Waldencast SPAC Presentation Deck

OBAGI + Milk transaction summary

MAKEUP

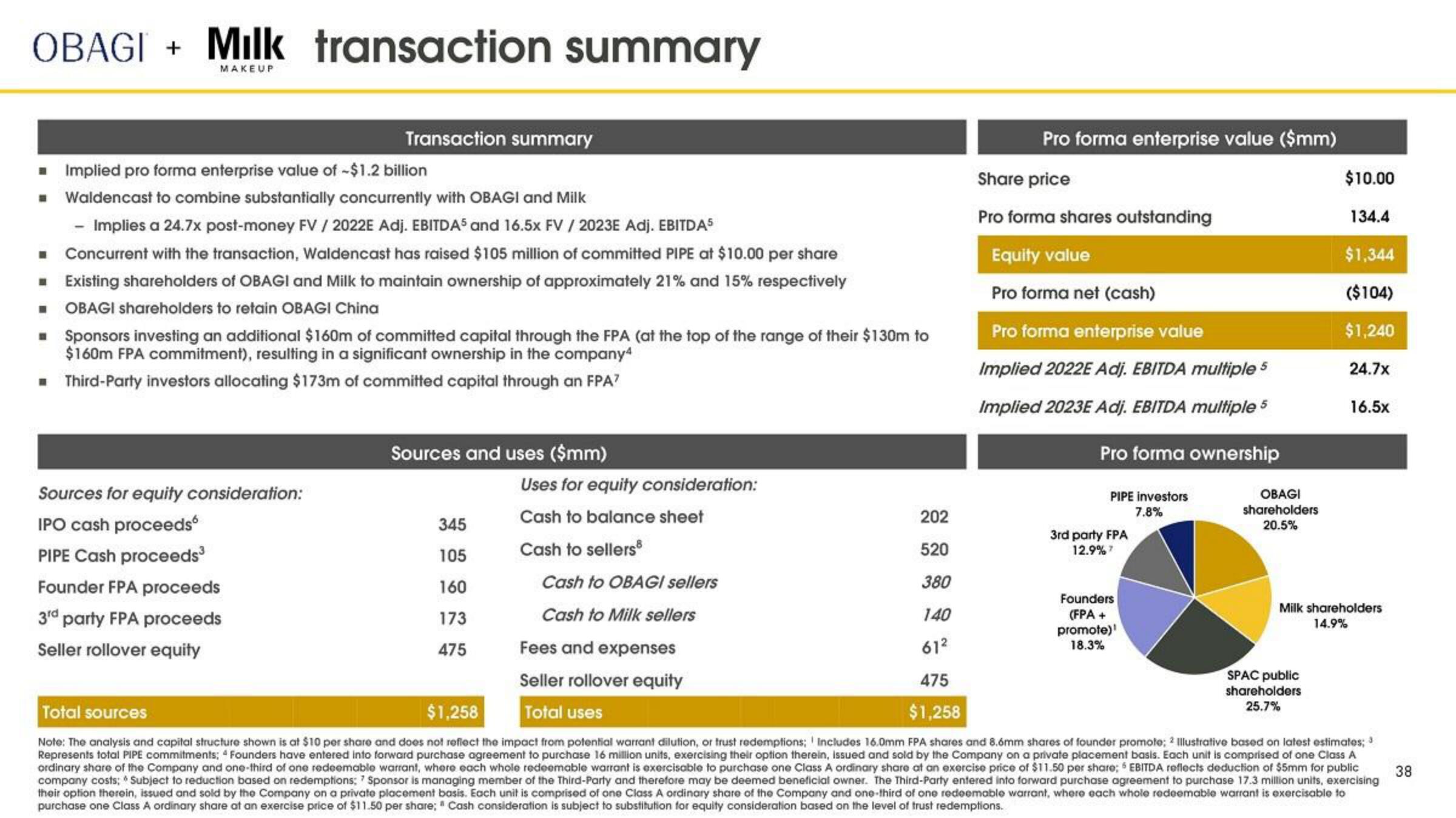

■ Implied pro forma enterprise value of -$1.2 billion

■ Waldencast to combine substantially concurrently with OBAGI and Milk

- Implies a 24.7x post-money FV / 2022E Adj. EBITDA5 and 16.5x FV / 2023E Adj. EBITDA

■ Concurrent with the transaction, Waldencast has raised $105 million of committed PIPE at $10.00 per share

☐ Existing shareholders of OBAGI and Milk to maintain ownership of approximately 21% and 15% respectively

■ OBAGI shareholders to retain OBAGI China

Transaction summary

■ Sponsors investing an additional $160m of committed capital through the FPA (at the top of the range of their $130m to

$160m FPA commitment), resulting in a significant ownership in the company4

■ Third-Party investors allocating $173m of committed capital through an FPA?

Sources for equity consideration:

IPO cash proceeds

PIPE Cash proceeds³

Founder FPA proceeds

3rd party FPA proceeds

Seller rollover equity

Sources and uses ($mm)

Uses for equity consideration:

Cash to balance sheet

Cash to sellers

345

105

160

173

475

Pro forma enterprise value ($mm)

Cash to OBAGI sellers

Cash to Milk sellers

Share price

Pro forma shares outstanding

Equity value

Pro forma net (cash)

Pro forma enterprise value

Implied 2022E Adj. EBITDA multiple 5

Implied 2023E Adj. EBITDA multiple 5

Pro forma ownership

PIPE investors

7.8%

3rd party FPA

12.9% 7

OBAGI

shareholders

20.5%

202

520

380

140

Fees and expenses

Seller rollover equity

Total uses

61²

475

$1,258

Total sources

$1,258

Note: The analysis and capital structure shown is at $10 per share and does not reflect the impact from potential warrant dilution, or trust redemptions; Includes 16.0mm FPA shares and 8.6mm shares of founder promote; 2 Illustrative based on latest estimates; 3

Represents total PIPE commitments; 4 Founders have entered into forward purchase agreement to purchase 16 million units, exercising their option therein, issued and sold by the Company on a private placement basis. Each unit is comprised of one Class A

ordinary share of the Company and one-third of one redeemable warrant, where each whole redeemable warrant is exercisable to purchase one Class A ordinary share at an exercise price of $11.50 per share; 5 EBITDA reflects deduction of $5mm for public

company costs; Subject to reduction based on redemptions; 7 Sponsor is managing member of the Third-Party and therefore may be deeme beneficial wner. The Third-Party entered into forward purchase agreement to purchase 17.3 million units, exercising

their option therein, issued and sold by the Company on a private placement basis. Each unit is comprised of one Class A ordinary share of the Company and one-third of one redeemable warrant, where each whole redeemable warrant is exercisable to

purchase one Class A ordinary share at an exercise price of $11.50 per share; Cash consideration is subject to substitution for equity consideration based on the level of trust redemptions.

Founders

(FPA +

promote)

18.3%

$10.00

134.4

$1,344

($104)

$1,240

SPAC public

shareholders

25.7%

24.7x

16.5x

Milk shareholders

14.9%

38View entire presentation