Informatica Investor Presentation Deck

43

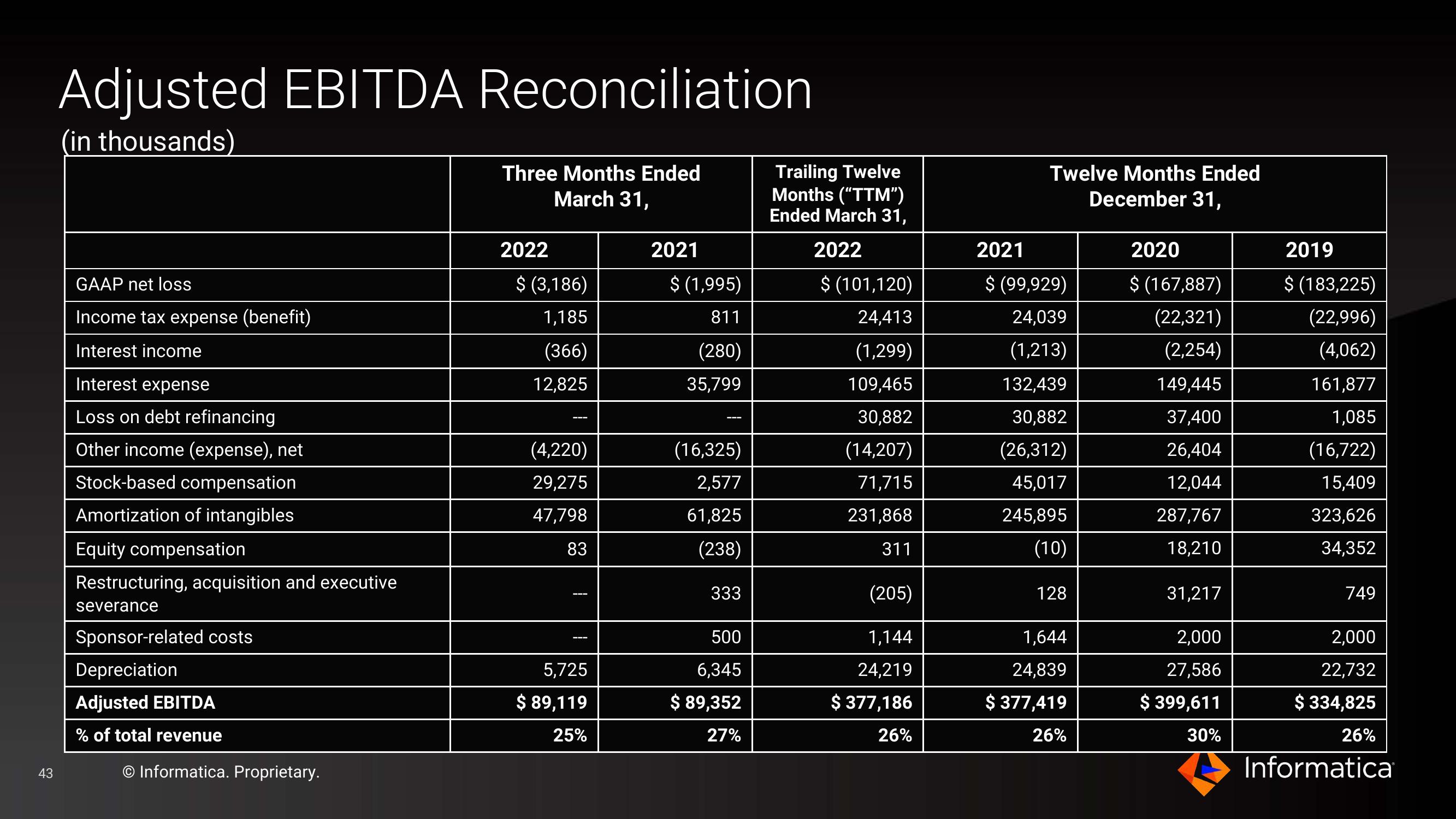

Adjusted EBITDA Reconciliation

(in thousands)

GAAP net loss

Income tax expense (benefit)

Interest income

Interest expense

Loss on debt refinancing

Other income (expense), net

Stock-based compensation

Amortization of intangibles

Equity compensation

Restructuring, acquisition and executive

severance

Sponsor-related costs

Depreciation

Adjusted EBITDA

% of total revenue

Informatica. Proprietary.

Three Months Ended

March 31,

2022

$ (3,186)

1,185

(366)

12,825

(4,220)

29,275

47,798

83

T

I

5,725

$ 89,119

25%

2021

$ (1,995)

811

(280)

35,799

(16,325)

2,577

61,825

(238)

333

500

6,345

$ 89,352

27%

Trailing Twelve

Months ("TTM")

Ended March 31,

2022

$ (101,120)

24,413

(1,299)

109,465

30,882

(14,207)

71,715

231,868

311

(205)

1,144

24,219

$ 377,186

26%

2021

Twelve Months Ended

December 31,

$ (99,929)

24,039

(1,213)

132,439

30,882

(26,312)

45,017

245,895

(10)

128

1,644

24,839

$ 377,419

26%

2020

$ (167,887)

(22,321)

(2,254)

149,445

37,400

26,404

12,044

287,767

18,210

31,217

2,000

27,586

$ 399,611

30%

2019

$ (183,225)

(22,996)

(4,062)

161,877

1,085

(16,722)

15,409

323,626

34,352

749

2,000

22,732

$ 334,825

26%

InformaticaView entire presentation