First Foundation Investor Presentation Deck

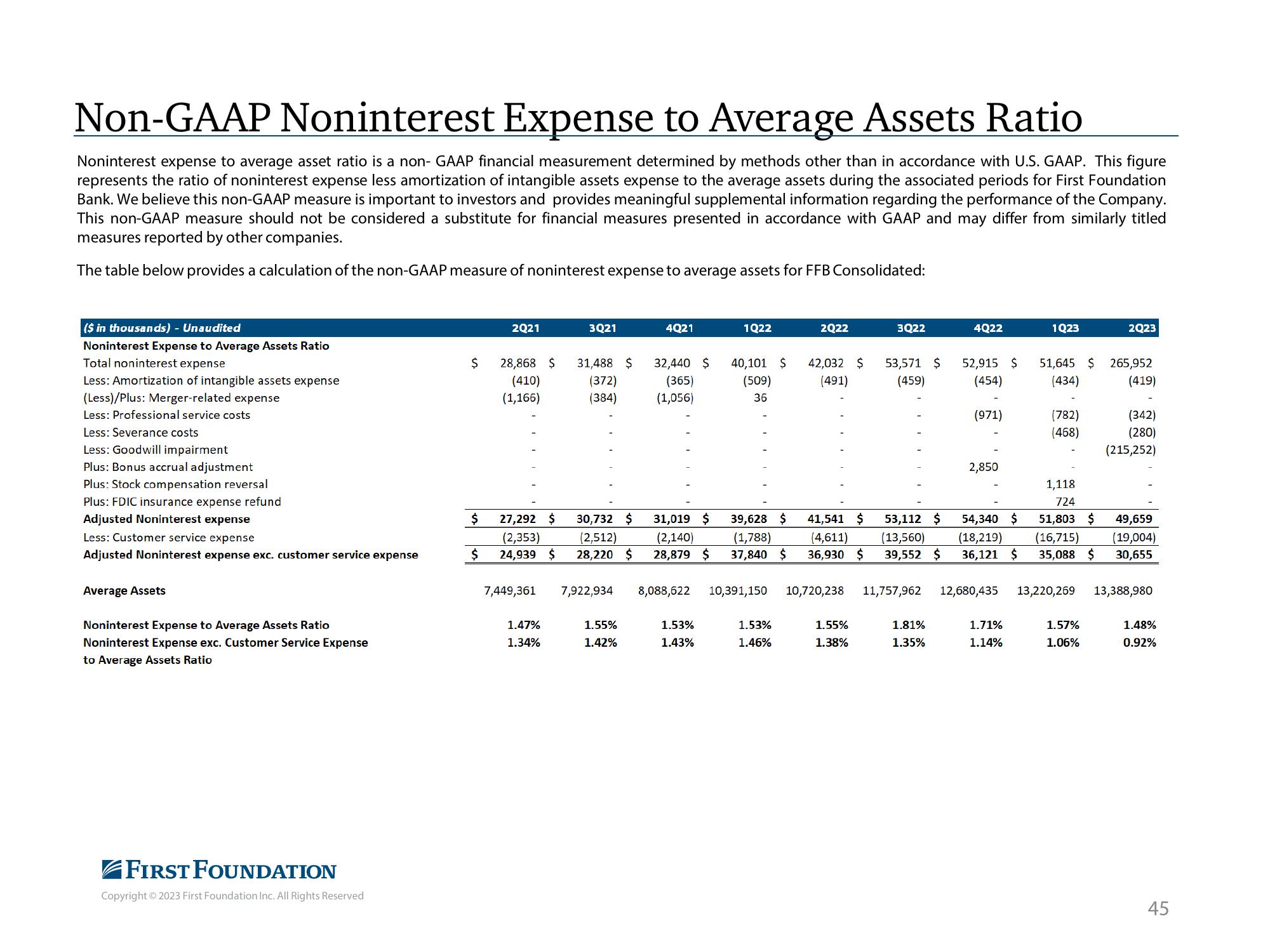

Non-GAAP Noninterest Expense to Average Assets Ratio

Noninterest expense to average asset ratio is a non- GAAP financial measurement determined by methods other than in accordance with U.S. GAAP. This figure

represents the ratio of noninterest expense less amortization of intangible assets expense to the average assets during the associated periods for First Foundation

Bank. We believe this non-GAAP measure is important to investors and provides meaningful supplemental information regarding the performance of the Company.

This non-GAAP measure should not be considered a substitute for financial measures presented in accordance with GAAP and may differ from similarly titled

measures reported by other companies.

The table below provides a calculation of the non-GAAP measure of noninterest expense to average assets for FFB Consolidated:

($ in thousands) - Unaudited

Noninterest Expense to Average Assets Ratio

Total noninterest expense

Less: Amortization of intangible assets expense

(Less)/Plus: Merger-related expense

Less: Professional service costs

Less: Severance costs

Less: Goodwill impairment

Plus: Bonus accrual adjustment

Plus: Stock compensation reversal

Plus: FDIC insurance expense refund

Adjusted Noninterest expense

Less: Customer service expense

just Noninterest expense exc. ustomer service expense

Average Assets

Noninterest Expense to Average Assets Ratio

Noninterest Expense exc. Customer Service Expense

to Average Assets Ratio

FIRST FOUNDATION

Copyright © 2023 First Foundation Inc. All Rights Reserved

$

$

2021

28,868 $

(410)

(1,166)

27,292 $

(2,353)

$ 24,93 $

7,449,361

1.47%

1.34%

3Q21

31,488 $

(372)

(384)

30,732 $

(2,512)

7,922,934

1.55%

1.42%

$

4Q21

32,440 $

(365)

(1,056)

31,019 $

(2,140)

28,879 $

1Q22

1.53%

1.43%

40,101 $

(509)

36

2Q22

39,628 $ 41,541 $

(1,788) (4,611)

37,840 $ 36,930 $

1.53%

1.46%

42,032 $ 53,571 $

(491)

(459)

3Q22

8,088,622 10,391,150 10,720,238 11,757,962

1.55%

1.38%

53,112 $

(13,560)

9,55 $

1.81%

1.35%

4Q22

52,915 $

(454)

(971)

2,850

54,340 $

(18,219)

$

1.71%

1.14%

1Q23

51,645 $ 265,952

(434)

(419)

(782)

(468)

1,118

724

51,803 $

(16,715)

35,088 $

12,680,435 13,220,269

2023

1.57%

1.06%

(342)

(280)

(215,252)

49,659

(19,004)

30

13,388,980

1.48%

0.92%

45View entire presentation