Credit Suisse Investment Banking Pitch Book

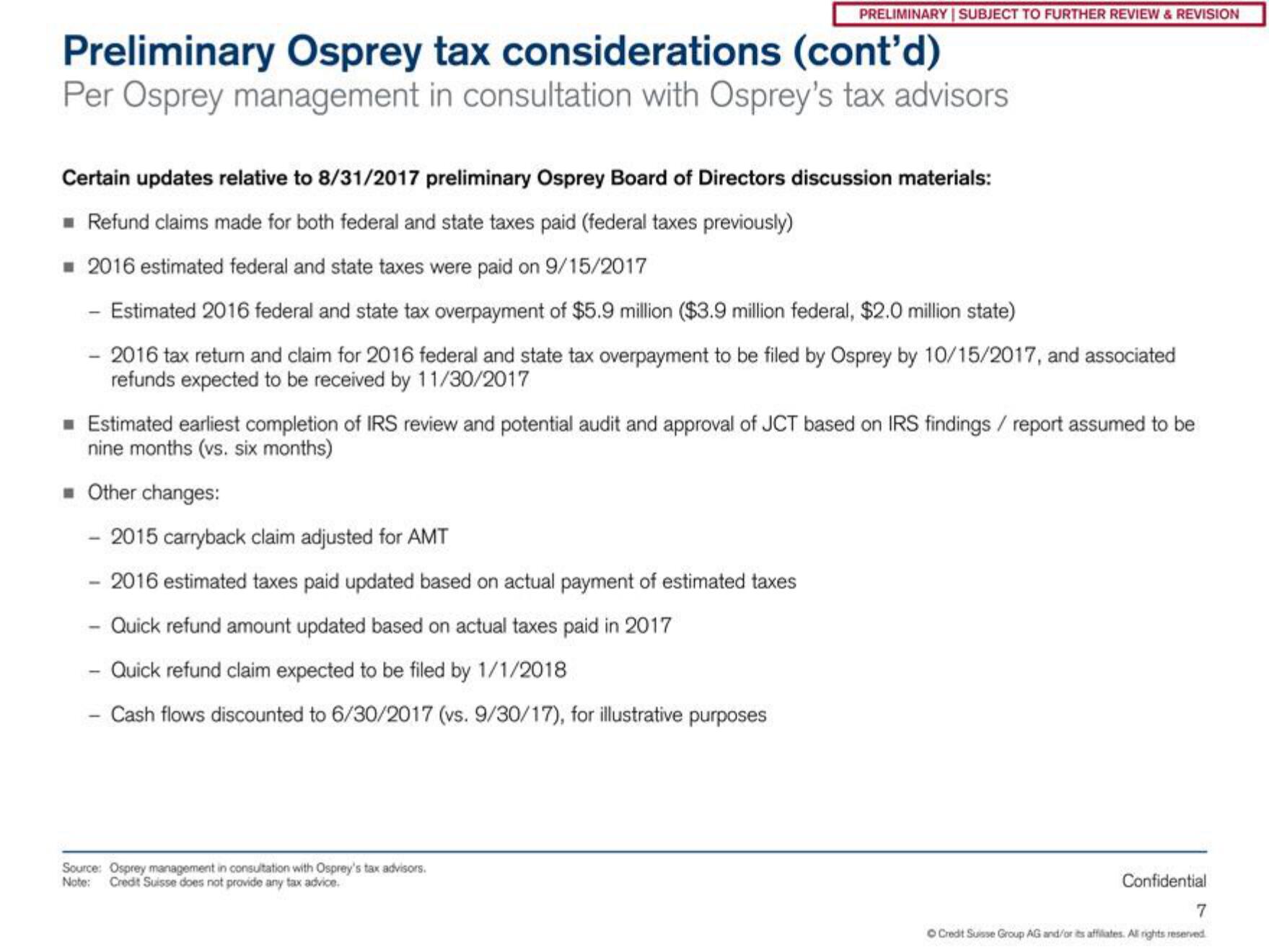

Preliminary Osprey tax considerations (cont'd)

Per Osprey management in consultation with Osprey's tax advisors

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

Certain updates relative to 8/31/2017 preliminary Osprey Board of Directors discussion materials:

■ Refund claims made for both federal and state taxes paid (federal taxes previously)

2016 estimated federal and state taxes were paid on 9/15/2017

- Estimated 2016 federal and state tax overpayment of $5.9 million ($3.9 million federal, $2.0 million state)

- 2016 tax return and claim for 2016 federal and state tax overpayment to be filed by Osprey by 10/15/2017, and associated

refunds expected to be received by 11/30/2017

■ Estimated earliest completion of IRS review and potential audit and approval of JCT based on IRS findings / report assumed to be

nine months (vs. six months)

■ Other changes:

- 2015 carryback claim adjusted for AMT

- 2016 estimated taxes paid updated based on actual payment of estimated taxes

Quick refund amount updated based on actual taxes paid in 2017

Quick refund claim expected to be filed by 1/1/2018

- Cash flows discounted to 6/30/2017 (vs. 9/30/17), for illustrative purposes

-

Source: Osprey management in consultation with Osprey's tax advisors.

Note:

Credit Suisse does not provide any tax advice.

Confidential

7

Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation