Bank of America Investment Banking Pitch Book

Appendix

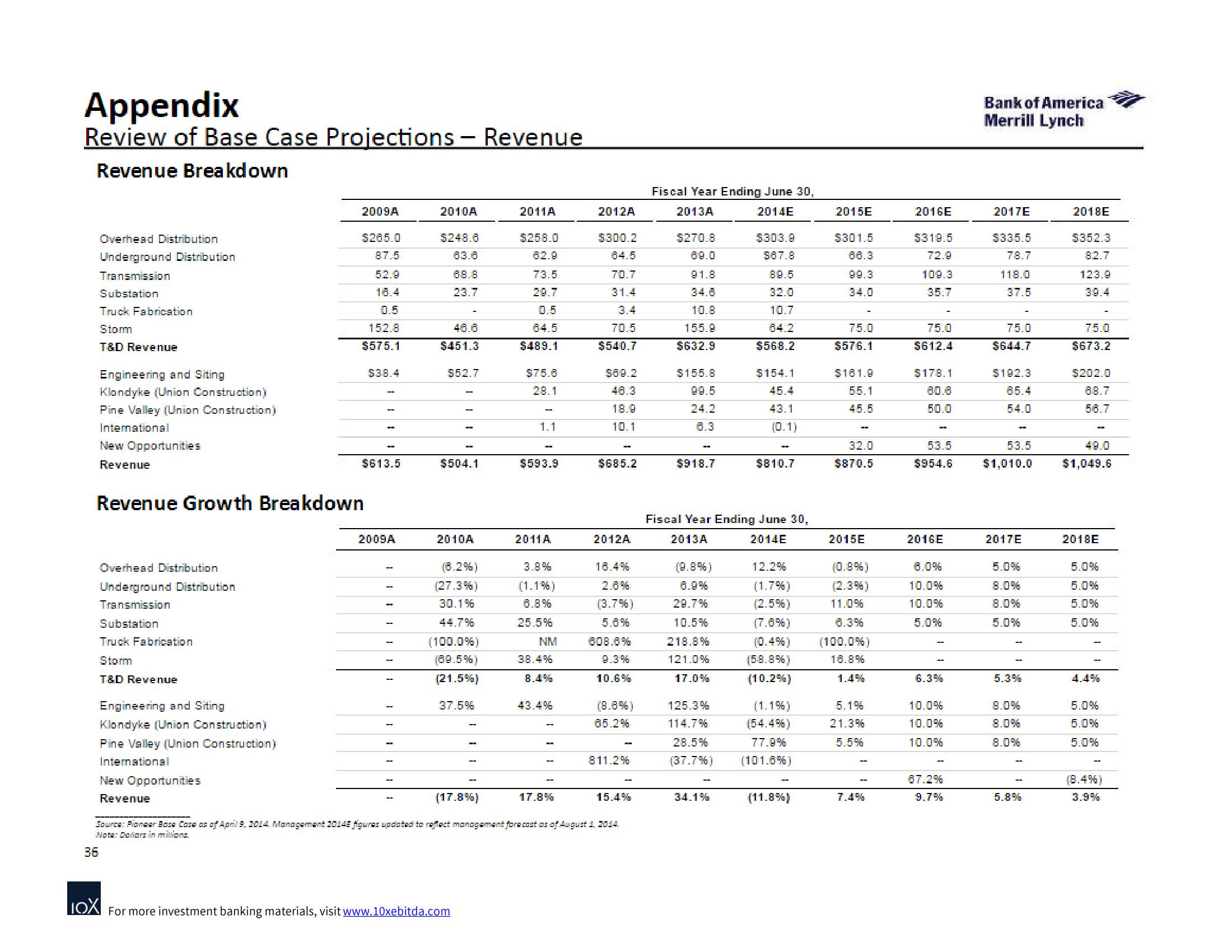

Review of Base Case Projections - Revenue

Revenue Breakdown

Overhead Distribution

Underground Distribution

Transmission

Substation

Truck Fabrication

Storm

T&D Revenue

Engineering and Siting

Klondyke (Union Construction)

Pine Valley (Union Construction)

International

New Opportunities

Revenue

Overhead Distribution

Underground Distribution

Transmission

Substation

Revenue Growth Breakdown

Truck Fabrication

Storm

T&D Revenue

Engineering and Siting

Klondyke (Union Construction)

Pine Valley (Union Construction)

International

2009A

$265.0

87.5

52.9

18.4

0.5

152.8

$575.1

New Opportunities

Revenue

$38.4

$613.5

2009A

2010A

$248.0

63.6

88.8

23.7

46.6

$451.3

552.7

$504.1

2010A

(8.2%)

(27.3%)

30.1%

44.7%

(100.0%)

(69.5%)

(21.5%)

37.5%

(17.8%)

2011A

IOX For more investment banking materials, visit www.10xebitda.com

$258.0

82.9

73.5

29.7

0.5

64.5

$489.1

$75.8

28.1

1.1

$593.9

2011 A

3.8%

(1.1%)

6.8%

25.5%

NM

38.4%

8.4%

43.4%

17.8%

2012A

$300.2

64.5

70.7

31.4

3.4

70.5

$540.7

569.2

48.3

18.9

10.1

$685.2

2012A

18.4%

2.6%

(3.7%)

5.0%

608.6%

9.3%

10.6%

(8.8%)

65.2%

811.2%

15.4%

Source: Pioneer Bose Cosa as of April 9. 2014. Management 20148 figuras updated to reflect management forecast as of August 1, 2014.

Note: Dollars in milions.

36

Fiscal Year Ending June 30,

2013A

2014E

$270.8

89.0

91.8

34.8

10.8

155.9

$632.9

$155.8

99.5

24.2

6.3

$918.7

(9.8%)

6.9%

29.7%

10.5%

218.8%

121.0%

17.0%

125.3%

114.7%

28.5%

(37.7%)

$303.9

587.8

89.5

32.0

10.7

64.2

$568.2

Fiscal Year Ending June 30,

2013A

2014E

34.1%

$154.1

45.4

43.1

(0.1)

$810.7

(1.1%)

(54.4%)

77.9%

(101.6%)

2015E

(11.8%)

5301.5

88.3

99.3

34.0

75.0

$576.1

$181.9

55.1

45.5

32.0

$870.5

12.2%

(0.8%)

(1.7%)

(2.3%)

(2.5%)

11.0%

6.3%

(7.6%)

(0.4%) (100.0%)

(58.8%)

16.8%

(10.2%)

1.4%

2015E

5.1%

21.3%

5.5%

7.4%

2016E

$319.5

72.9

109.3

35.7

75.0

$612.4

$178.1

80.8

50.0

53.5

$954.6

2016E

8.0%

10.0%

10.0%

5.0%

-

6.3%

10.0%

10.0%

10.0%

87.2%

9.7%

Bank of America

Merrill Lynch

2017E

$335.5

78.7

118.0

37.5

75.0

$644.7

$192.3

85.4

54.0

53.5

$1,010.0

2017E

5.0%

8.0%

8.0%

5.0%

5.3%

8.0%

8.0%

8.0%

5.8%

2018E

$352.3

82.7

123.9

39.4

75.0

$673.2

$202.0

88.7

58.7

49.0

$1,049.6

2018E

5.0%

5.0%

5.0%

5.0%

4.4%

5.0%

5.0%

5.0%

(8.4%)

3.9%View entire presentation