OnesSpaWorld SPAC

SUPERIOR AFTER-TAX FREE CASH FLOW

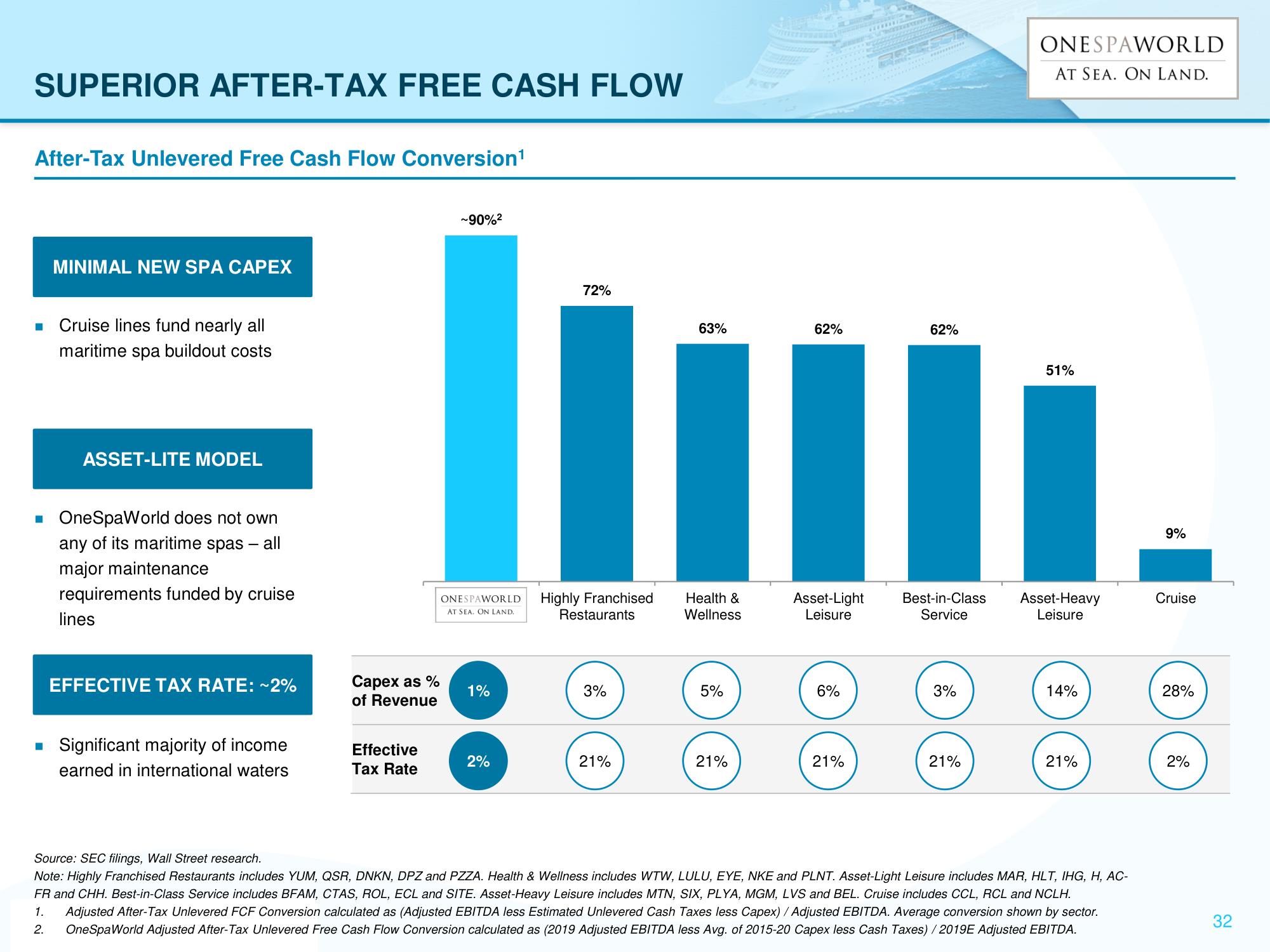

After-Tax Unlevered Free Cash Flow Conversion¹

MINIMAL NEW SPA CAPEX

■ Cruise lines fund nearly all

maritime spa buildout costs

ASSET-LITE MODEL

■ OneSpaWorld does not own

any of its maritime spas - all

major maintenance

requirements funded by cruise

lines

EFFECTIVE TAX RATE: ~2%

■ Significant majority of income

earned in international waters

Capex as %

of Revenue

Effective

Tax Rate

~90%²

ONESPAWORLD

AT SEA. ON LAND.

1%

2%

72%

Highly Franchised

Restaurants

3%

21%

63%

Health &

Wellness

5%

21%

62%

Asset-Light

Leisure

6%

21%

62%

Best-in-Class

Service

3%

21%

ONESPAWORLD

AT SEA. ON LAND.

51%

Asset-Heavy

Leisure

14%

21%

Source: SEC filings, Wall Street research.

Note: Highly Franchised Restaurants includes YUM, QSR, DNKN, DPZ and PZZA. Health & Wellness includes WTW, LULU, EYE, NKE and PLNT. Asset-Light Leisure includes MAR, HLT, IHG, H, AC-

FR and CHH. Best-in-Class Service includes BFAM, CTAS, ROL, ECL and SITE. Asset-Heavy Leisure includes MTN, SIX, PLYA, MGM, LVS and BEL. Cruise includes CCL, RCL and NCLH.

1. Adjusted After-Tax Unlevered FCF Conversion calculated as (Adjusted EBITDA less Estimated Unlevered Cash Taxes less Capex) / Adjusted EBITDA. Average conversion shown by sector.

2.

OneSpaWorld Adjusted After-Tax Unlevered Free Cash Flow Conversion calculated as (2019 Adjusted EBITDA less Avg. of 2015-20 Capex less Cash Taxes)/2019E Adjusted EBITDA.

9%

Cruise

28%

2%

32View entire presentation