First Quarter 2017 Financial Review

Financial Summary

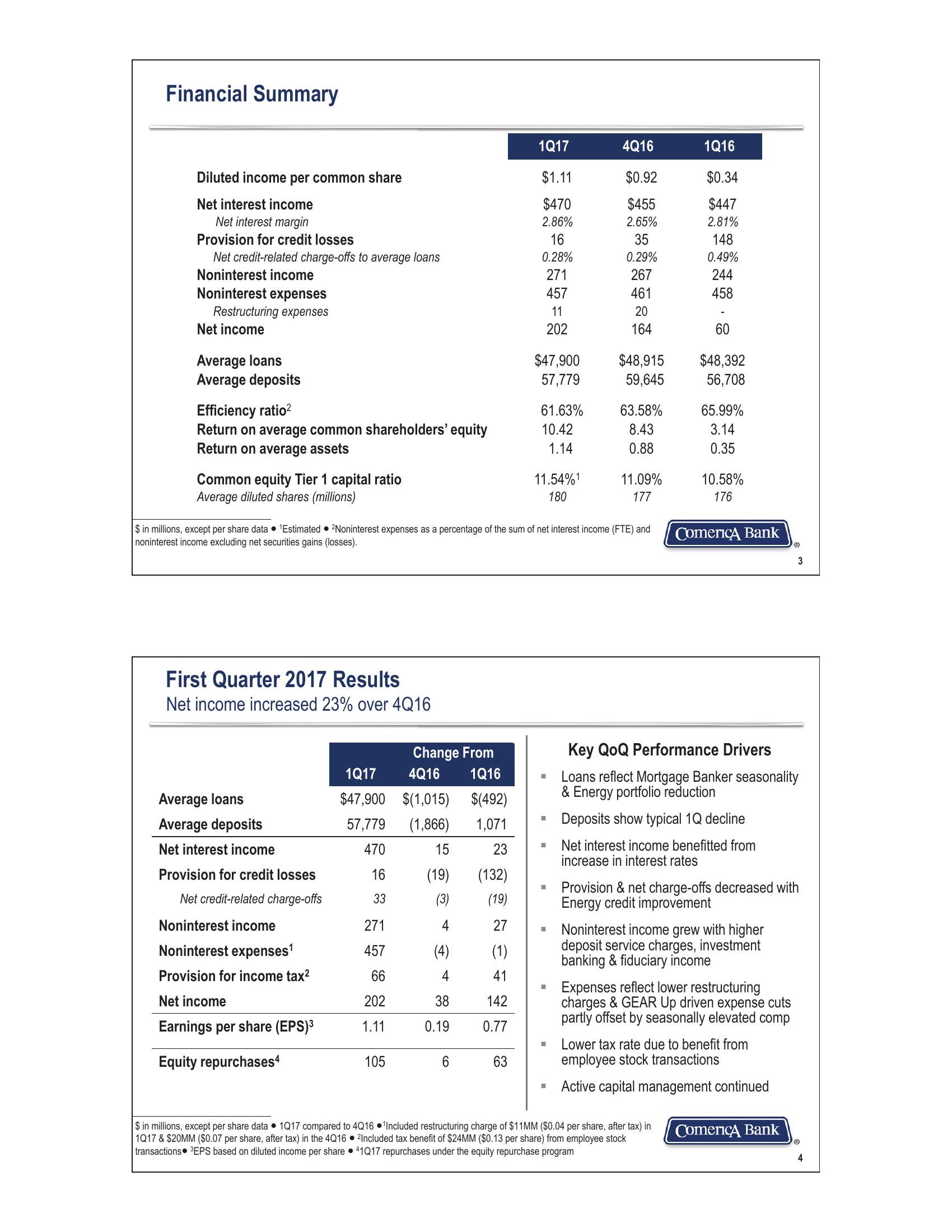

1Q17

4Q16

1Q16

Diluted income per common share

$1.11

$0.92

$0.34

Net interest income

$470

$455

$447

Net interest margin

2.86%

2.65%

2.81%

Provision for credit losses

16

35

148

Net credit-related charge-offs to average loans

0.28%

0.29%

0.49%

Noninterest income

271

267

244

Noninterest expenses

457

461

458

Restructuring expenses

Net income

Average loans

11

20

202

164

60

$47,900

$48,915

$48,392

Average deposits

57,779

59,645

56,708

Efficiency ratio²

61.63%

63.58%

65.99%

Return on average common shareholders' equity

10.42

8.43

3.14

Return on average assets

1.14

0.88

0.35

Common equity Tier 1 capital ratio

11.54%¹

11.09%

10.58%

Average diluted shares (millions)

180

177

176

$ in millions, except per share data ⚫1Estimated 2Noninterest expenses as a percentage of the sum of net interest income (FTE) and

noninterest income excluding net securities gains (losses).

Comerica Bank

First Quarter 2017 Results

Net income increased 23% over 4Q16

1Q17

Average loans

Change From

4Q16 1Q16

$47,900 $(1,015) $(492)

Average deposits

57,779 (1,866)

1,071

Net interest income

470

15

23

Provision for credit losses

16

(19)

(132)

Net credit-related charge-offs

33

(3)

(19)

Noninterest income

271

4

27

Noninterest expenses¹

457

(4)

(1)

Key QoQ Performance Drivers

Loans reflect Mortgage Banker seasonality

& Energy portfolio reduction

Deposits show typical 1Q decline

Net interest income benefitted from

increase in interest rates

Provision & net charge-offs decreased with

Energy credit improvement

Noninterest income grew with higher

deposit service charges, investment

banking & fiduciary income

Provision for income tax²

66

4

41

Expenses reflect lower restructuring

Net income

202

38

142

charges & GEAR Up driven expense cuts

partly offset by seasonally elevated comp

Earnings per share (EPS)³

1.11

0.19

0.77

Equity repurchases4

105

6

63

Lower tax rate due to benefit from

employee stock transactions

3

$ in millions, except per share data

1Q17 compared to 4Q16

Active capital management continued

Included restructuring charge of $11MM ($0.04 per share, after tax) in

1Q17 & $20MM ($0.07 per share, after tax) in the 4Q16 ⚫ 2Included tax benefit of $24MM ($0.13 per share) from employee stock

transactions EPS based on diluted income per share ⚫41Q17 repurchases under the equity repurchase program

Comerica Bank

4View entire presentation