BMO Capital Markets Investment Banking Pitch Book

BMO Capital Markets

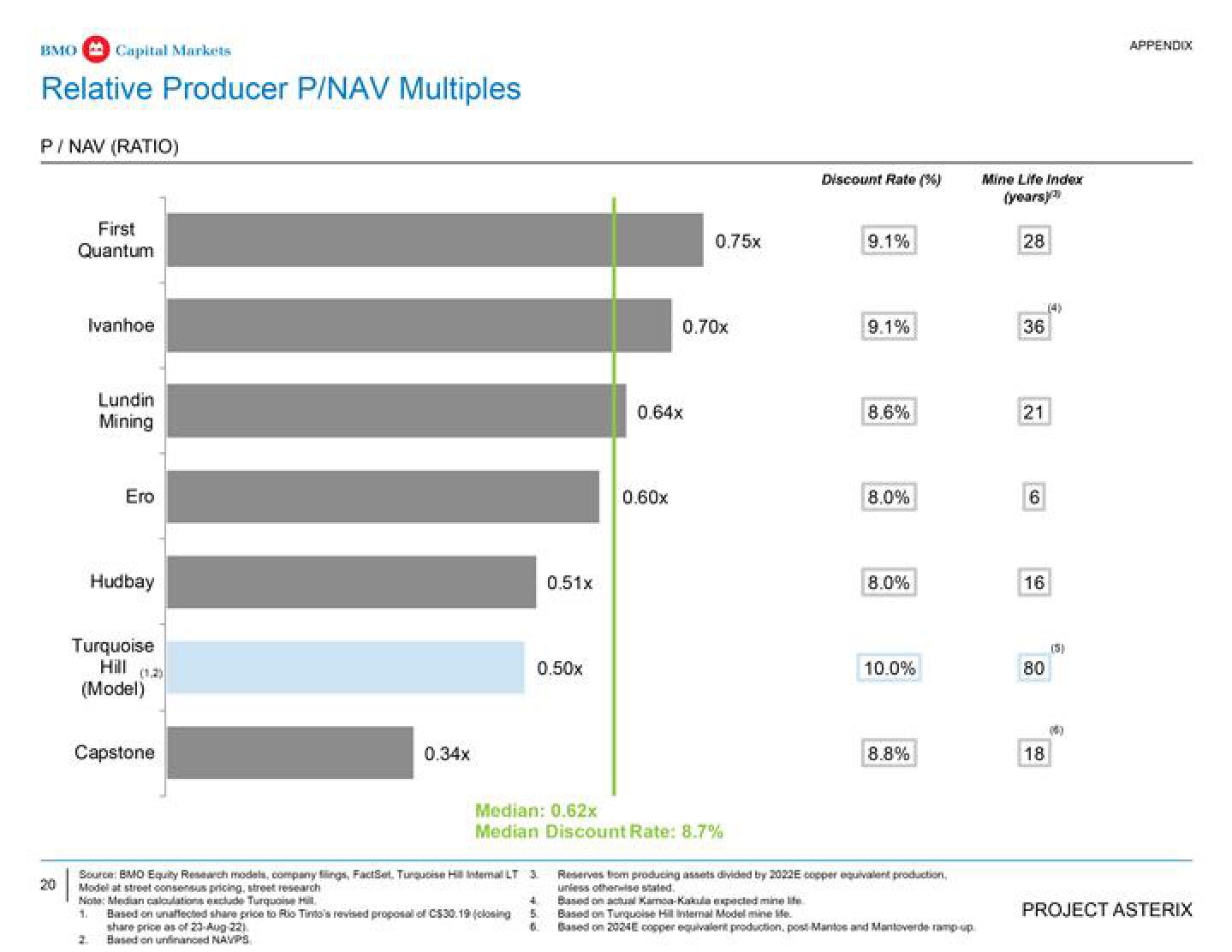

Relative Producer P/NAV Multiples

P/NAV (RATIO)

First

Quantum

Ivanhoe

Lundin

Mining

Ero

Hudbay

Turquoise

Hill

(Model)

Capstone

0.34x

0.50x

Source: BMO Equity Research models, company lings, FactSet, Turquoise Hill Internal LT 3

Model at street consensus pricing, street research

Note: Median calculations exclude Turquoise Hil

1. Based on unaffected share price to Rio Tinto's revised proposal of C530.19 folosing

share price as of 23-Aug-221

Based on unfinanced NAVIPS

0.51x

4

5.

6.

0.64x

0.60x

Median: 0.62x

Median Discount Rate: 8.7%

0.75x

0.70x

Discount Rate (%)

9.1%

9.1%

8.6%

8.0%

8.0%

10.0%

8.8%

Reserves from producing assets divided by 2022E copper equivalent production,

unless otherwise stated.

Based on actual Kamoa-Kakula expected mine le

Based on Turquoise Hill Internal Model mine Me

Based on 2024 copper equivalent production, post Mantos and Mantoverde ramp up

Mine Life Index

(years)

28

36

21

6

16

80

18

(5)

APPENDIX

PROJECT ASTERIXView entire presentation