WeWork Investor Presentation Deck

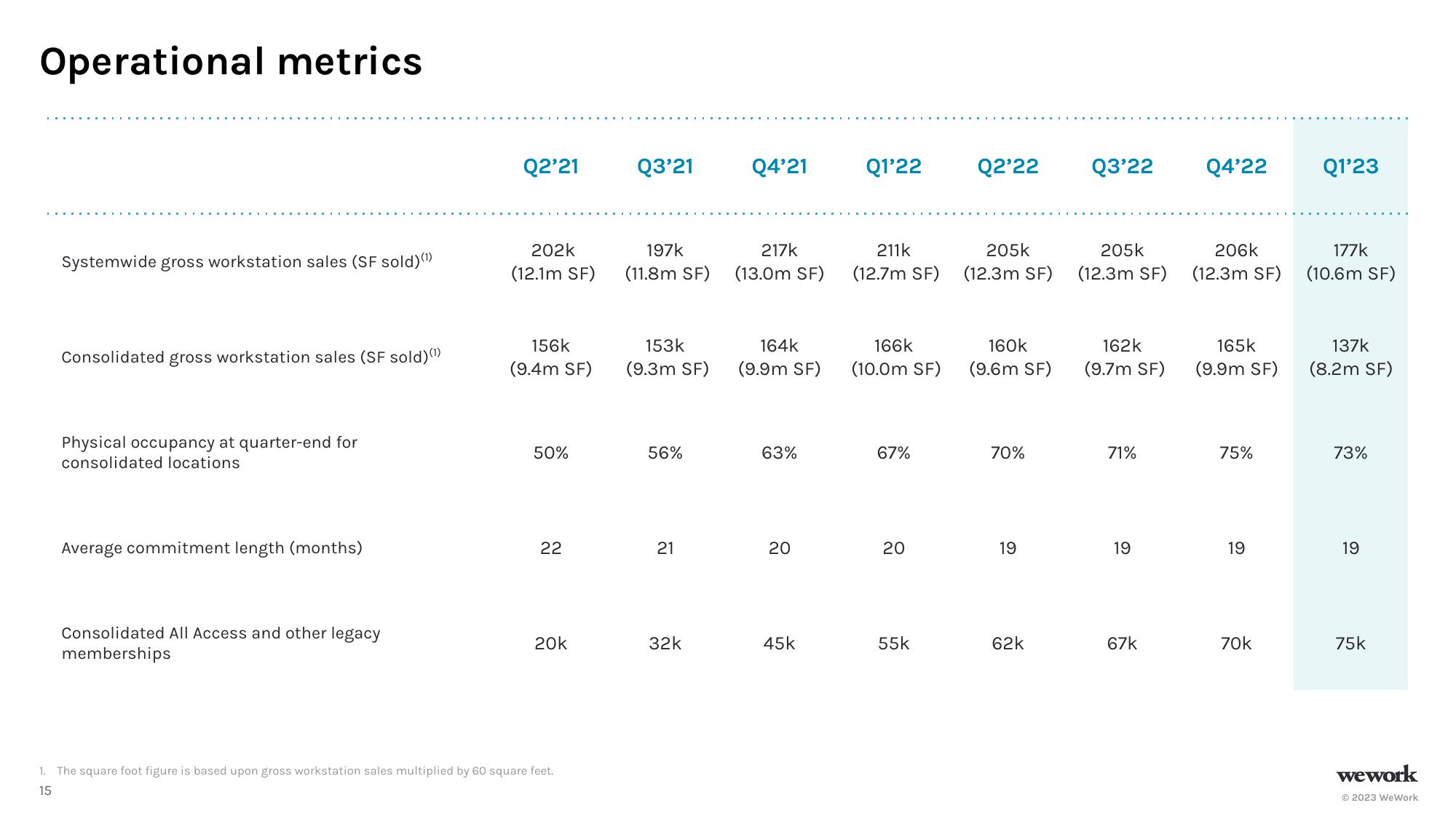

Operational metrics

Systemwide gross workstation sales (SF sold) (1)

Consolidated gross workstation sales (SF sold)(¹)

Physical occupancy at quarter-end for

consolidated locations

Average commitment length (months)

Consolidated All Access and other legacy

memberships

Q2'21

202k

(12.1m SF)

156k

(9.4m SF)

50%

22

20k

1. The square foot figure is based upon gross workstation sales multiplied by 60 square feet.

15

Q3'21

197k

(11.8m SF)

153k

(9.3m SF)

56%

21

32k

Q4'21

217k

(13.0m SF)

164k

(9.9m SF)

63%

20

45k

Q1'22

211k

(12.7m SF)

166k

(10.0m SF)

67%

20

55k

Q2'22 Q3'22

205k

(12.3m SF)

160k

(9.6m SF)

70%

19

62k

205k

(12.3m SF)

162k

(9.7m SF)

71%

19

67k

Q4'22

206k

(12.3m SF)

165k

(9.9m SF)

75%

19

70k

Q1'23

177k

(10.6m SF)

137k

(8.2m SF)

73%

19

75k

wework

Ⓒ2023 WeWorkView entire presentation