Main Street Capital Fixed Income Presentation Deck

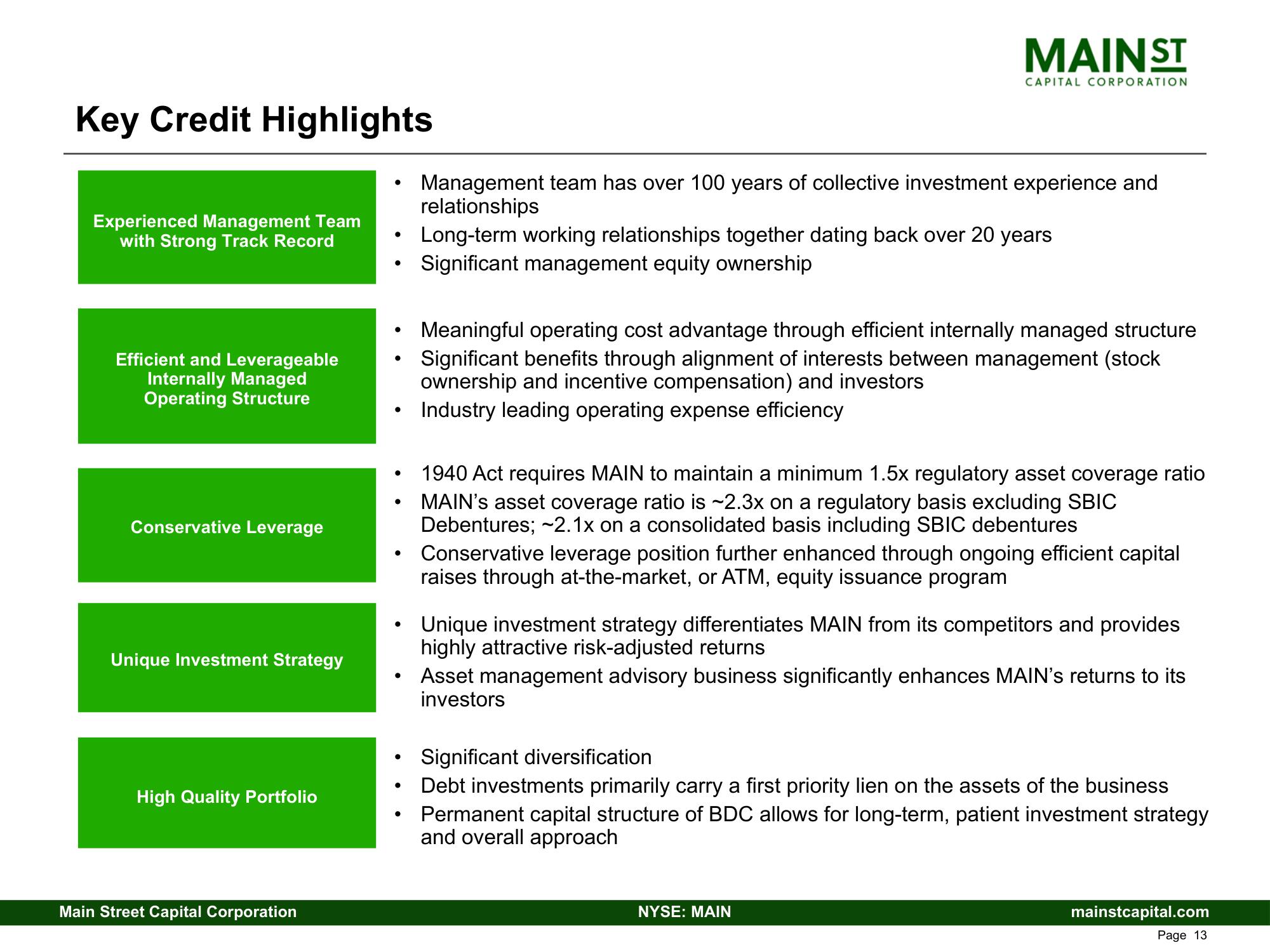

Key Credit Highlights

Experienced Management Team

with Strong Track Record

Efficient and Leverageable

Internally Managed

Operating Structure

Conservative Leverage

Unique Investment Strategy

High Quality Portfolio

Main Street Capital Corporation

●

●

●

●

●

●

●

●

●

●

Management team has over 100 years of collective investment experience and

relationships

MAIN ST

CAPITAL CORPORATION

Long-term working relationships together dating back over 20 years

Significant management equity ownership

Meaningful operating cost advantage through efficient internally managed structure

Significant benefits through alignment of interests between management (stock

ownership and incentive compensation) and investors

Industry leading operating expense efficiency

1940 Act requires MAIN to maintain a minimum 1.5x regulatory asset coverage ratio

MAIN's asset coverage ratio is ~2.3x on a regulatory basis excluding SBIC

Debentures; ~2.1x on a consolidated basis including SBIC debentures

Conservative leverage position further enhanced

raises through at-the-market, or ATM, equity issuance program

ongoing efficient capital

Unique investment strategy differentiates MAIN from its competitors and provides

highly attractive risk-adjusted returns

Asset management advisory business significantly enhances MAIN's returns to its

investors

NYSE: MAIN

Significant diversification

Debt investments primarily carry a first priority lien on the assets of the business

Permanent capital structure of BDC allows for long-term, patient investment strategy

and overall approach

mainstcapital.com

Page 13View entire presentation