Granite Ridge Investor Presentation Deck

Overview

Assets

Strategy & Execution

Strategic Partnerships: How & Why

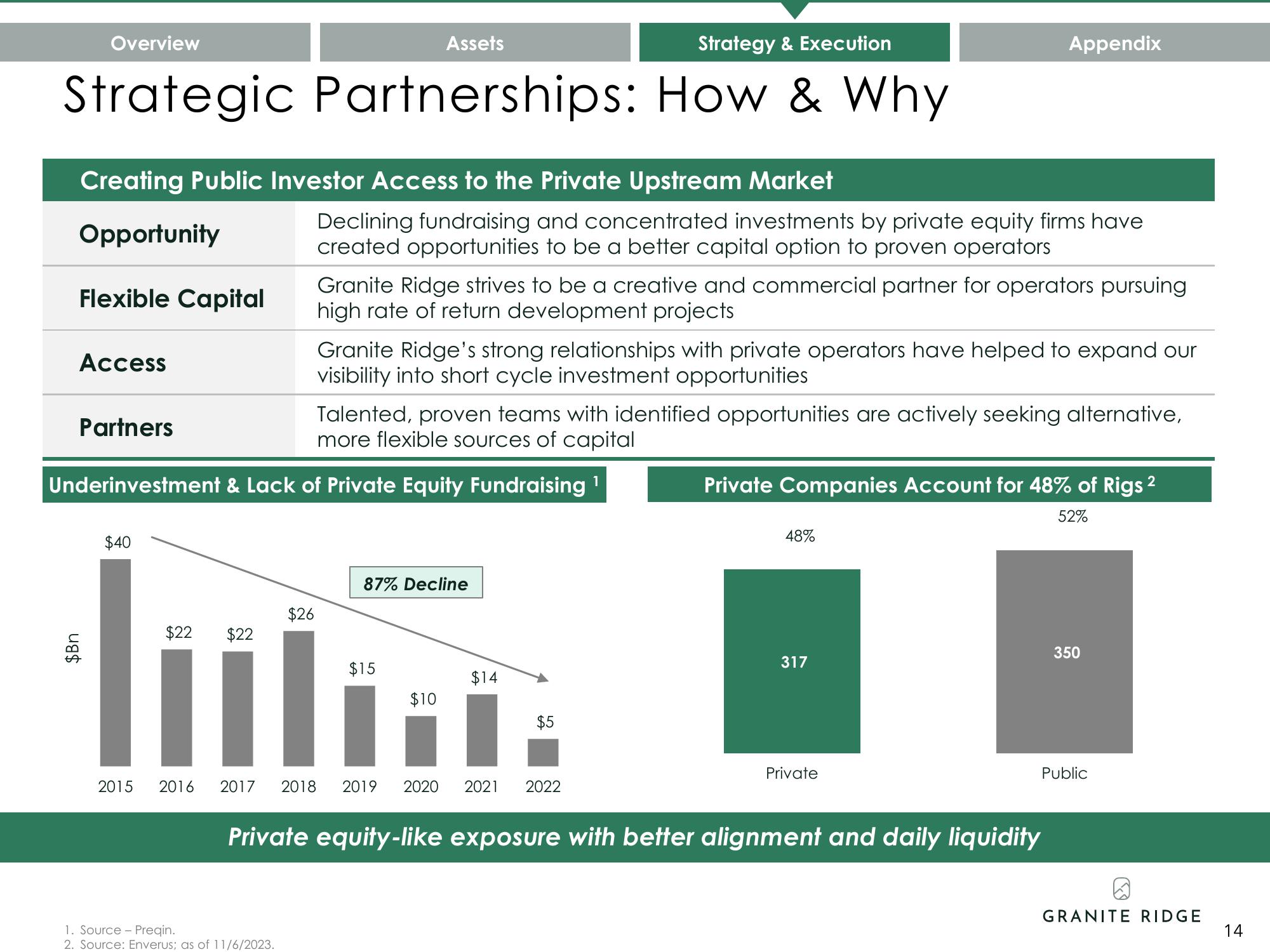

Creating Public Investor Access to the Private Upstream Market

Opportunity

Flexible Capital

Access

Partners

$Bn

$40

li

$22 $22

Underinvestment & Lack of Private Equity Fundraising ¹

1

2015 2016

Declining fundraising and concentrated investments by private equity firms have

created opportunities to be a better capital option to proven operators

$26

1. Source - Preqin.

2. Source: Enverus; as of 11/6/2023.

Granite Ridge strives to be a creative and commercial partner for operators pursuing

high rate of return development projects

Granite Ridge's strong relationships with private operators have helped to expand our

visibility into short cycle investment opportunities

Talented, proven teams with identified opportunities are actively seeking alternative,

more flexible sources of capital

87% Decline

$15

$10

$14

$5

2017 2018 2019 2020 2021 2022

Appendix

Private Companies Account for 48% of Rigs ²

2

52%

48%

317

Private

Private equity-like exposure with better alignment and daily liquidity

350

Public

@

GRANITE RIDGE

14View entire presentation