Dutch Bros Results Presentation Deck

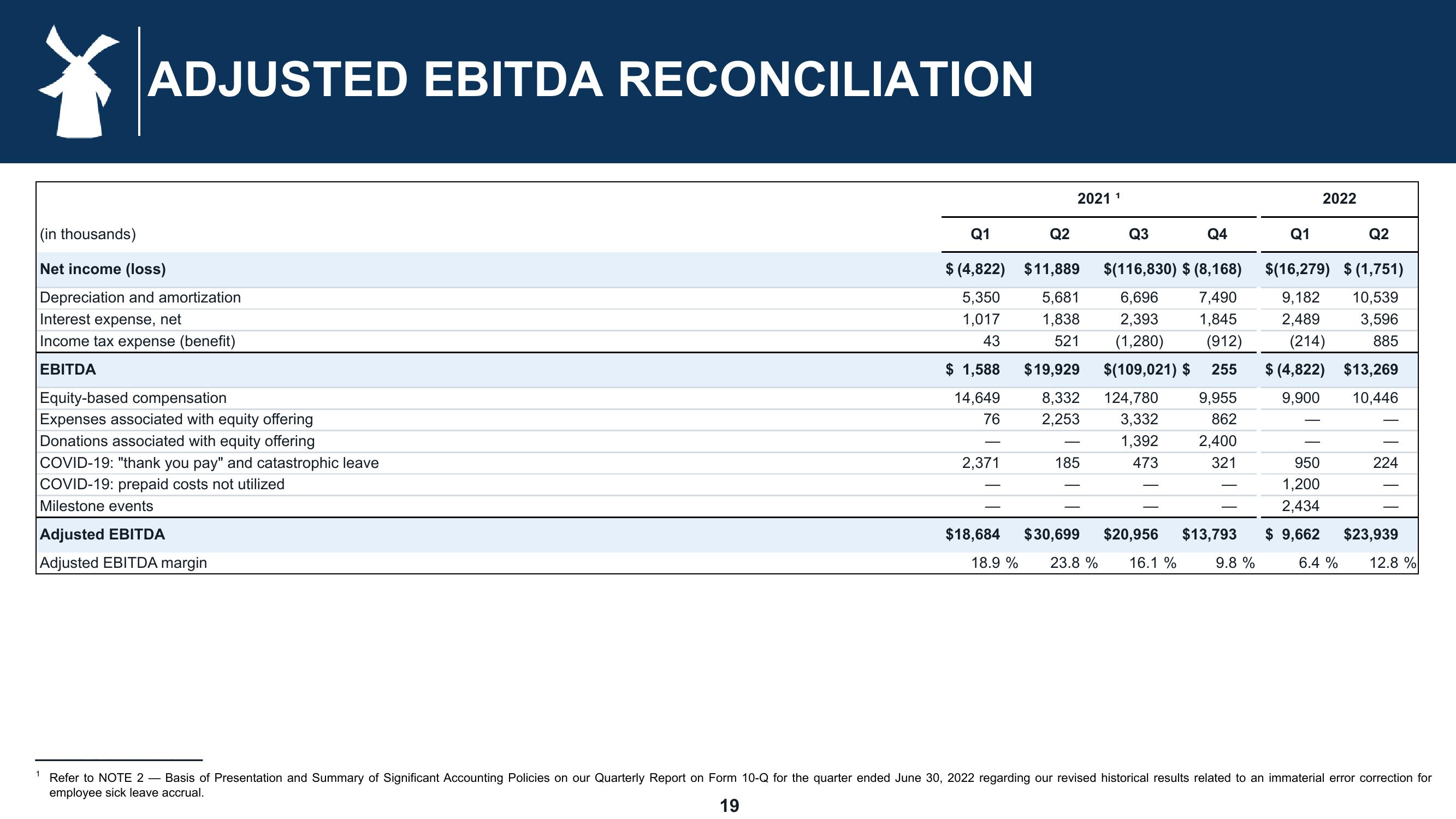

ADJUSTED EBITDA RECONCILIATION

(in thousands)

Net income (loss)

Depreciation and amortization

Interest expense, net

Income tax expense (benefit)

EBITDA

Equity-based compensation

Expenses associated with equity offering

Donations associated with equity offering

COVID-19: "thank you pay" and catastrophic leave

COVID-19: prepaid costs not utilized

Milestone events

Adjusted EBITDA

Adjusted EBITDA margin

Q1

$ (4,822)

5,350

1,017

43

$ 1,588

14,649

76

2,371

2021 1

Q2

$11,889

5,681

1,838

521

$19,929

8,332

2,253

185

Q3

$(116,830) $ (8,168)

6,696 7,490

2,393 1,845

(1,280) (912)

$(109,021) $ 255

124,780 9,955

3,332

862

1,392

473

2,400

321

Q4

$18,684 $30,699 $20,956 $13,793

18.9 % 23.8 % 16.1 %

9.8 %

2022

Q1

Q2

$(16,279) $(1,751)

2,489

9,182 10,539

3,596

(214) 885

$(4,822) $13,269

9,900

10,446

950

1,200

2,434

$ 9,662

6.4 %

224

$23,939

12.8 %

1 Refer to NOTE 2 - Basis of Presentation and Summary of Significant Accounting Policies on our Quarterly Report on Form 10-Q for the quarter ended June 30, 2022 regarding our revised historical results related to an immaterial error correction for

employee sick leave accrual.

19View entire presentation