Affirm Results Presentation Deck

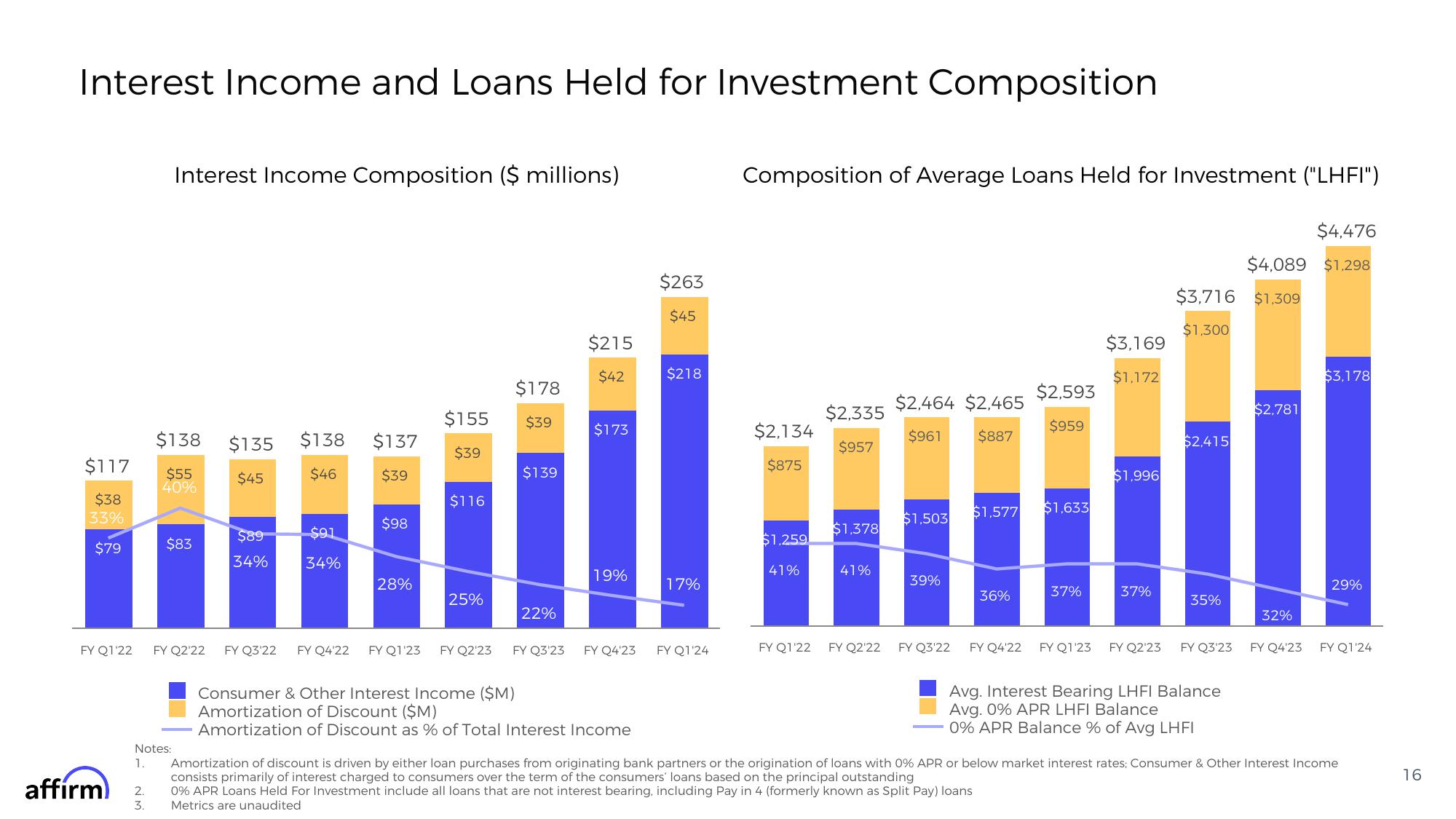

Interest Income and Loans Held for Investment Composition

$117

$38

33%

$79

FY Q1'22

affirm

2.

3.

Interest Income Composition ($ millions)

$138

$55

40%

$83

Notes:

1.

FY Q2'22

$135

$45

$89

34%

$138

$46

$91

34%

$137

$39

$98

28%

$155

$39

$116

25%

$178

$39

$139

22%

$215

$42

$173

19%

FY Q3'22 FY Q4'22 FY Q1'23 FY Q2'23 FY Q3'23 FY Q4'23

Consumer & Other Interest Income ($M)

Amortization of Discount ($M)

Amortization of Discount as % of Total Interest Income

$263

$45

$218

17%

FY Q1'24

Composition of Average Loans Held for Investment ("LHFI")

$2,134

$875

$1,259

41%

$2,335

$957

$1,378

41%

FY Q1'22 FY Q2'22

$2,464 $2,465

$961 $887

$1,503

39%

FY Q3'22

$1,577 $1,633

36%

$2,593

$959

FY Q4'22

37%

$3,169

$1,172

$1,996

37%

FY Q1'23 FY Q2'23

$3,716 $1,309

$1,300

$2,415

35%

FY Q3'23

$4,476

$4,089 $1,298

Avg. Interest Bearing LHFI Balance

Avg. 0% APR LHFI Balance

0% APR Balance % of Avg LHFI

$2,781

32%

FY Q4'23

$3,178

29%

FY Q1'24

Amortization of discount is driven by either loan purchases from originating bank partners or the origination of loans with 0% APR or below market interest rates; Consumer & Other Interest Income

consists primarily of interest charged to consumers over the term of the consumers' loans based on the principal outstanding

0% APR Loans Held For Investment include all loans that are not interest bearing, including Pay in 4 (formerly known as Split Pay) loans

Metrics are unaudited

16View entire presentation