Credit Suisse Investment Banking Pitch Book

Maine NAV analysis assumptions

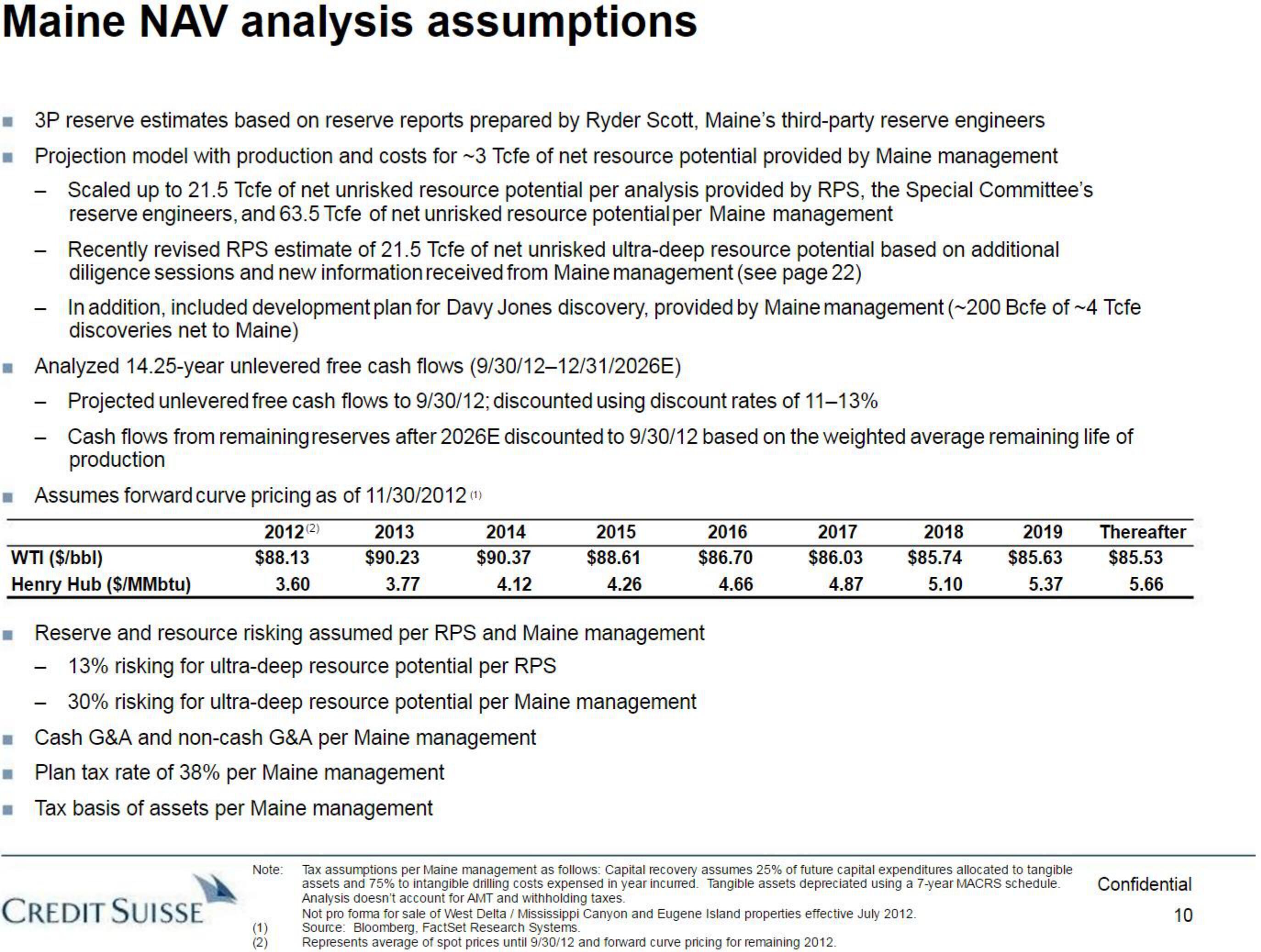

3P reserve estimates based on reserve reports prepared by Ryder Scott, Maine's third-party reserve engineers

Projection model with production and costs for ~3 Tcfe of net resource potential provided by Maine management

Scaled up to 21.5 Tcfe of net unrisked resource potential per analysis provided by RPS, the Special Committee's

reserve engineers, and 63.5 Tcfe of net unrisked resource potential per Maine management

-

Analyzed 14.25-year unlevered free cash flows (9/30/12-12/31/2026E)

Projected unlevered free cash flows to 9/30/12; discounted using discount rates of 11-13%

Cash flows from remaining reserves after 2026E discounted to 9/30/12 based on the weighted average remaining life of

production

-

Recently revised RPS estimate of 21.5 Tcfe of net unrisked ultra-deep resource potential based on additional

diligence sessions and new information received from Maine management (see page 22)

In addition, included development plan for Davy Jones discovery, provided by Maine management (~200 Bcfe of ~4 Tcfe

discoveries net to Maine)

Assumes forward curve pricing as of 11/30/2012 (¹)

2012 (2)

WTI ($/bbl)

Henry Hub ($/MMbtu)

-

$88.13

3.60

CREDIT SUISSE

Note:

2013

$90.23

3.77

■ Reserve and resource risking assumed per RPS and Maine management

13% risking for ultra-deep resource potential per RPS

30% risking for ultra-deep resource potential per Maine management

Cash G&A and non-cash G&A per Maine management

Plan tax rate of 38% per Maine management

Tax basis of assets per Maine management

(1)

(2)

2014

$90.37

4.12

2015

$88.61

4.26

2016

$86.70

4.66

2017

$86.03

4.87

2018

$85.74

5.10

2019 Thereafter

$85.63

$85.53

5.37

5.66

Tax assumptions per Maine management as follows: Capital recovery assumes 25% of future capital expenditures allocated to tangible

assets and 75% to intangible drilling costs expensed in year incurred. Tangible assets depreciated using a 7-year MACRS schedule.

Analysis doesn't account for AMT and withholding taxes.

Not pro forma for sale of West Delta / Mississippi Canyon and Eugene Island properties effective July 2012.

Source: Bloomberg, FactSet Research Systems.

Represents average of spot prices until 9/30/12 and forward curve pricing for remaining 2012.

Confidential

10View entire presentation