Alternus Energy SPAC Presentation Deck

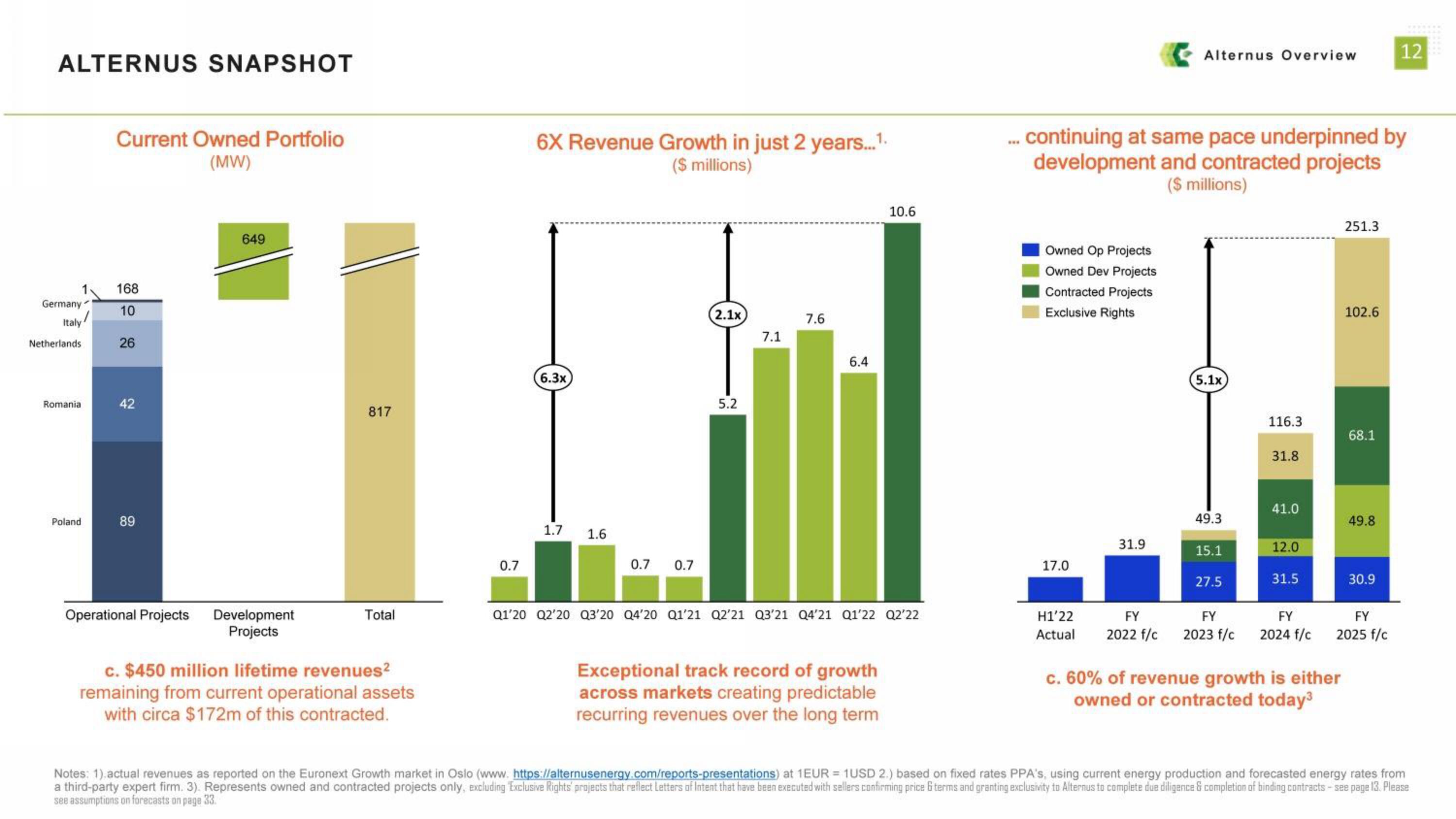

ALTERNUS SNAPSHOT

Germany

Italy

Netherlands

Romania

Poland

Current Owned Portfolio

(MW)

168

10

26

42

89

Operational Projects

649

Development

Projects

817

Total

c. $450 million lifetime revenues²

remaining from current operational assets

with circa $172m of this contracted.

0.7

6X Revenue Growth in just 2 years...1.

($ millions)

6.3x

1.7 1.6

0.7 0.7

2.1x

5.2

7.1

7.6

6.4

10.6

Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22

Exceptional track record of growth

across markets creating predictable

recurring revenues over the long term

Owned Op Projects

Owned Dev Projects

Contracted Projects

Exclusive Rights

continuing at same pace underpinned by

development and contracted projects

($ millions)

17.0

H1’22

Actual

31.9

Alternus Overview

FY

2022 f/c

(5.1x)

49.3

15.1

27.5

116.3

31.8

41.0

12.0

31.5

FY

FY

2023 f/c 2024 f/c

251.3

c. 60% of revenue growth is either

owned or contracted today³

102.6

68.1

49.8

30.9

FY

2025 f/c

12

Notes: 1).actual revenues as reported on the Euronext Growth market in Oslo (www. https://alternusenergy.com/reports-presentations) at 1EUR = 1USD 2.) based on fixed rates PPA's, using current energy production and forecasted energy rates from

a third-party expert firm. 3). Represents owned and contracted projects only, excluding Exclusive Rights' projects that reflect Letters of Intent that have been executed with sellers confirming price 6 terms and granting exclusivity to Alternus to complete due diligence & completion of binding contracts-see page 13. Please

see assumptions on forecasts on page 33.View entire presentation