Advent Capital Balanced Strategy Update

DISCLOSURES

Firm Information:

Advent Capital Management, LLC (Advent) is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Advent is an independent, privately held limited liability company. Advent

Capital Management UK Limited, a wholly-owned subsidiary of Advent located in London, is authorized and regulated by the U.K. Financial Conduct Authority. Advent specializes in global and domestic convertible, high yield, and event-driven

strategies based on a credit focused investment process with offices in New York and London. Advent has approximately $8.6 billion in assets under management (as of 5/31/20). We manage institutional assets across long-only, alternative

and closed end fund strategies. A list of all firm composites is available upon request.

Advent claims compliance with the Global Investment Performance Standards (GIPSⓇ) and has prepared and presented this report in compliance with the GIPS standards. The verification report(s) is/are available upon request. Advent has

been independently verified for the period 9/30/95 - 12/31/19. Verification assesses whether (1) the firm has complied with all the composite construction requirements of the GIPS standards on a firm-wide basis and (2) the firm's policies

and procedures are designed to calculate and present performance in compliance with the GIPS standards. The Balanced Convertible Institutional Composite has been examined for the periods 10/01/95 - 12/31/19. The verification and

performance examination reports are available upon request. Additional information regarding policies for valuing portfolios, calculating performance and preparing compliant presentations are available upon request. Past performance does

not guarantee future results. This performance report should not be construed as a recommendation to purchase or sell any particular securities held in composite accounts. Market conditions can vary widely over time and can result in a loss

of portfolio value. Performance reflects the reinvestment of dividends and other earnings.

