Affirm Results Presentation Deck

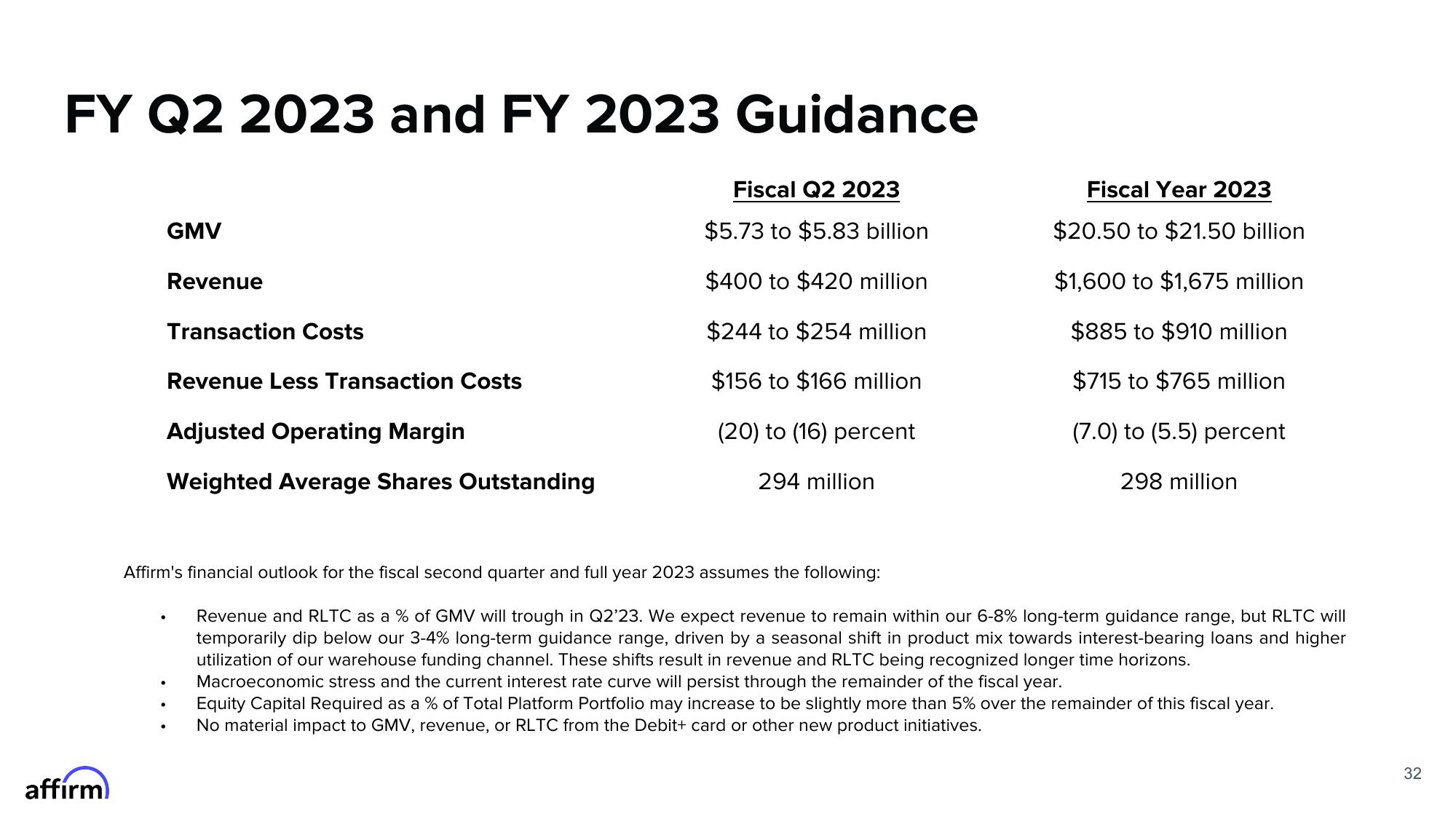

FY Q2 2023 and FY 2023 Guidance

Fiscal Q2 2023

$5.73 to $5.83 billion

$400 to $420 million

$244 to $254 million

$156 to $166 million

(20) to (16) percent

294 million

affirm

GMV

Revenue

Transaction Costs

Revenue Less Transaction Costs

Adjusted Operating Margin

Weighted Average Shares Outstanding

Fiscal Year 2023

$20.50 to $21.50 billion

$1,600 to $1,675 million

$885 to $910 million

$715 to $765 million

(7.0) to (5.5) percent

298 million

Affirm's financial outlook for the fiscal second quarter and full year 2023 assumes the following:

Revenue and RLTC as a % of GMV will trough in Q2'23. We expect revenue to remain within our 6-8% long-term guidance range, but RLTC will

temporarily dip below our 3-4% long-term guidance range, driven by a seasonal shift in product mix towards interest-bearing loans and higher

utilization of our warehouse funding channel. These shifts result in revenue and RLTC being recognized longer time horizons.

Macroeconomic stress and the current interest rate curve will persist through the remainder of the fiscal year.

Equity Capital Required as a % of Total Platform Portfolio may increase to be slightly more than 5% over the remainder of this fiscal year.

No material impact to GMV, revenue, or RLTC from the Debit+ card or other new product initiatives.

32View entire presentation