Blackwells Capital Activist Presentation Deck

I

■

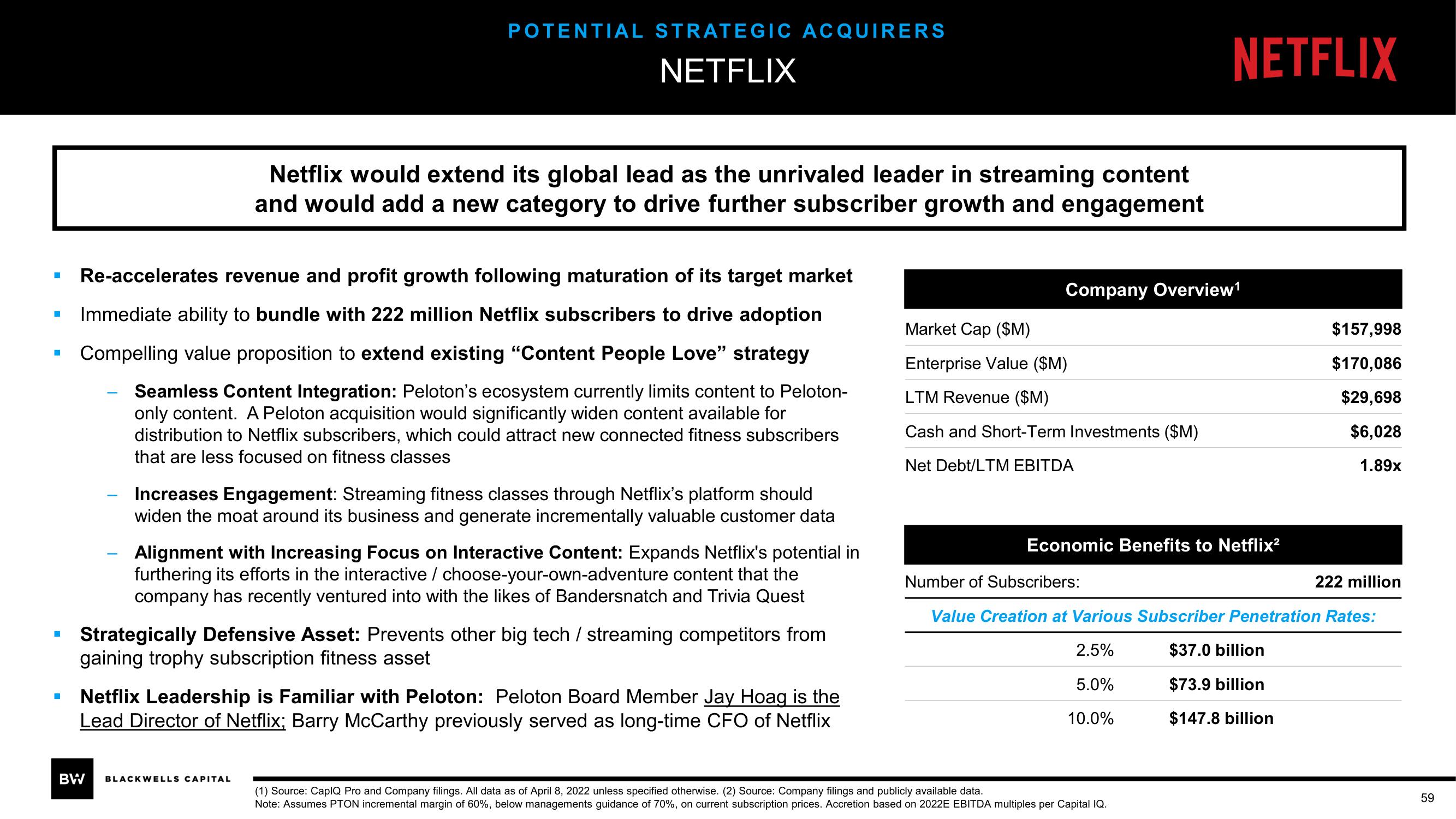

POTENTIAL STRATEGIC ACQUIRERS

NETFLIX

Netflix would extend its global lead as the unrivaled leader in streaming content

and would add a new category to drive further subscriber growth and engagement

Re-accelerates revenue and profit growth following maturation of its target market

Immediate ability to bundle with 222 million Netflix subscribers to drive adoption

Compelling value proposition to extend existing "Content People Love" strategy

Seamless Content Integration: Peloton's ecosystem currently limits content to Peloton-

only content. A Peloton acquisition would significantly widen content available for

distribution to Netflix subscribers, which could attract new connected fitness subscribers

that are less focused on fitness classes

Increases Engagement: Streaming fitness classes through Netflix's platform should

widen the moat around its business and generate incrementally valuable customer data

Alignment with Increasing Focus on Interactive Content: Expands Netflix's potential in

furthering its efforts in the interactive / choose-your-own-adventure content that the

company has recently ventured into with the likes of Bandersnatch and Trivia Quest

Strategically Defensive Asset: Prevents other big tech / streaming competitors from

gaining trophy subscription fitness asset

BW BLACKWELLS CAPITAL

Netflix Leadership is Familiar with Peloton: Peloton Board Member Jay Hoag is the

Lead Director of Netflix; Barry McCarthy previously served as long-time CFO of Netflix

Company Overview¹

Market Cap ($M)

Enterprise Value ($M)

LTM Revenue ($M)

Cash and Short-Term Investments ($M)

Net Debt/LTM EBITDA

NETFLIX

Economic Benefits to Netflix²

(1) Source: CapIQ Pro and Company filings. All data as of April 8, 2022 unless specified otherwise. (2) Source: Company filings and publicly available data.

Note: Assumes PTON incremental margin of 60%, below managements guidance of 70%, on current subscription prices. Accretion based on 2022E EBITDA multiples per Capital IQ.

$157,998

$170,086

$29,698

$6,028

1.89x

Number of Subscribers:

Value Creation at Various Subscriber Penetration Rates:

2.5%

$37.0 billion

5.0%

$73.9 billion

10.0%

$147.8 billion

222 million

59View entire presentation