Aeva Investor Presentation Deck

Pro Forma Equity Ownership

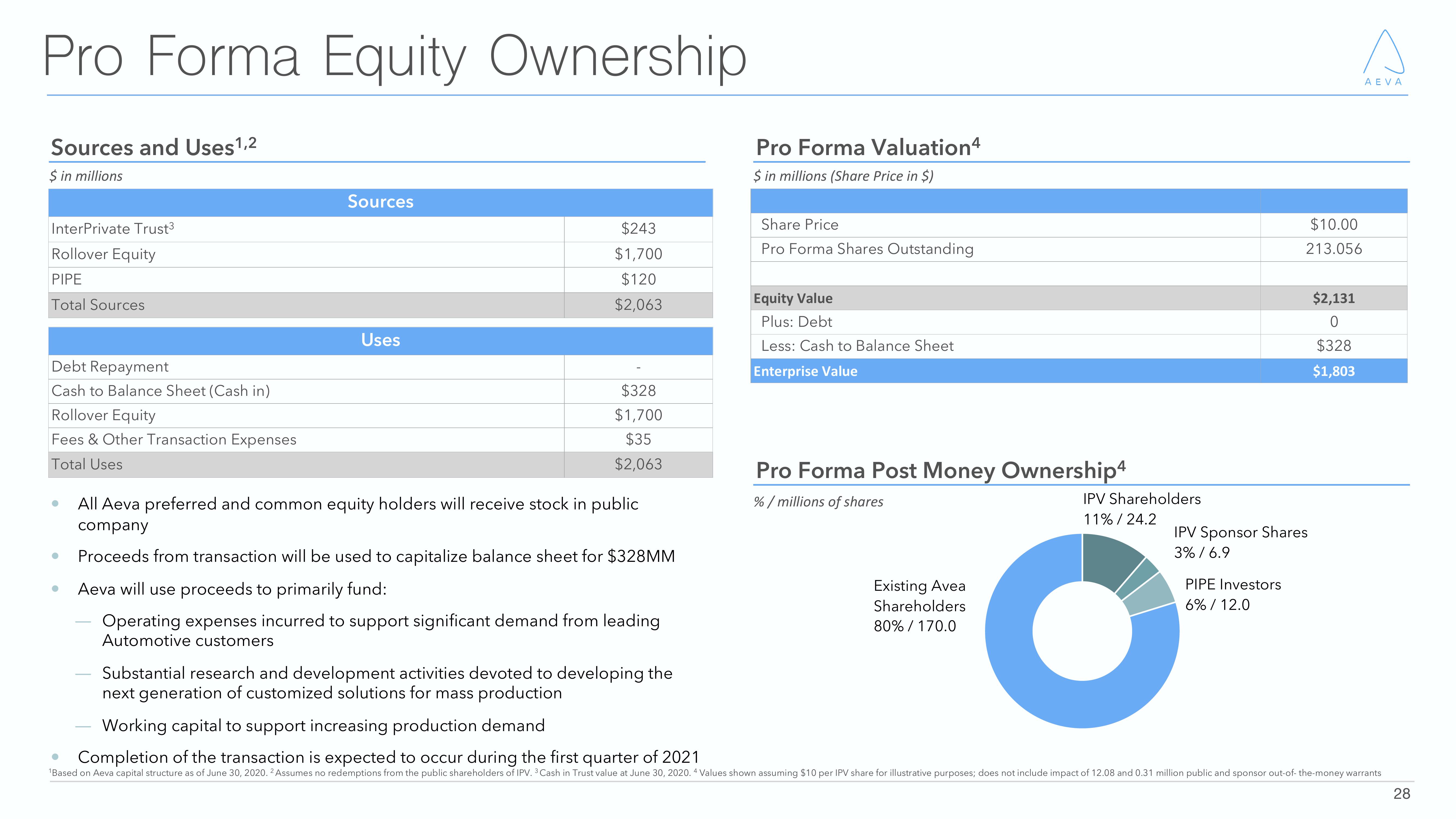

Sources and Uses ¹,2

$ in millions

InterPrivate Trust³

Rollover Equity

PIPE

Total Sources

Debt Repayment

Cash to Balance Sheet (Cash in)

Rollover Equity

Fees & Other Transaction Expenses

Total Uses

●

●

Sources

Uses

$243

$1,700

$120

$2,063

$328

$1,700

$35

$2,063

All Aeva preferred and common equity holders will receive stock in public

company

Proceeds from transaction will be used to capitalize balance sheet for $328MM

Aeva will use proceeds to primarily fund:

Operating expenses incurred to support significant demand from leading

Automotive customers

Pro Forma Valuation4

$ in millions (Share Price in $)

Share Price

Pro Forma Shares Outstanding

Equity Value

Plus: Debt

Less: Cash to Balance Sheet

Enterprise Value

Pro Forma Post Money Ownership4

%/millions of shares

Existing Avea

Shareholders

80% / 170.0

IPV Shareholders

11% / 24.2

$10.00

213.056

IPV Sponsor Shares

3% / 6.9

PIPE Investors

6% / 12.0

$2,131

0

$328

$1,803

AEVA

Substantial research and development activities devoted to developing the

next generation of customized solutions for mass production

Working capital to support increasing production demand

•

Completion of the transaction is expected to occur during the first quarter of 2021

¹Based on Aeva capital structure as of June 30, 2020. 2 Assumes no redemptions from the public shareholders of IPV. ³ Cash in Trust value at June 30, 2020. 4 Values shown assuming $10 per IPV share for illustrative purposes; does not include impact of 12.08 and 0.31 million public and sponsor out-of-the-money warrants

28View entire presentation