Baird Investment Banking Pitch Book

ILLUSTRATIVE HAS / GETS ANALYSIS (CONT.)

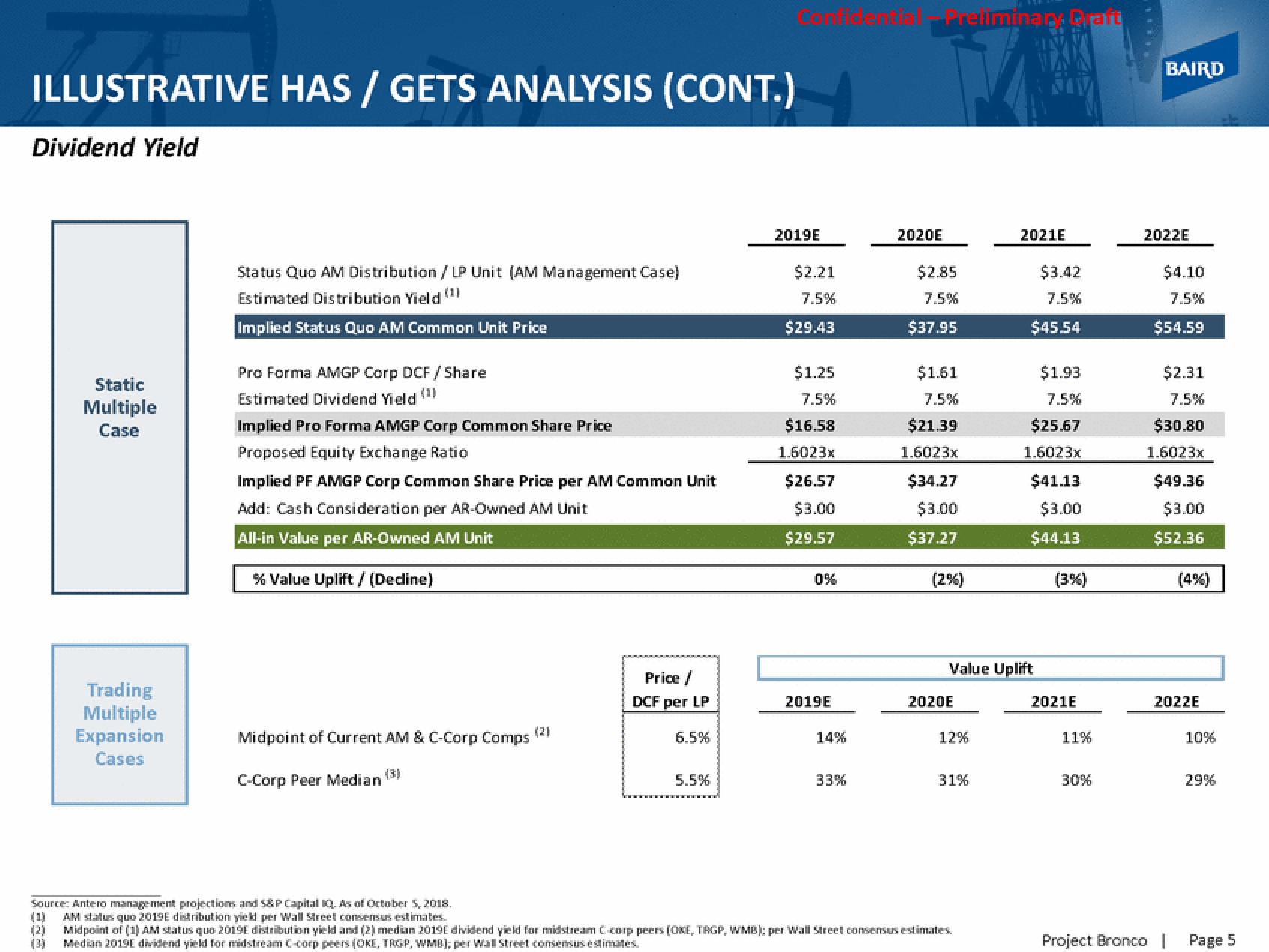

Dividend Yield

Static

Multiple

Case

Trading

Multiple

Expansion

Cases

Status Quo AM Distribution / LP Unit (AM Management Case)

Estimated Distribution Yield

Implied Status Quo AM Common Unit Price

Pro Forma AMGP Corp DCF/Share

Estimated Dividend Yield

Implied Pro Forma AMGP Corp Common Share Price

Proposed Equity Exchange Ratio

Implied PF AMGP Corp Common Share Price per AM Common Unit

Add: Cash Consideration per AR-Owned AM Unit

All-in Value per AR-Owned AM Unit

% Value Uplift / (Dedine)

Midpoint of Current AM & C-Corp Comps

C-Corp Peer Median

Price /

DCF per LP

6.5%

5.5%

2019E

$2.21

7.5%

$29.43

$1.25

7.5%

$16.58

1.6023x

$26.57

$3.00

$29.57

0%

2019E

14%

33%

Trellminara Graft

2020E

$2.85

7.5%

$37.95

$1.61

7.5%

$21.39

1.6023x

$34.27

$3.00

$37.27

(2%)

2020E

12%

31%

2021E

Value Uplift

Source: Antero management projections and S&P Capital IQ. As of October 5, 2018.

(1) AM status quo 2019E distribution yield per Wall Street consensus estimates.

Midpoint of (1) AM status quo 2019E distribution yield and (2) median 2019E dividend yield for midstream C-corp peers (OKE, TRGP, WMB): per Wall Street consensus estimates.

Median 2019E dividend yield for midstream C-corp peers (OKE, TRGP, WMB); per Wall Street consensus estimates.

$3.42

7.5%

$45.54

$1.93

7.5%

$25.67

1.6023x

$41.13

$3.00

$44.13

(3%)

2021E

11%

30%

*****

BAIRD

2022E

Project Bronco

$4.10

7.5%

$54.59

$2.31

7.5%

$30.80

1.6023x

$49.36

$3.00

$52.36

(4%)

2022E

10%

29%

Page 5View entire presentation