Kinnevik Results Presentation Deck

Intro

SEK m

GROUP FINANCIAL STATEMENTS

Change in Fair Value of Financial Assets

Dividends Received

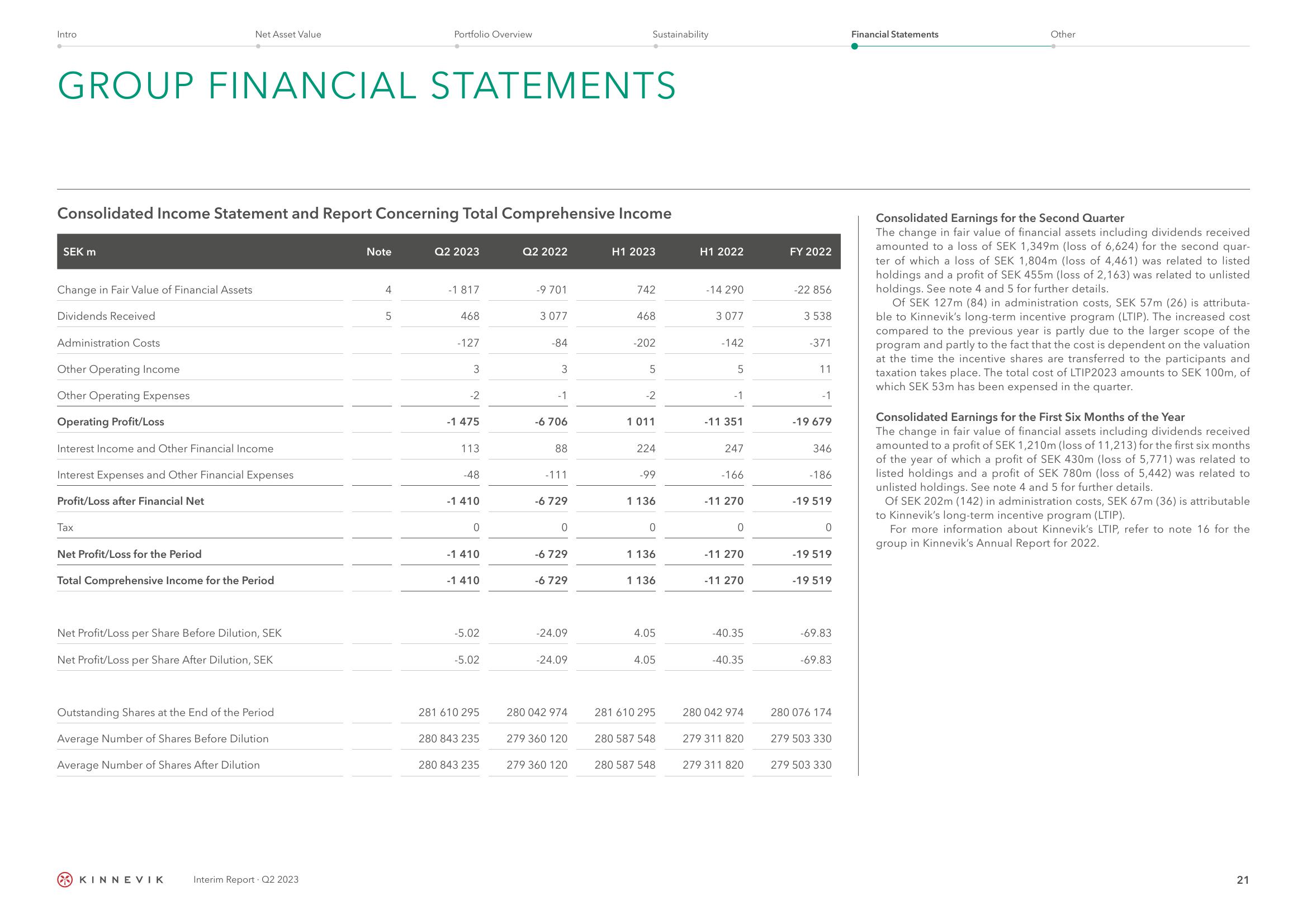

Consolidated Income Statement and Report Concerning Total Comprehensive Income

Administration Costs

Other Operating Income

Other Operating Expenses

Operating Profit/Loss

Net Asset Value

Interest Income and Other Financial Income

Interest Expenses and Other Financial Expenses

Profit/Loss after Financial Net

Tax

Net Profit/Loss for the Period

Total Comprehensive Income for the Period

Net Profit/Loss per Share Before Dilution, SEK

Net Profit/Loss per Share After Dilution, SEK

Outstanding Shares at the End of the Period

Average Number of Shares Before Dilution

Average Number of Shares After Dilution

KINNEVIK

Interim Report Q2 2023

Note

Portfolio Overview

4

5

Q2 2023

-1817

468

-127

3

-2

-1 475

113

-48

-1 410

0

-1 410

-1 410

-5.02

-5.02

281 610 295

280 843 235

280 843 235

Q2 2022

-9 701

3 077

-84

3

-1

-6 706

88

-111

-6 729

0

-6 729

-6 729

-24.09

-24.09

280 042 974

Sustainability

279 360 120

279 360 120

H1 2023

742

468

-202

5

-2

1 011

224

-99

1 136

0

1 136

1 136

4.05

4.05

281 610 295

280 587 548

280 587 548

H1 2022

-14 290

3 077

-142

5

-1

-11 351

247

-166

-11 270

0

-11 270

-11 270

-40.35

-40.35

280 042 974

279 311 820

279 311 820

FY 2022

-22 856

3 538

-371

11

-1

-19 679

346

-186

-19 519

0

-19 519

-19 519

-69.83

-69.83

280 076 174

279 503 330

279 503 330

Financial Statements

Other

Consolidated Earnings for the Second Quarter

The change in fair value of financial assets including dividends received

amounted to a loss of SEK 1,349m (loss of 6,624) for the second quar-

ter of which a loss of SEK 1,804m (loss of 4,461) was related to listed

holdings and a profit of SEK 455m (loss of 2,163) was related to unlisted

holdings. See note 4 and 5 for further details.

Of SEK 127m (84) in administration costs, SEK 57m (26) is attributa-

ble to Kinnevik's long-term incentive program (LTIP). The increased cost

compared to the previous year is partly due to the larger scope of the

program and partly to the fact that the cost is dependent on the valuation

at the time the incentive shares are transferred to the participants and

taxation takes place. The total cost of LTIP2023 amounts to SEK 100m, of

which SEK 53m has been expensed in the quarter.

Consolidated Earnings for the First Six Months of the Year

The change in fair value of financial assets including dividends received

amounted to a profit of SEK 1,210m (loss of 11,213) for the first six months

of the year of which a profit of SEK 430m (loss of 5,771) was related to

listed holdings and a profit of SEK 780m (loss of 5,442) was related to

unlisted holdings. See note 4 and 5 for further details.

Of SEK 202m (142) in administration costs, SEK 67m (36) is attributable

to Kinnevik's long-term incentive program (LTIP).

For more information about Kinnevik's LTIP, refer to note 16 for the

group in Kinnevik's Annual Report for 2022.

21View entire presentation