Citi Investment Banking Pitch Book

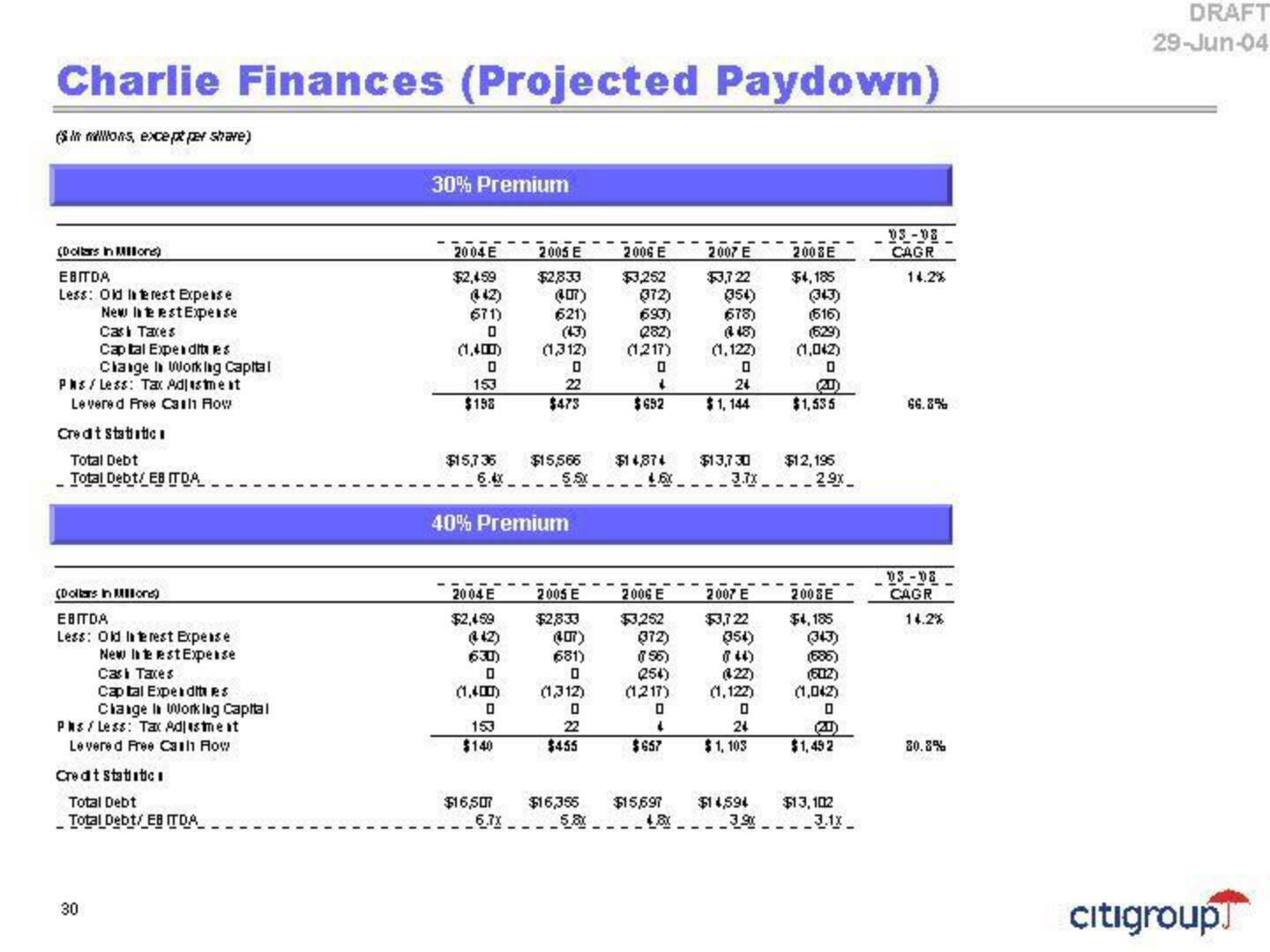

Charlie Finances (Projected Paydown)

(in mons, excepper share)

(Dolbys in Ilon)

EBITDA

Less: Old Interest Expense

New Interest Expense

Cari Taxes

Captal Expenditures

Change In Working Capital

Pas / Less: Tax Adjustment

Levered Free Cash Row

Credit Statistic.

Total Debt

Total Debt/ EBITDA

(Dolls in Milone)

EBITDA

Less: Old Interest Expense

New Ite est Expense

Casi Taxes

Captal Expenditures

Change In Working Capital

Pls / Less: Tax Adjustment

Levered Free Cash Row

30

Credit Statistic

Total Debt

Total Debt/EB ITDA

30% Premium

2004 E

$2,459

(42)

671)

0

(1,400)

0

153

$198

2004 E

$2,459

(442)

630)

0

(1,400)

0

153

$140

2005 E

$2,833

40% Premium

$16,507

(407)

621)

(43)

(1,312)

6.7x

0

22

$473

2005 E

$2,833

2006 E

$3,252

(407)

681)

0

(1,312)

0

22

$455

(372)

693)

(282)

(1,217)

0

4

$692

$15,735 $15,566 $14,874 $13,730 $12,195

6.4x5.5____1__3.7x____29x_

2006 E

$3,252

(372)

(56)

(254)

(1,217)

2007 E

$3,7 22

0

4

$657

(354)

678)

(48)

(1,122)

0

24

$1,144

2007 E

$3,7 22

(54)

(44)

(422)

(1,122)

0

24

$1,103

2003E

$4,185

$16,355 $15,697 $14,594

5.8x

48x

(343)

(616)

(629)

(1,042)

0

(20)

$1,535

2003E

$4,185

(343)

(585)

(202)

(1,042)

0

(20)

$1,492

$13,102

39 3.1x

03-08

CAGR

14.2%

66.8%

03-08

CAGR

14.2%

20.8%

DRAFT

29-Jun-04

Citigroup]View entire presentation