FY 2018 Fourth Quarter Earnings Call

Non-GAAP reconciliations

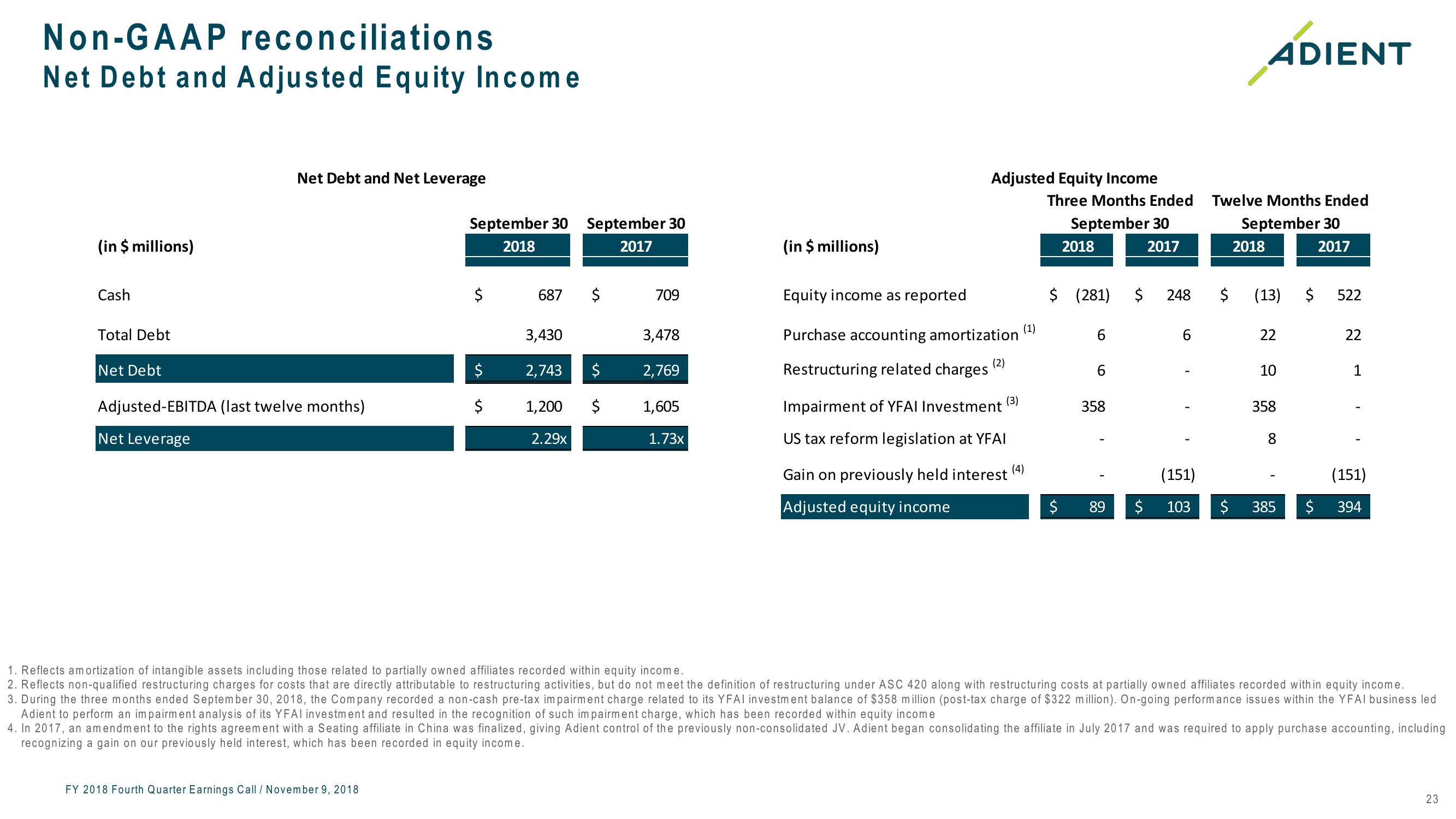

Net Debt and Adjusted Equity Income

ADIENT

Net Debt and Net Leverage

(in $ millions)

September 30

2018

September 30

2017

(in $ millions)

Adjusted Equity Income

Three Months Ended

2018

September 30

2017

September 30

2018

2017

Twelve Months Ended

Cash

$

687 $

709

Equity income as reported

$ (281)

ՄՌ

$

248 $

(13)

$ 522

(1)

Total Debt

Net Debt

3,430

3,478

Purchase accounting amortization

6

6

22

22

$

2,743

$

2,769

Adjusted-EBITDA (last twelve months)

Net Leverage

$

1,200

$

1,605

2.29x

1.73x

Restructuring related charges

Impairment of YFAI Investment (3)

US tax reform legislation at YFAI

Gain on previously held interest

Adjusted equity income

(2)

6

10

1

358

358

8

(4)

(151)

(151)

$

89

$

103

$

385

$

394

1. Reflects amortization of intangible assets including those related to partially owned affiliates recorded within equity income.

2. Reflects non-qualified restructuring charges for costs that are directly attributable to restructuring activities, but do not meet the definition of restructuring under ASC 420 along with restructuring costs at partially owned affiliates recorded within equity income.

3. During the three months ended September 30, 2018, the Company recorded a non-cash pre-tax impairment charge related to its YFAI investment balance of $358 million (post-tax charge of $322 million). On-going performance issues within the YFAI business led

Adient to perform an impairment analysis of its YFAI investment and resulted in the recognition of such impairment charge, which has been recorded within equity income

4. In 2017, an amendment to the rights agreement with a Seating affiliate in China was finalized, giving Adient control of the previously non-consolidated JV. Adient began consolidating the affiliate in July 2017 and was required to apply purchase accounting, including

recognizing a gain on our previously held interest, which has been recorded in equity income.

FY 2018 Fourth Quarter Earnings Call / November 9, 2018

23View entire presentation