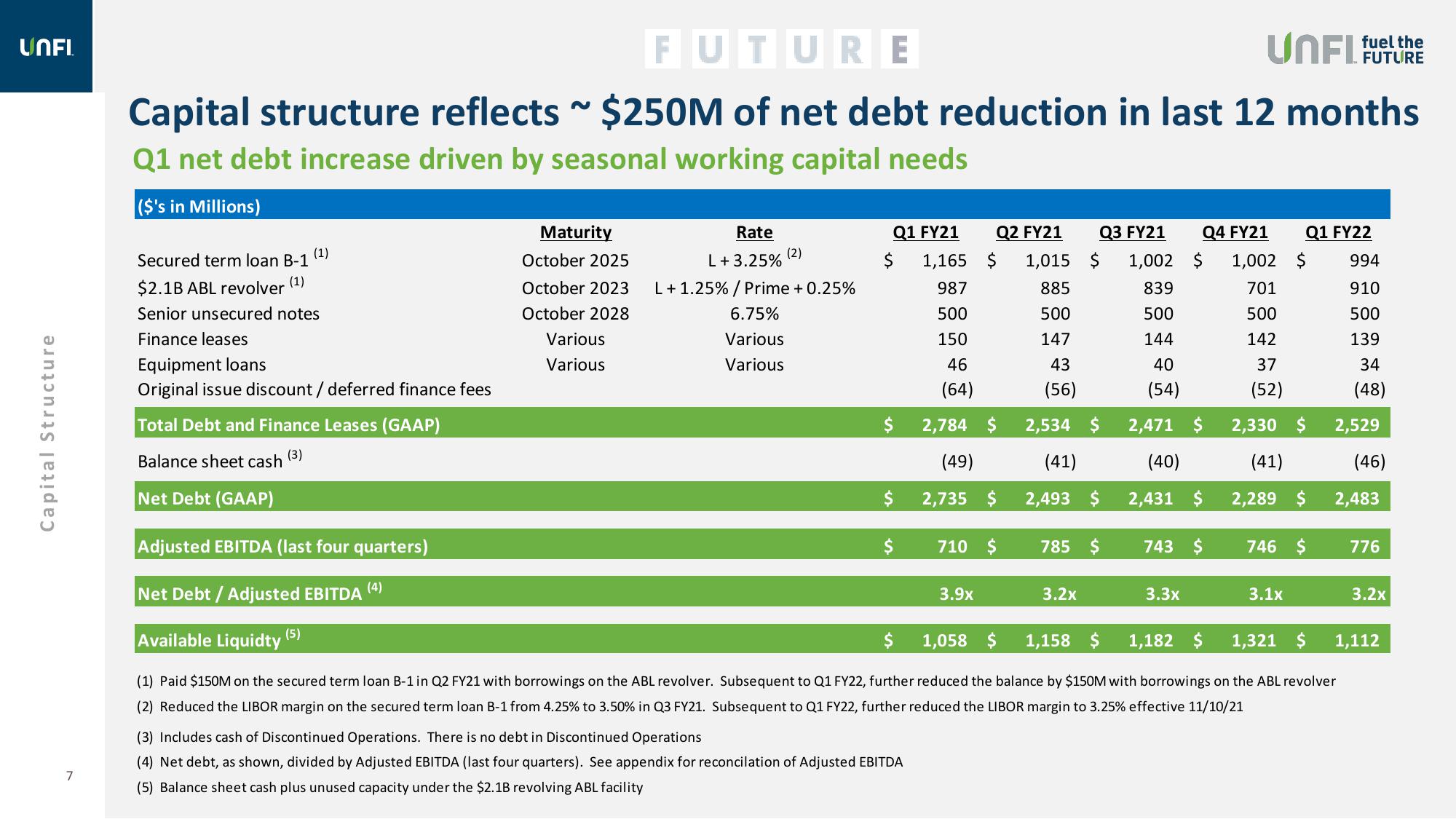

Capital structure reflects ~ $250M of net debt reduction in last 12 months

Q1 net debt increase driven by seasonal working capital needs

($'s in Millions)

(1)

Secured term loan B-1

$2.1B ABL revolver (¹)

Senior unsecured notes

Finance leases

Equipment loans

Original issue discount /deferred finance fees

Total Debt and Finance Leases (GAAP)

(3)

Balance sheet cash

Net Debt (GAAP)

Adjusted EBITDA (last four quarters)

Net Debt / Adjusted EBITDA

(5)

(4)

Maturity

October 2025

October 2023

October 2028

Various

Various

Rate

L +3.25%

L + 1.25% / Prime + 0.25%

6.75%

Various

Various

(2)

Q1 FY21

1,165

987

500

150

46

(64)

2,784 $

(49)

2,735 $

$

$

$

$

Q2 FY21 Q3 FY21 Q4 FY21

$ 1,015 $ 1,002 $ 1,002

839

885

701

500

500

500

147

144

142

43

40

37

(56)

(54)

(52)

2,471 $ 2,330 $

2,534 $

(41)

2,493 $

(40)

2,431 $

(41)

2,289 $

(3) Includes cash of Discontinued Operations. There is no debt in Discontinued Operations

(4) Net debt, as shown, divided by Adjusted EBITDA (last four quarters). See appendix for reconcilation of Adjusted EBITDA

(5) Balance sheet cash plus unused capacity under the $2.1B revolving ABL facility

710 $

3.9x

785 $

3.2x

743 $

3.3x

Q1 FY22

3.1x

$

746 $

994

910

500

139

34

(48)

2,529

Available Liquidty

$

1,058 $ 1,158 $

1,182 $ 1,321 $

(1) Paid $150M on the secured term loan B-1 in Q2 FY21 with borrowings on the ABL revolver. Subsequent to Q1 FY22, further reduced the balance by $150M with borrowings on the ABL revolver

(2) Reduced the LIBOR margin on the secured term loan B-1 from 4.25% to 3.50% in Q3 FY21. Subsequent to Q1 FY22, further reduced the LIBOR margin to 3.25% effective 11/10/21

(46)

2,483

776

3.2x

1,112View entire presentation