OpenText Mergers and Acquisitions Presentation Deck

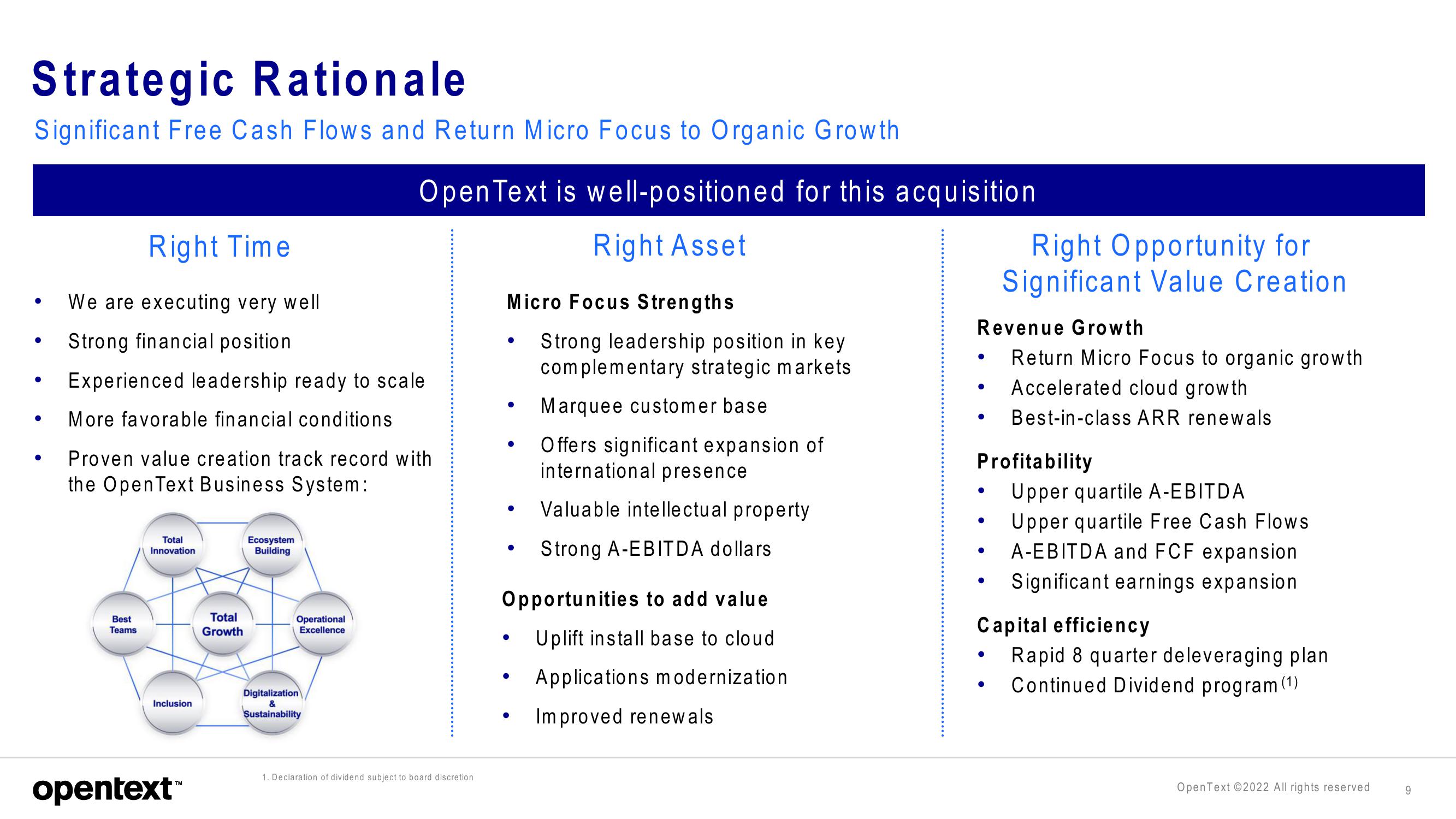

Strategic Rationale

Significant Free Cash Flows and Return Micro Focus to Organic Growth

●

●

●

●

●

Right Time

We are executing very well

Strong financial position

Experienced leadership ready to scale

More favorable financial conditions

Proven value creation track record with

the OpenText Business System:

Best

Teams

Total

Innovation

Inclusion

opentext™

Total

Growth

Ecosystem

Building

Operational

Excellence

Open Text is well-positioned for this acquisition.

Right Asset

Digitalization

&

Sustainability

1. Declaration of dividend subject to board discretion

Micro Focus Strengths

●

• Valuable intellectual property

●

Strong A-EBITDA dollars

●

Strong leadership position in key

complementary strategic markets

Marquee customer base

Offers significant expansion of

international presence

Opportunities to add value

Uplift install base to cloud

Applications modernization

Improved renewals

●

●

Revenue Growth

●

●

●

Profitability

●

Right Opportunity for

Significant Value Creation.

●

Return Micro Focus to organic growth

Accelerated cloud growth

Best-in-class ARR renewals

●

Upper quartile A-EBITDA

Capital efficiency

Upper quartile Free Cash Flows

A-EBITDA and FCF expansion

Significant earnings expansion

Rapid 8 quarter de leveraging plan.

Continued Dividend program (1)

OpenText ©2022 All rights reserved

9View entire presentation