CubeSmart Investor Presentation Deck

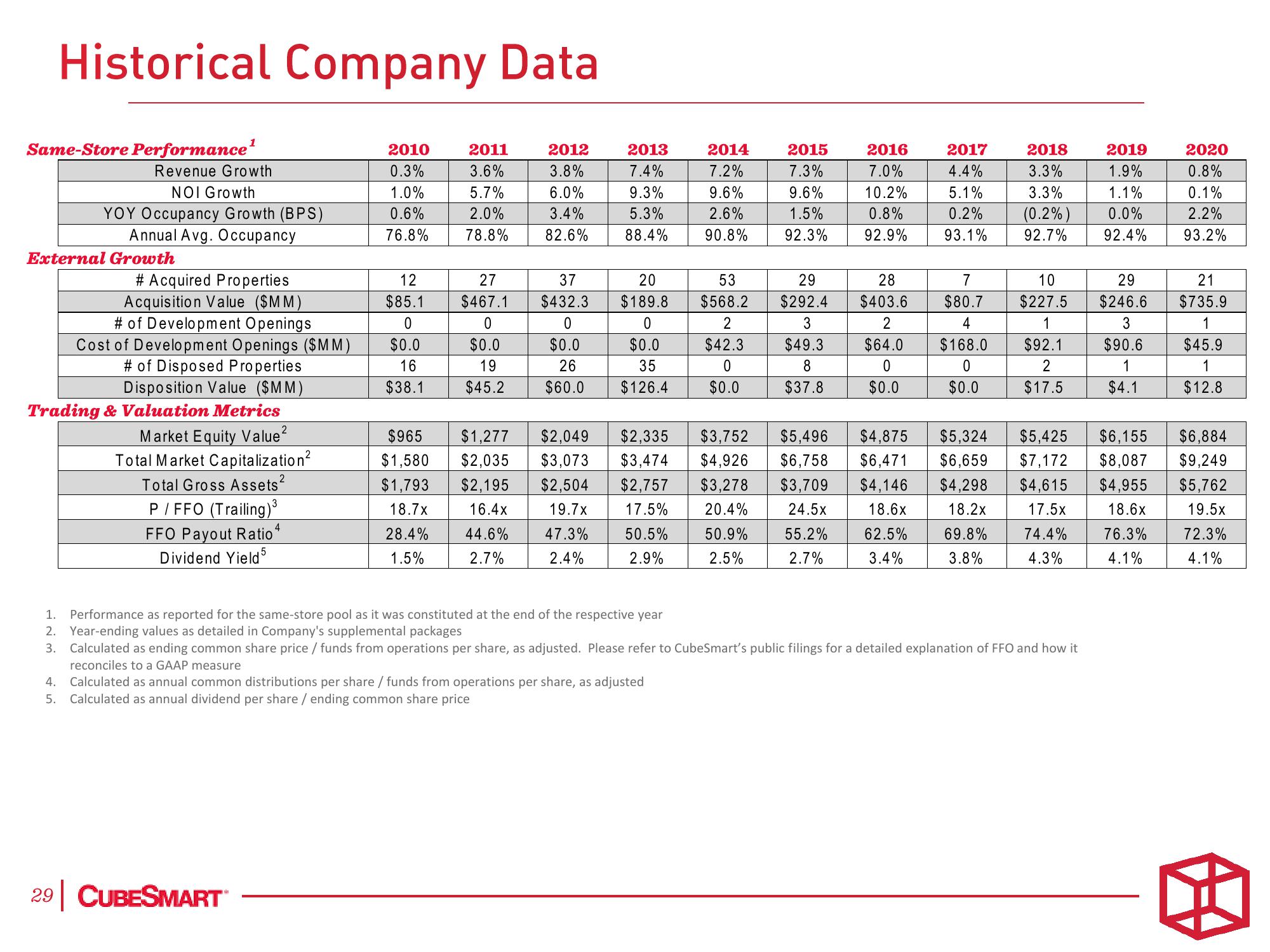

Historical Company Data

Same-Store Performance ¹

Revenue Growth

NOI Growth

YOY Occupancy Growth (BPS)

Annual Avg. Occupancy

External Growth

# Acquired Properties

Acquisition Value ($MM)

# of Development Openings

Cost of Development Openings ($MM)

# of Disposed Properties

Disposition Value ($MM)

Trading & Valuation Metrics

2

Market Equity Value

Total Market Capitalization²

Total Gross Assets²

P/FFO (Trailing) ³

FFO Payout Ratio ¹

Dividend Yield5

2010

0.3%

1.0%

0.6%

76.8%

29 CUBESMART

12

$85.1

0

$0.0

16

$38.1

$965

$1,580

$1,793

18.7x

28.4%

1.5%

2011

3.6%

5.7%

2.0%

78.8%

27

$467.1

0

$0.0

19

$45.2

2012

3.8%

6.0%

3.4%

82.6%

37

$432.3

0

$0.0

26

$60.0

$1,277 $2,049

$2,035 $3,073

$2,504

$2,195

16.4x

19.7x

44.6%

47.3%

2.7%

2.4%

2013

7.4%

9.3%

5.3%

88.4%

20

$189.8

0

$0.0

35

$126.4

2014

7.2%

9.6%

2.6%

90.8%

53

$568.2

2

$42.3

0

$0.0

$2,335 $3,752

$3,474 $4,926

$2,757 $3,278

17.5%

20.4%

50.5%

50.9%

2.9%

2.5%

2015

7.3%

9.6%

1.5%

92.3%

29

$292.4

3

$49.3

8

$37.8

2016

7.0%

10.2%

0.8%

92.9%

28

$403.6

2

$64.0

0

$0.0

$5,496 $4,875

$6,758 $6,471

$3,709 $4,146

24.5× 18.6x

55.2%

62.5%

2.7%

3.4%

2017

2018

4.4%

3.3%

3.3%

5.1%

0.2% (0.2%)

92.7%

93.1%

7

$80.7

4

$168.0

0

$0.0

10

$227.5

1

$92.1

2

$17.5

69.8%

3.8%

1. Performance as reported for the same-store pool as it was constituted at the end of the respective year

2. Year-ending values as detailed in Company's supplemental packages

3. Calculated as ending common share price / funds from operations per share, as adjusted. Please refer to CubeSmart's public filings for a detailed explanation of FFO and how it

reconciles to a GAAP measure

4. Calculated as annual common distributions per share / funds from operations per share, as adjusted

5. Calculated as annual dividend per share / ending common share price

2019

1.9%

1.1%

0.0%

92.4%

$5,324 $5,425

$6,155

$6,659 $7,172 $8,087

$4,298 $4,615 $4,955

17.5x

18.2x

18.6x

74.4%

76.3%

4.3%

4.1%

29

$246.6

3

$90.6

1

$4.1

2020

0.8%

0.1%

2.2%

93.2%

21

$735.9

1

$45.9

1

$12.8

$6,884

$9,249

$5,762

19.5×

72.3%

4.1%View entire presentation