UBS ESG Presentation Deck

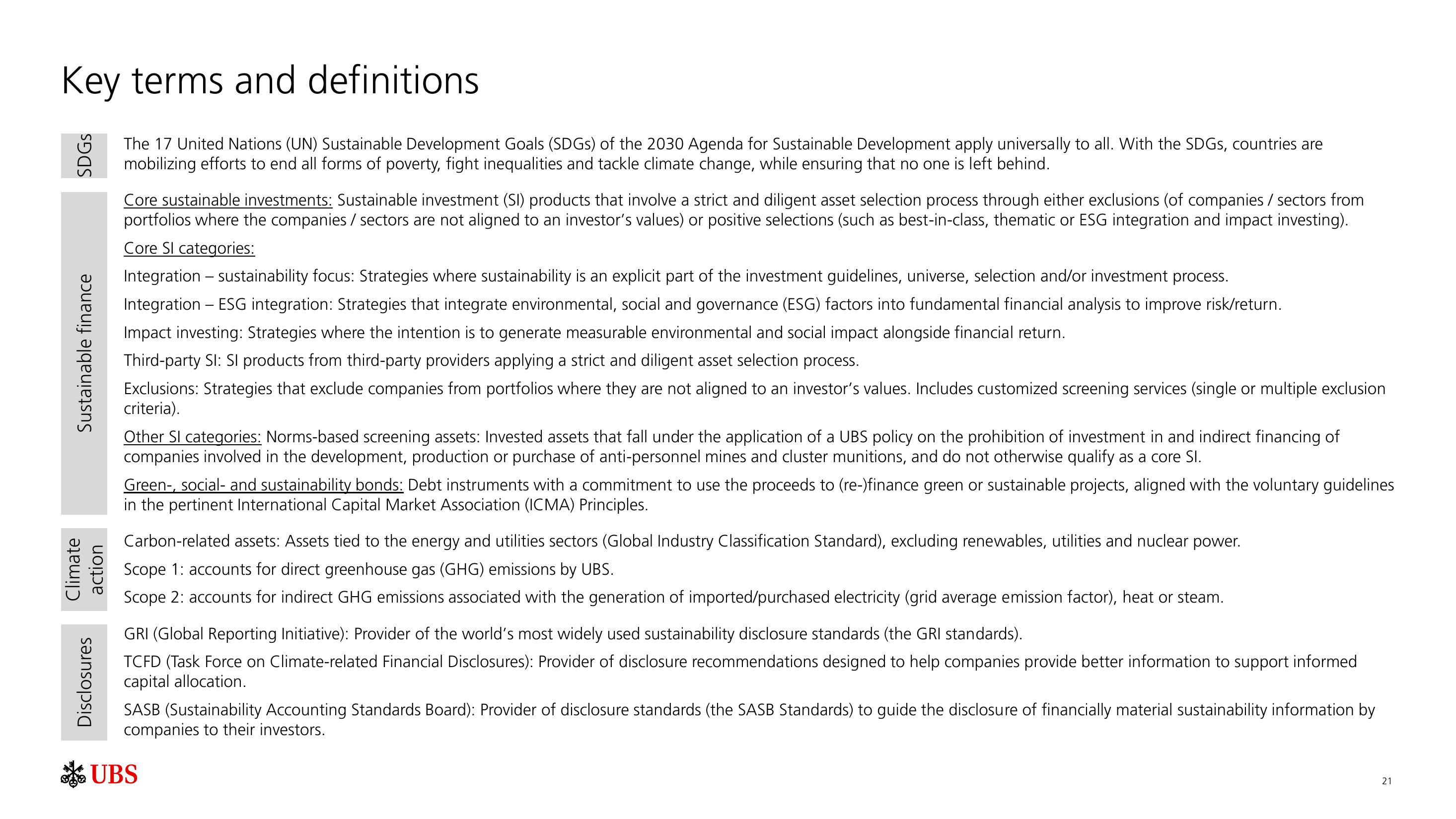

Key terms and definitions

The 17 United Nations (UN) Sustainable Development Goals (SDGs) of the 2030 Agenda for Sustainable Development apply universally to all. With the SDGs, countries are

mobilizing efforts to end all forms of poverty, fight inequalities and tackle climate change, while ensuring that no one is left behind.

SDGs

Sustainable finance

Climate

action

Disclosures

Core sustainable investments: Sustainable investment (SI) products that involve a strict and diligent asset selection process through either exclusions (of companies / sectors from

portfolios where the companies / sectors are not aligned to an investor's values) or positive selections (such as best-in-class, thematic or ESG integration and impact investing).

Core Sl categories:

Integration - sustainability focus: Strategies where sustainability is an explicit part of the investment guidelines, universe, selection and/or investment process.

Integration - ESG integration: Strategies that integrate environmental, social and governance (ESG) factors into fundamental financial analysis to improve risk/return.

Impact investing: Strategies where the intention is to generate measurable environmental and social impact alongside financial return.

Third-party SI: SI products from third-party providers applying a strict and diligent asset selection process.

Exclusions: Strategies that exclude companies from portfolios where they are not aligned to an investor's values. Includes customized screening services (single or multiple exclusion

criteria).

Other Sl categories: Norms-based screening assets: Invested assets that fall under the application of a UBS policy on the prohibition of investment in and indirect financing of

companies involved in the development, production or purchase of anti-personnel mines and cluster munitions, and do not otherwise qualify as a core SI.

Green-, social- and sustainability bonds: Debt instruments with a commitment to use the proceeds to (re-)finance green or sustainable projects, aligned with the voluntary guidelines

in the pertinent International Capital Market Association (ICMA) Principles.

Carbon-related assets: Assets tied to the energy and utilities sectors (Global Industry Classification Standard), excluding renewables, utilities and nuclear power.

Scope 1: accounts for direct greenhouse gas (GHG) emissions by UBS.

Scope 2: accounts for indirect GHG emissions associated with the generation of imported/purchased electricity (grid average emission factor), heat or steam.

GRI (Global Reporting Initiative): Provider of the world's most widely used sustainability disclosure standards (the GRI standards).

TCFD (Task Force on Climate-related Financial Disclosures): Provider of disclosure recommendations designed to help companies provide better information to support informed

capital allocation.

SASB (Sustainability Accounting Standards Board): Provider of disclosure standards (the SASB Standards) to guide the disclosure of financially material sustainability information by

companies to their investors.

UBS

21View entire presentation