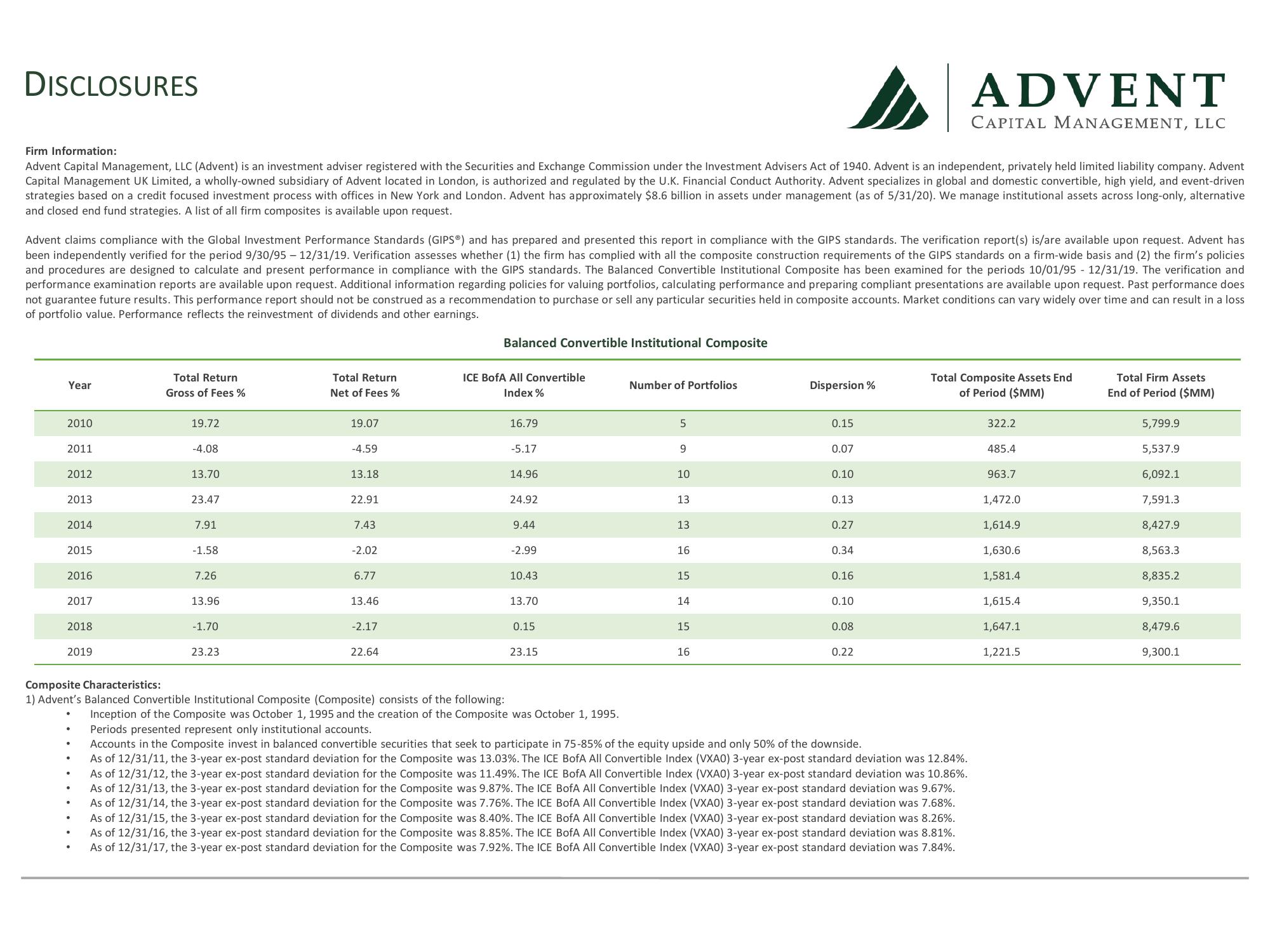

Year

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

Total Return

Gross of Fees%

19.72

-4.08

13.70

23.47

7.91

-1.58

7.26

13.96

-1.70

23.23

Total Return

Net of Fees %

19.07

-4.59

13.18

22.91

7.43

-2.02

6.77

13.46

-2.17

22.64

Balanced Convertible Institutional Composite

ICE BofA All Convertible

Index %

16.79

-5.17

14.96

24.92

9.44

-2.99

10.43

13.70

0.15

23.15

Number of Portfolios

5

9

10

13

13

16

15

14

15

16

Dispersion%

0.15

0.07

0.10

0.13

0.27

0.34

0.16

0.10

0.08

ADVENT

CAPITAL MANAGEMENT, LLC

0.22

Total Composite Assets End

of Period ($MM)

Composite Characteristics:

1) Advent's Balanced Convertible Institutional Composite (Composite) consists of the following:

Inception of the Composite was October 1, 1995 and the creation of the Composite was October 1, 1995.

Periods presented represent only institutional accounts.

Accounts in the Composite invest in balanced convertible securities that seek to participate in 75-85% of the equity upside and only 50% of the downside.

As of 12/31/11, the 3-year ex-post standard deviation for the Composite was 13.03%. The ICE BofA All Convertible Index (VXA0) 3-year ex-post standard deviation was 12.84%.

As of 12/31/12, the 3-year ex-post standard deviation for the Composite was 11.49%. The ICE BofA All Convertible Index (VXAO) 3-year ex-post standard deviation was 10.86%.

As of 12/31/13, the 3-year ex-post standard deviation for the Composite was 9.87%. The ICE BofA All Convertible Index (VXAO) 3-year ex-post standard deviation was 9.67%.

As of 12/31/14, the 3-year ex-post standard deviation for the Composite was 7.76%. The ICE BofA All Convertible Index (VXAO) 3-year ex-post standard deviation was 7.68%.

As of 12/31/15, the 3-year ex-post standard deviation for the Composite was 8.40%. The ICE BofA All Convertible Index (VXAO) 3-year ex-post standard deviation was 8.26%.

As of 12/31/16, the 3-year ex-post standard deviation for the Composite was 8.85%. The ICE BofA All Convertible Index (VXAO) 3-year ex-post standard deviation was 8.81%.

As of 12/31/17, the 3-year ex-post standard deviation for the Composite was 7.92%. The ICE BofA All Convertible Index (VXAO) 3-year ex-post standard deviation was 7.84%.

322.2

485.4

963.7

1,472.0

1,614.9

1,630.6

1,581.4

1,615.4

1,647.1

1,221.5

Total Firm Assets

End of Period ($MM)

5,799.9

5,537.9

6,092.1

7,591.3

8,427.9

8,563.3

8,835.2

9,350.1

8,479.6

9,300.1View entire presentation