UBS ESG Presentation Deck

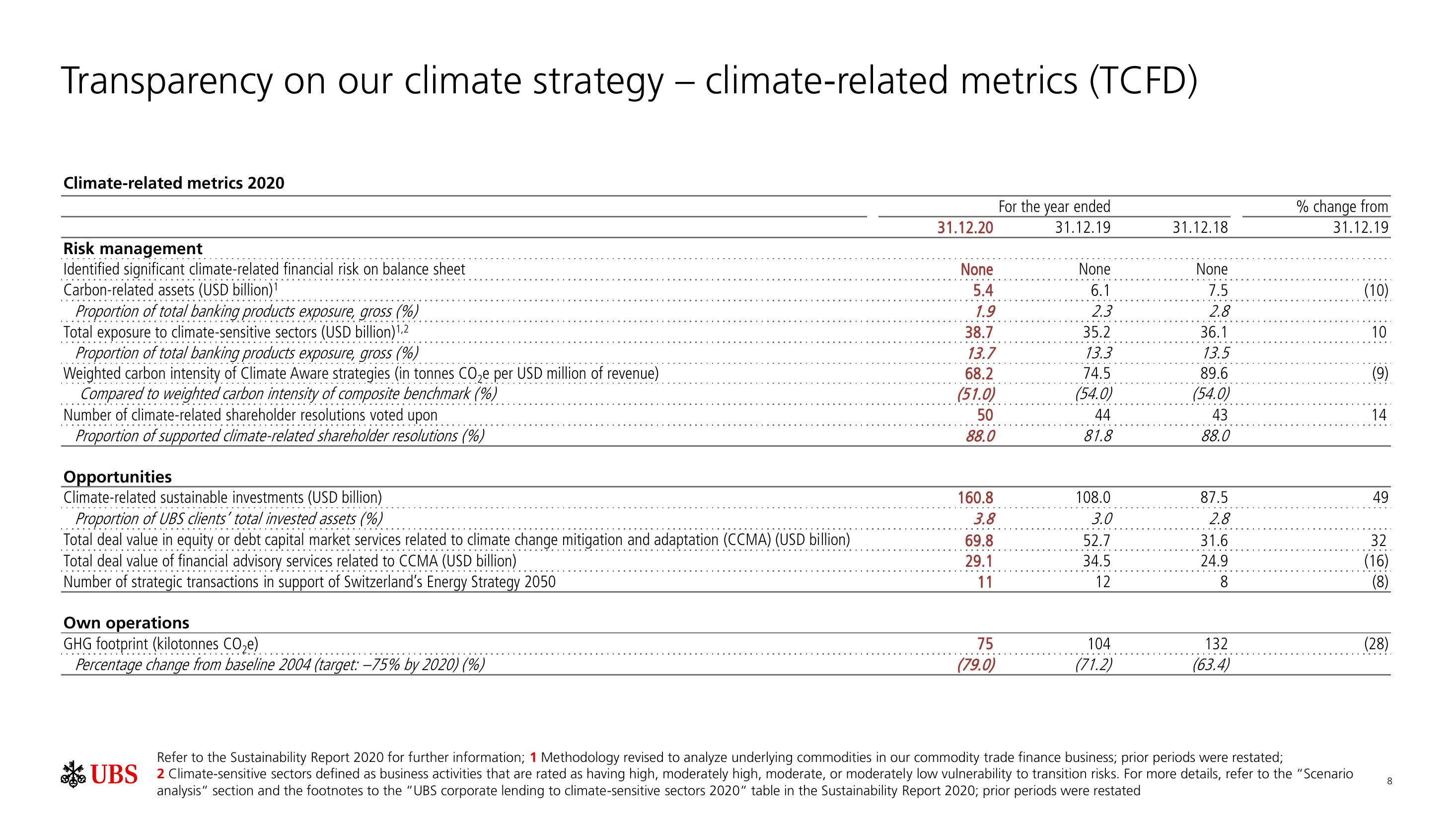

Transparency on our climate strategy - climate-related metrics (TCFD)

Climate-related metrics 2020

Risk management

Identified significant climate-related financial risk on balance sheet

Carbon-related assets (USD billion)1

Proportion of total banking products exposure, gross (%)

Total exposure to climate-sensitive sectors (USD billion)¹,2

Proportion of total banking products exposure, gross (%)

Weighted carbon intensity of Climate Aware strategies (in tonnes CO₂e per USD million of revenue)

Compared to weighted carbon intensity of composite benchmark (%)

Number of climate-related shareholder resolutions voted upon

Proportion of supported climate-related shareholder resolutions (%)

Opportunities

Climate-related sustainable investments (USD billion)

Proportion of UBS clients' total invested assets (%)

Total deal value in equity or debt capital market services related to climate change mitigation and adaptation (CCMA) (USD billion)

Total deal value of financial advisory services related to CCMA (USD billion)

Number of strategic transactions in support of Switzerland's Energy Strategy 2050

Own operations

GHG footprint (kilotonnes CO₂e)

Percentage change from baseline 2004 (target: -75% by 2020) (%)

31.12.20

None

5.4

1.9

38.7

13.7

68.2

(51.0)

50

88.0

160.8

3.8

69.8

29.1

11

75

(79.0)

For the year ended

31.12.19

None

6.1

2.3

35.2

13.3

74.5

(54.0)

44

81.8

108.0

3.0

52.7

34.5

12

104

(71.2)

31.12.18

None

7.5

2.8

36.1

13.5

89.6

(54.0)

43

88.0

87.5

2.8

31.6

24.9

8

132

(63.4)

% change from

31.12.19

Refer to the Sustainability Report 2020 for further information; 1 Methodology revised to analyze underlying commodities in our commodity trade finance business; prior periods were restated;

UBS 2 Climate-sensitive sectors defined as business activities that are rated as having high, moderately high, moderate, or moderately low vulnerability to transition risks. For more details, refer to the "Scenario

analysis" section and the footnotes to the "UBS corporate lending to climate-sensitive sectors 2020" table in the Sustainability Report 2020; prior periods were restated

(10)

10

(9)

14

49

32

(16)

(8)

(28)

8View entire presentation