AngloAmerican Results Presentation Deck

Footnotes

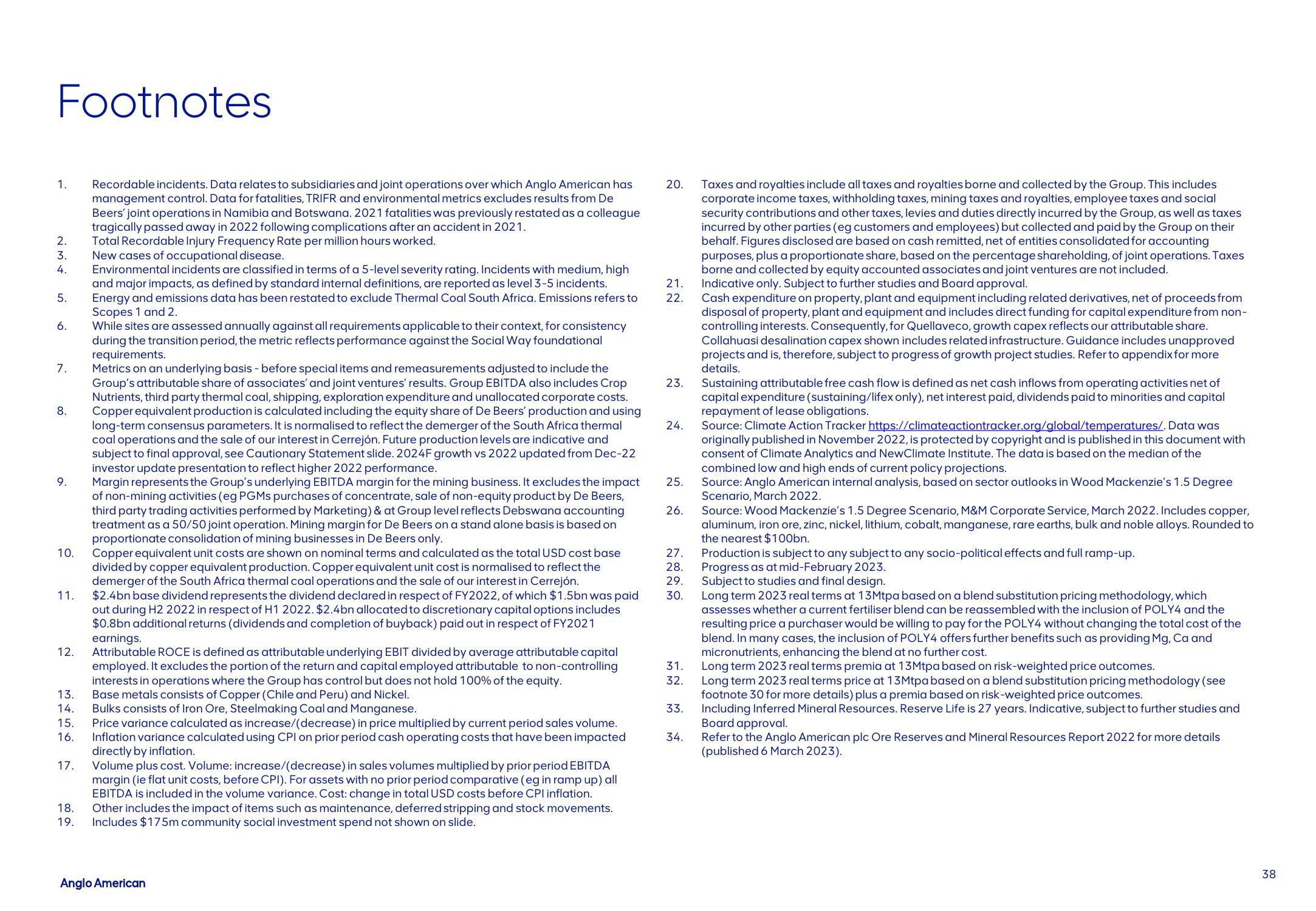

1. Recordable incidents. Data relates to subsidiaries and joint operations over which Anglo American has

management control. Data for fatalities, TRIFR and environmental metrics excludes results from De

Beers' joint operations in Namibia and Botswana. 2021 fatalities was previously restated as a colleague

tragically passed away in 2022 following complications after an accident in 2021.

2. Total Recordable Injury Frequency Rate per million hours worked.

234

3.

New cases of occupational disease.

Environmental incidents are classified in terms of a 5-level severity rating. Incidents with medium, high

and major impacts, as defined by standard internal definitions, are reported as level 3-5 incidents.

5. Energy and emissions data has been restated to exclude Thermal Coal South Africa. Emissions refers to

Scopes 1 and 2.

While sites are assessed annually against all requirements applicable to their context, for consistency

during the transition period, the metric reflects performance against the Social Way foundational

requirements.

6.

7.

8.

9.

10.

11.

12.

Metrics on an underlying basis - before special items and remeasurements adjusted to include the

Group's attributable share of associates' and joint ventures' results. Group EBITDA also includes Crop

Nutrients, third party thermal coal, shipping, exploration expenditure and unallocated corporate costs.

