Deutsche Bank Fixed Income Presentation Deck

Continued high loss-absorbing capacity

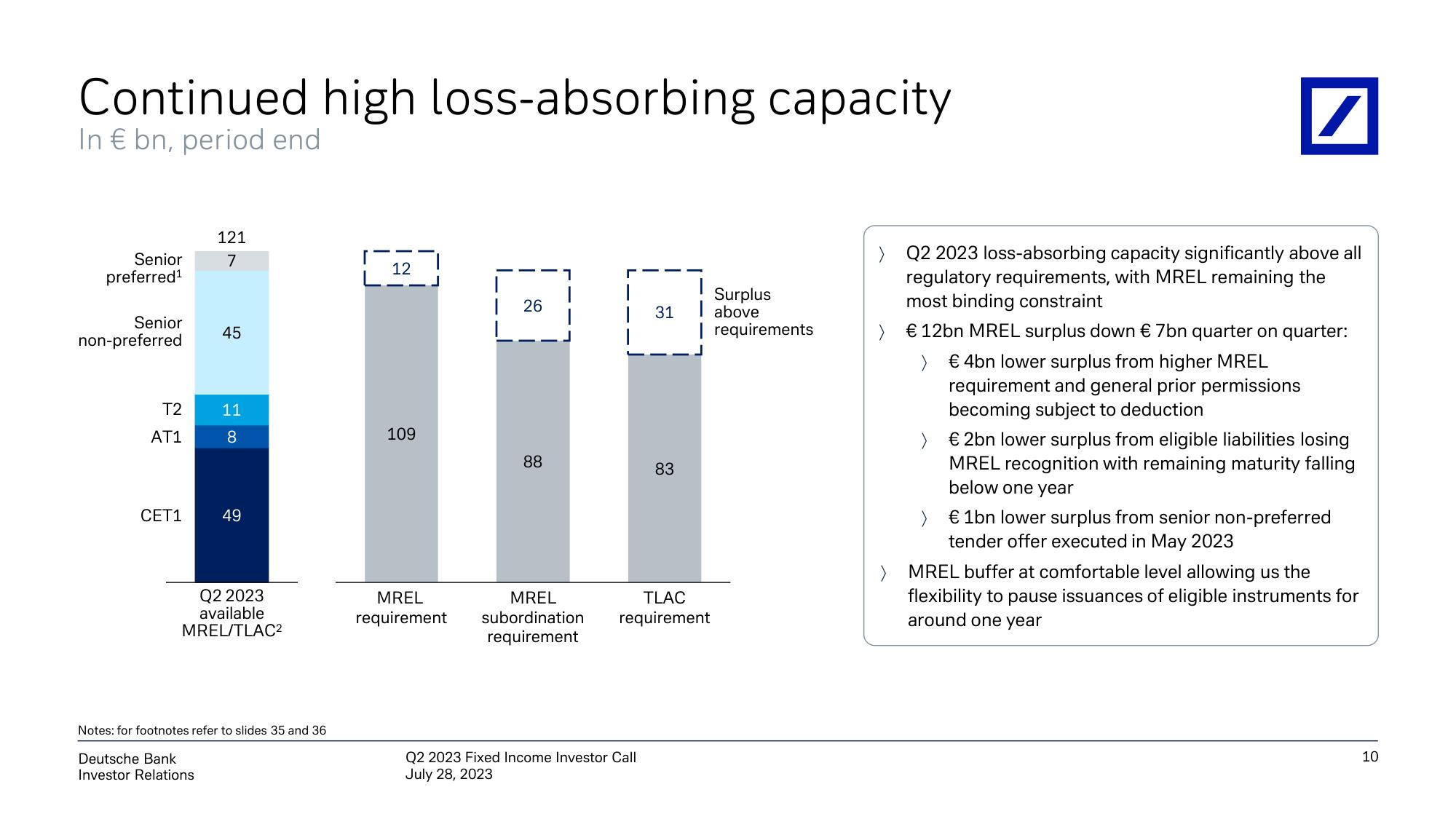

In € bn, period end

Senior

preferred¹

Senior

non-preferred

T2

AT1

CET1

121

7

45

11

8

49

Q2 2023

available

MREL/TLAC²

Notes: for footnotes refer to slides 35 and 36

Deutsche Bank

Investor Relations

12

109

MREL

requirement

26

88

1

MREL

subordination

requirement

31

Q2 2023 Fixed Income Investor Call

July 28, 2023

83

Surplus

above

I requirements

TLAC

requirement

/

> Q2 2023 loss-absorbing capacity significantly above all

regulatory requirements, with MREL remaining the

most binding constraint

€ 12bn MREL surplus down € 7bn quarter on quarter:

>

€ 4bn lower surplus from higher MREL

requirement and general prior permissions

becoming subject to deduction

>

€ 2bn lower surplus from eligible liabilities losing

MREL recognition with remaining maturity falling

below one year

>

€ 1bn lower surplus from senior non-preferred

tender offer executed in May 2023

> MREL buffer at comfortable level allowing us the

flexibility to pause issuances of eligible instruments for

around one year

10View entire presentation