Oaktree Real Estate Opportunities Fund VII, L.P.

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

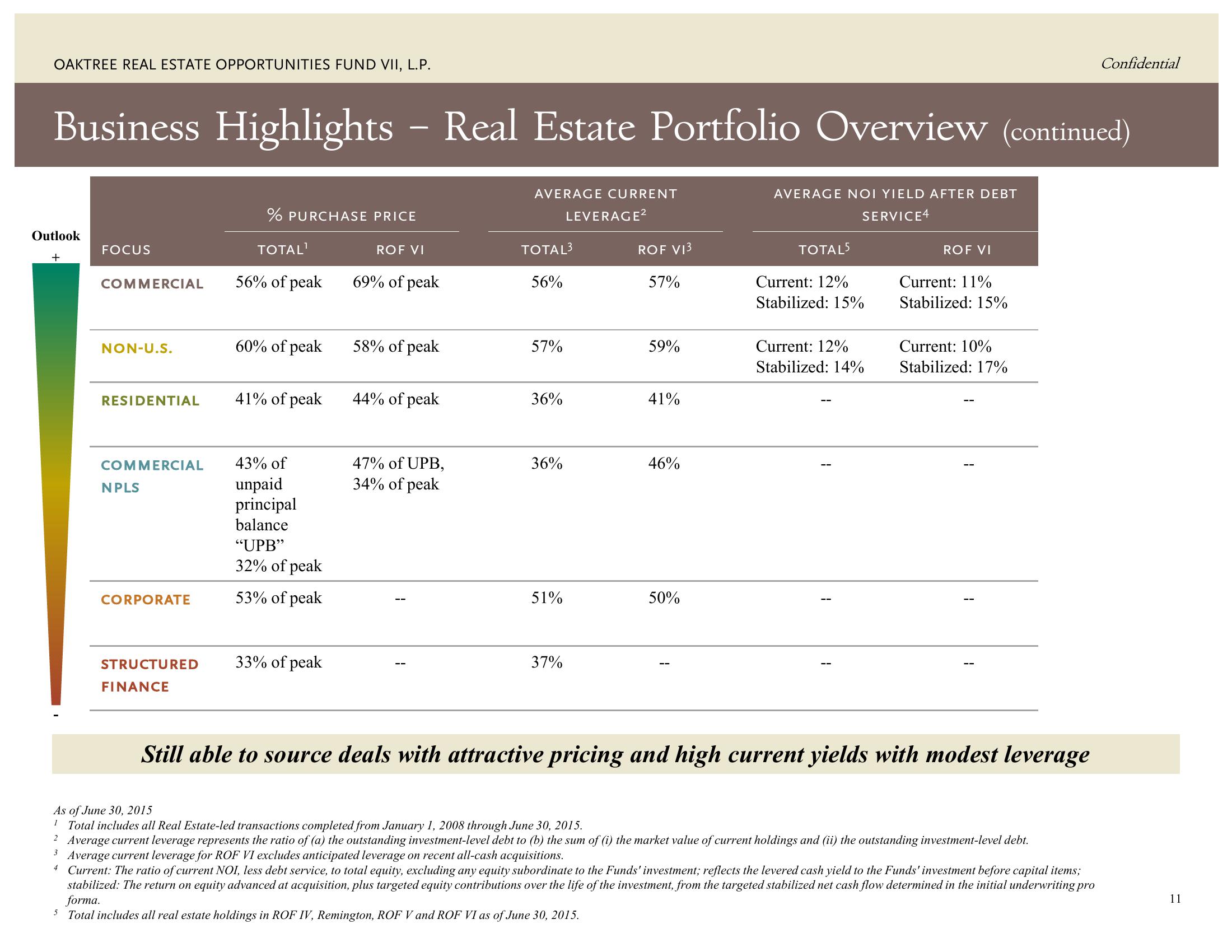

Business Highlights - Real Estate Portfolio Overview (continued)

Outlook

+

FOCUS

COMMERCIAL

NON-U.S.

RESIDENTIAL

COMMERCIAL

NPLS

CORPORATE

STRUCTURED

FINANCE

% PURCHASE PRICE

TOTAL¹

56% of peak

60% of peak

41% of peak

43% of

unpaid

principal

balance

"UPB"

32% of peak

53% of peak

33% of peak

ROF VI

69% of peak

58% of peak

44% of peak

47% of UPB,

34% of peak

AVERAGE CURRENT

TOTAL³

56%

57%

36%

36%

51%

LEVERAGE²

37%

ROF V13

57%

59%

41%

46%

50%

AVERAGE NOI YIELD AFTER DEBT

SERVICE4

TOTAL5

Current: 12%

Stabilized: 15%

Current: 12%

Stabilized: 14%

1

ROF VI

Current: 11%

Stabilized: 15%

Current: 10%

Stabilized: 17%

1

Still able to source deals with attractive pricing and high current yields with modest leverage

As of June 30, 2015

¹ Total includes all Real Estate-led transactions completed from January 1, 2008 through June 30, 2015.

2 Average current leverage represents the ratio of (a) the outstanding investment-level debt to (b) the sum of (i) the market value of current holdings and (ii) the outstanding investment-level debt.

3 Average current leverage for ROF VI excludes anticipated leverage on recent all-cash acquisitions.

Confidential

4 Current: The ratio of current NOI, less debt service, to total equity, excluding any equity subordinate to the Funds' investment; reflects the levered cash yield to the Funds' investment before capital items;

stabilized: The return on equity advanced at acquisition, plus targeted equity contributions over the life of the investment, from the targeted stabilized net cash flow determined in the initial underwriting pro

forma.

5 Total includes all real estate holdings in ROF IV, Remington, ROF V and ROF VI as of June 30, 2015.

11View entire presentation