HSBC Investor Day Presentation Deck

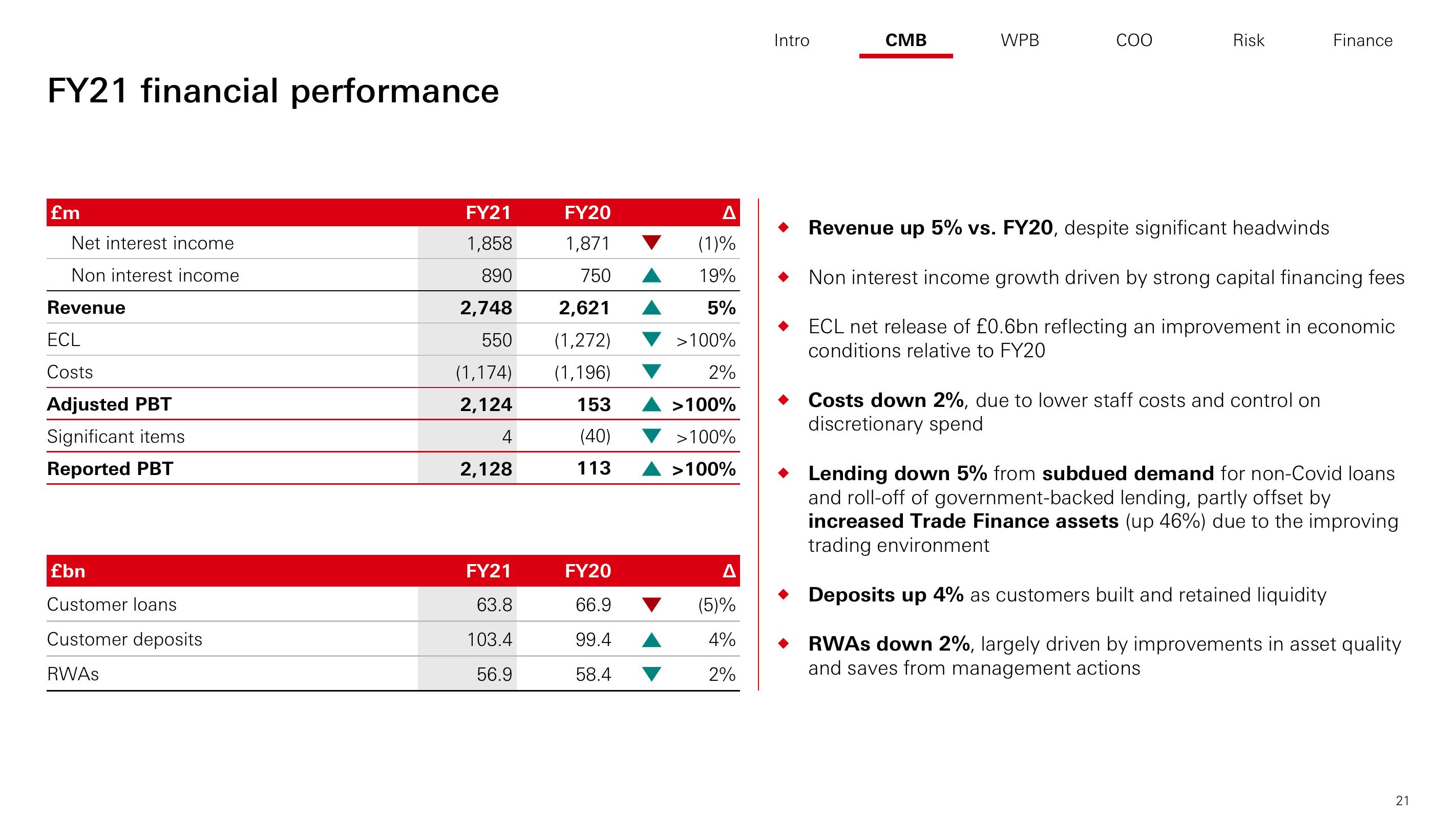

FY21 financial performance

£m

Net interest income

Non interest income

Revenue

ECL

Costs

Adjusted PBT

Significant items

Reported PBT

£bn

Customer loans

Customer deposits

RWAS

FY21

1,858

890

2,748

550

(1,174)

2,124

4

2,128

FY21

63.8

103.4

56.9

FY20

1,871

750

2,621

(1,272)

(1,196)

153

(40)

113

FY20

66.9

99.4

58.4

A

(1)%

19%

5%

>100%

2%

>100%

>100%

>100%

A

(5)%

4%

2%

Intro

CMB

WPB

COO

Risk

Finance

Revenue up 5% vs. FY20, despite significant headwinds

Non interest income growth driven by strong capital financing fees

ECL net release of £0.6bn reflecting an improvement in economic

conditions relative to FY20

Costs down 2%, due to lower staff costs and control on

discretionary spend

Lending down 5% from subdued demand for non-Covid loans

and roll-off of government-backed lending, partly offset by

increased Trade Finance assets (up 46%) due to the improving

trading environment

Deposits up 4% as customers built and retained liquidity

◆ RWAs down 2%, largely driven by improvements in asset quality.

and saves from management actions

21View entire presentation