CorpAcq SPAC Presentation Deck

32

3A

$451

ΝΑ

$174

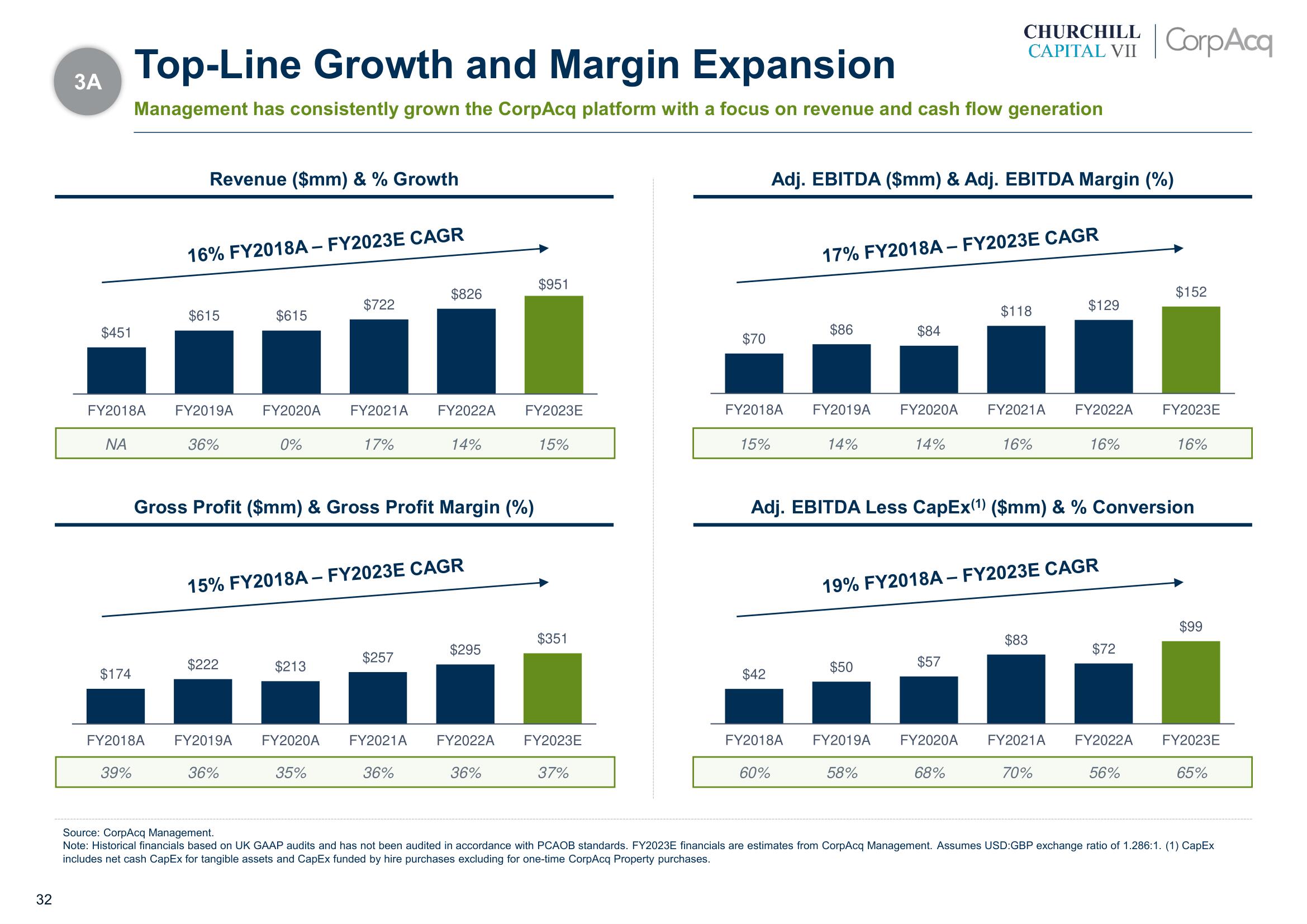

Top-Line Growth and Margin Expansion

Management has consistently grown the CorpAcq platform with a focus on revenue and cash flow generation

Revenue ($mm) & % Growth

39%

16% FY2018A - FY2023E CAGR

$615

FY2018A FY2019A FY2020A FY2021A FY2022A

36%

14%

$615

$222

0%

36%

FY2018A FY2019A FY2020A

$722

Gross Profit ($mm) & Gross Profit Margin (%)

15% FY2018A - FY2023E CAGR

$213

17%

35%

$826

$257

FY2021A

36%

$295

FY2022A

36%

$951

FY2023E

15%

$351

FY2023E

37%

$70

FY2018A

15%

$42

Adj. EBITDA ($mm) & Adj. EBITDA Margin (%)

FY2018A

60%

17% FY2018A - FY2023E CAGR

$86

14%

FY2019A FY2020A FY2021A

CHURCHILL

CAPITAL VII CorpAcq

$84

$50

FY2019A

14%

58%

$118

$57

16%

Adj. EBITDA Less CapEx(1) ($mm) & % Conversion

19% FY2018A - FY2023E CAGR

$129

FY2022A

$83

16%

$72

FY2020A FY2021A FY2022A

68%

70%

$152

56%

FY2023E

16%

$99

FY2023E

65%

Source: CorpAcq Management.

Note: Historical financials based on UK GAAP audits and has not been audited in accordance with PCAOB standards. FY2023E financials are estimates from CorpAcq Management. Assumes USD:GBP exchange ratio of 1.286:1. (1) CapEx

includes net cash CapEx for tangible assets and CapEx funded by hire purchases excluding for one-time CorpAcq Property purchases.View entire presentation