Bausch+Lomb Results Presentation Deck

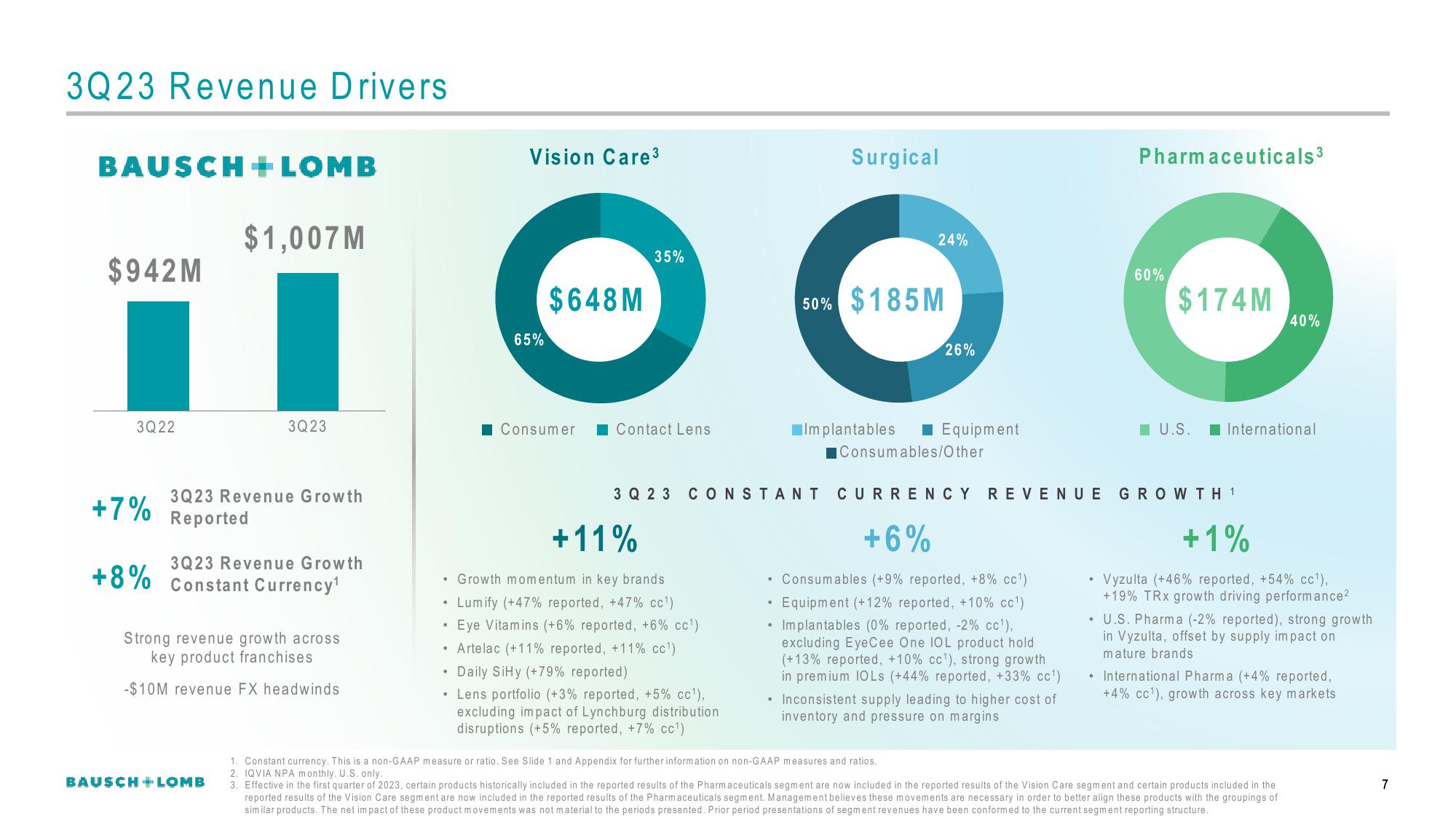

3Q23 Revenue Drivers

BAUSCH + LOMB

$942 M

3Q22

+7%

+8%

$1,007M

3Q23

3Q23 Revenue Growth

Reported

3Q23 Revenue Growth

Constant Currency¹

BAUSCH+ LOMB

Strong revenue growth across

key product franchises

-$10M revenue FX headwinds

Vision Care ³

65%

$648 M

Consumer

35%

Contact Lens

+11%

Growth momentum in key brands

Lumify (+47% reported, +47% cc¹)

Eye Vitamins (+6% reported, +6% cc¹)

Artelac (+11% reported, +11% cc¹)

Daily SiHy (+79% reported)

Lens portfolio (+3% reported, +5% cc¹),

excluding impact of Lynchburg distribution

disruptions (+5% reported, +7% cc¹)

Surgical

.

24%

50% $185M

26%

3 Q 2 3 CONSTANT CURRENCY REVENUE

+6%

• Consumables (+9% reported, +8% cc¹)

• Equipment (+12% reported, +10% cc¹)

Implantables (0% reported, -2% cc¹),

excluding Eye Cee One IOL product hold

(+13% reported, +10% cc¹), strong growth

in premium IOLS (+44% reported, +33% cc¹)

■Implantables ■ Equipment

Consumables/Other

• Inconsistent supply leading to higher cost of

inventory and pressure on margins

Pharmaceuticals ³

60%

$174M

U.S.

International

GROWTH 1

40%

+1%

Vyzulta (+46% reported, +54% cc¹),

+19% TRX growth driving performance²

• U.S. Pharma (-2% reported), strong growth

in Vyzulta, offset by supply impact on

mature brands

International Pharma (+4% reported,

+4% cc¹), growth across key markets

1. Constant currency. This is a non-GAAP measure or ratio. See Slide 1 and Appendix for further information on non-GAAP measures and ratios.

2. IQVIA NPA monthly. U.S. only.

3. Effective in the first quarter of 2023, certain products historically included in the reported results of the Pharmaceuticals segment are now included in the reported results of the Vision Care segment and certain products included in the

reported results of the Vision Care segment are now included in the reported results of the Pharmaceuticals segment. Management believes these movements are necessary in order to better align these products with the groupings of

similar products. The net impact of these product movements was not material to the periods presented. Prior period presentations of segment revenues have been conformed to the current segment reporting structure.

7View entire presentation