Newsight Imaging SPAC Presentation Deck

Underwriter IPO shares

Highlights

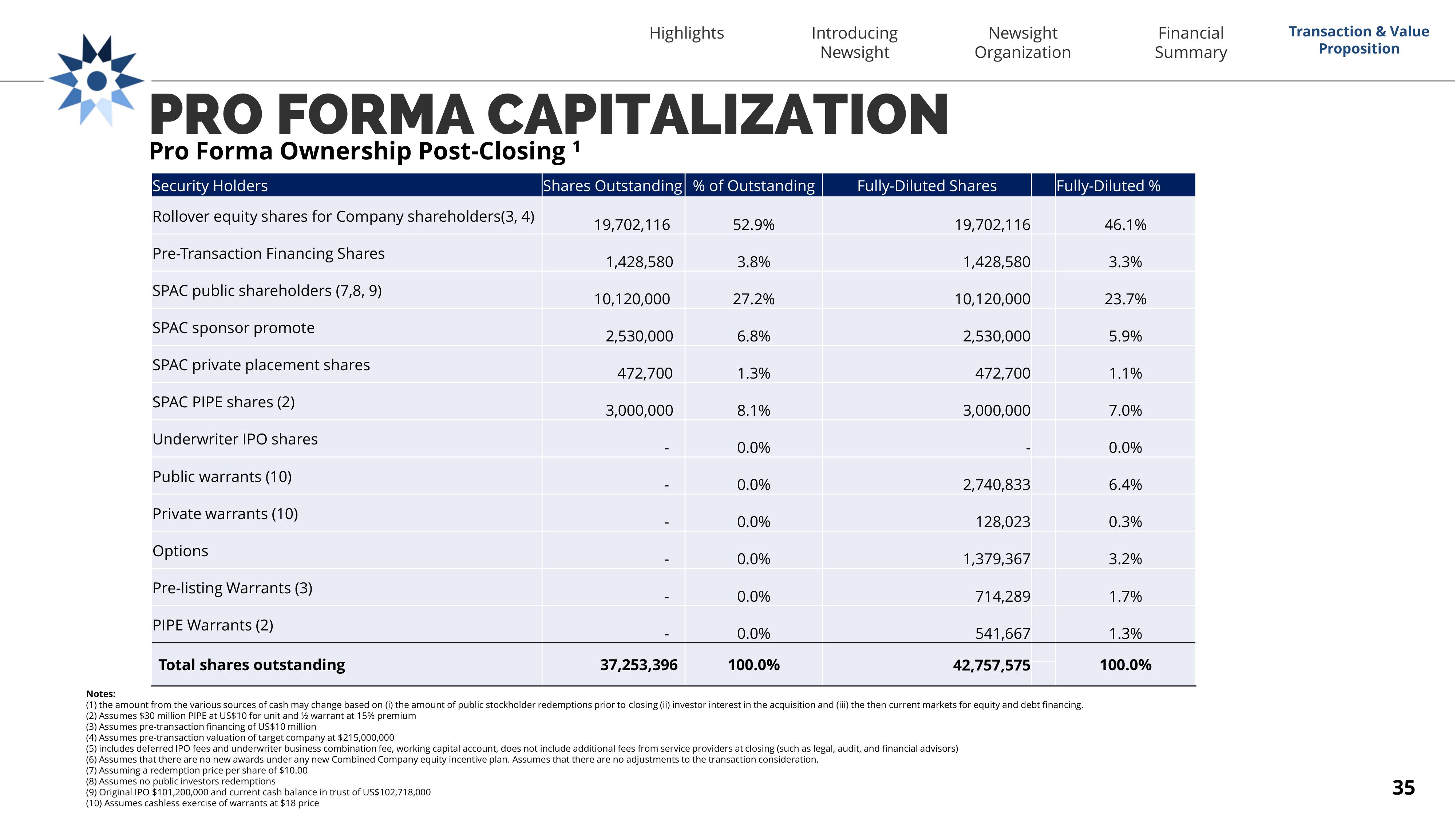

PRO FORMA CAPITALIZATION

Pro Forma Ownership Post-Closing 1

Security Holders

Rollover equity shares for Company shareholders(3, 4)

Pre-Transaction Financing Shares

SPAC public shareholders (7,8, 9)

SPAC sponsor promote

SPAC private placement shares

SPAC PIPE shares (2)

19,702,116

Shares Outstanding % of Outstanding Fully-Diluted Shares

1,428,580

10,120,000

2,530,

472,700

3,000,000

52.9%

37,253,396

3.8%

27.2%

6.8%

1.3%

8.1%

0.0%

0.0%

0.0%

Introducing

Newsight

0.0%

0.0%

0.0%

100.0%

Newsight

Organization

(6) Assumes that there are no new awards under any new Combined Company equity incentive plan. Assumes that there are no adjustments to the transaction consideration.

(7) Assuming a redemption price per share of $10.00

(8) Assumes no public investors redemptions

(9) Original IPO $101,200,000 and current cash balance in trust of US$102,718,000

(10) Assumes cashless exercise of warrants at $18 price

19,702,116

Public warrants (10)

Private warrants (10)

Options

Pre-listing Warrants (3)

PIPE Warrants (2)

Total shares outstanding

Notes:

(1) the amount from the various sources of cash may change based on (i) the amount of public stockholder redemptions prior to closing (ii) investor interest in the acquisition and (iii) the then current markets for equity and debt financing.

(2) Assumes $30 million PIPE at US$10 for unit and ½ warrant at 15% premium

(3) Assumes pre-transaction financing of US$10 million

(4) Assumes pre-transaction valuation of target company at $215,000,000

(5) includes deferred IPO fees and underwriter business combination fee, working capital account, does not include additional fees from service providers at closing (such as legal, audit, and financial advisors)

1,428,580

10,120,000

2,530,000

472,700

3,000,000

2,740,833

128,023

1,379,367

714,289

541,667

42,757,575

Fully-Diluted %

46.1%

3.3%

23.7%

5.9%

1.1%

7.0%

0.0%

6.4%

0.3%

3.2%

1.7%

Financial

Summary

1.3%

100.0%

Transaction & Value

Proposition

35View entire presentation