Copper equivalent production is calculated including the equity share of De Beers' production and using

long-term consensus parameters. It is normalised to reflect the demerger of the South Africa thermal

coal operations and the sale of our interest in Cerrejón. Future production levels are indicative and

subject to final approval, see Cautionary Statement slide. 2024F growth vs 2022 updated from Dec-22

investor update presentation to reflect higher 2022 performance.

Margin represents the Group's underlying EBITDA margin for the mining business. It excludes the impact

of non-mining activities (eg PGMs purchases of concentrate, sale of non-equity product by De Beers,

third party trading activities performed by Marketing) & at Group level reflects Debswana accounting

treatment as a 50/50 joint operation. Mining margin for De Beers on a stand alone basis is based on

proportionate consolidation of mining businesses in De Beers only.

Copper equivalent unit costs are shown on nominal terms and calculated as the total USD cost base

divided by copper equivalent production. Copper equivalent unit cost is normalised to reflect the

demerger of the South Africa thermal coal operations and the sale of our interest in Cerrejón.

$2.4bn base dividend represents the dividend declared in respect of FY2022, of which $1.5bn was paid

out during H2 2022 in respect of H1 2022. $2.4bn allocated to discretionary capital options includes

$0.8bn additional returns (dividends and completion of buyback) paid out in respect of FY2021

earnings.

Attributable ROCE is defined as attributable underlying EBIT divided by average attributable capital

employed. It excludes the portion of the return and capital employed attributable to non-controlling

interests in operations where the Group has control but does not hold 100% of the equity.

Base metals consists of Copper (Chile and Peru) and Nickel.

13.

14.

Bulks consists of Iron Ore, Steelmaking Coal and Manganese.

15. Price variance calculated as increase/(decrease) in price multiplied by current period sales volume.

16. Inflation variance calculated using CPI on prior period cash operating costs that have been impacted

directly by inflation.

Volume plus cost. Volume: increase/(decrease) in sales volumes multiplied by prior period EBITDA

margin (ie flat unit costs, before CPI). For assets with no prior period comparative (eg in

mp up) all

EBITDA is included in the volume variance. Cost: change in total USD costs before CPI inflation.

18. Other includes the impact of items such as maintenance, deferred stripping and stock movements.

19. Includes $175m community social investment spend not shown on slide.

17.

Anglo American

20.

21.

22.

23.

24.

25.

26.

27.

28.

29.

30.

33.

Taxes and royalties include all taxes and royalties borne and collected by the Group. This includes

corporate income taxes, withholding taxes, mining taxes and royalties, employee taxes and social

security contributions and other taxes, levies and duties directly incurred by the Group, as well as taxes

incurred by other parties (eg customers and employees) but collected and paid by the Group on their

behalf. Figures disclosed are based on cash remitted, net of entities consolidated for accounting

purposes, plus a proportionate share, based on the percentage shareholding, of joint operations. Taxes

borne and collected by equity accounted associates and joint ventures are not included.

Indicative only. Subject to further studies and Board approval.

Cash expenditure on property, plant and equipment including related derivatives, net of proceeds from

disposal of property, plant and equipment and includes direct funding for capital expenditure from non-

controlling interests. Consequently, for Quellaveco, growth capex reflects our attributable share.

Collahuasi desalination capex shown includes related infrastructure. Guidance includes unapproved

projects and is, therefore, subject to progress of growth project studies. Refer to appendix for more

details.

34.

Sustaining attributable free cash flow is defined as net cash inflows from operating activities net of

capital expenditure (sustaining/lifex only), net interest paid, dividends paid to minorities and capital

repayment of lease obligations.

Source: Climate Action Tracker https://climate actiontracker.org/global/temperatures/. Data was

originally published in November 2022, is protected by copyright and is published in this document with

consent of Climate Analytics and NewClimate Institute. The data is based on the median of the

combined low and high ends of current policy projections.

Source: Anglo American internal analysis, based on sector outlooks in Wood Mackenzie's 1.5 Degree

Scenario, March 2022.

Source: Wood Mackenzie's 1.5 Degree Scenario, M&M Corporate Service, March 2022. Includes copper,

aluminum, iron ore, zinc, nickel, lithium, cobalt, manganese, rare earths, bulk and noble alloys. Rounded to

the nearest $100bn.

31. Long term 2023 real terms premia at 13Mtpa based on risk-weighted price outcomes.

Long term 2023 real terms price at 13Mtpa based on a blend substitution pricing methodology (see

footnote 30 for more details) plus a premia based on risk-weighted price outcomes.

32.

Including Inferred Mineral Resources. Reserve Life is 27 years. Indicative, subject to further studies and

Board approval.

Refer to the Anglo American plc Ore Reserves and Mineral Resources Report 2022 for more details

(published 6 March 2023).

Production is subject to any subject to any socio-political effects and full ramp-up.

Progress as at mid-February 2023.

Subject to studies and final design.

Long term 2023 real terms at 13Mtpa based on a blend substitution pricing methodology, which

assesses whether a current fertiliser blend can be reassembled with the inclusion of POLY4 and the

resulting price a purchaser would be willing to pay for the POLY4 without changing the total cost of the

blend. In many cases, the inclusion of POLY4 offers further benefits such as providing Mg, Ca and

micronutrients, enhancing the blend at no further cost.

38View entire presentation