Dave Results Presentation Deck

Improving delinquency

performance

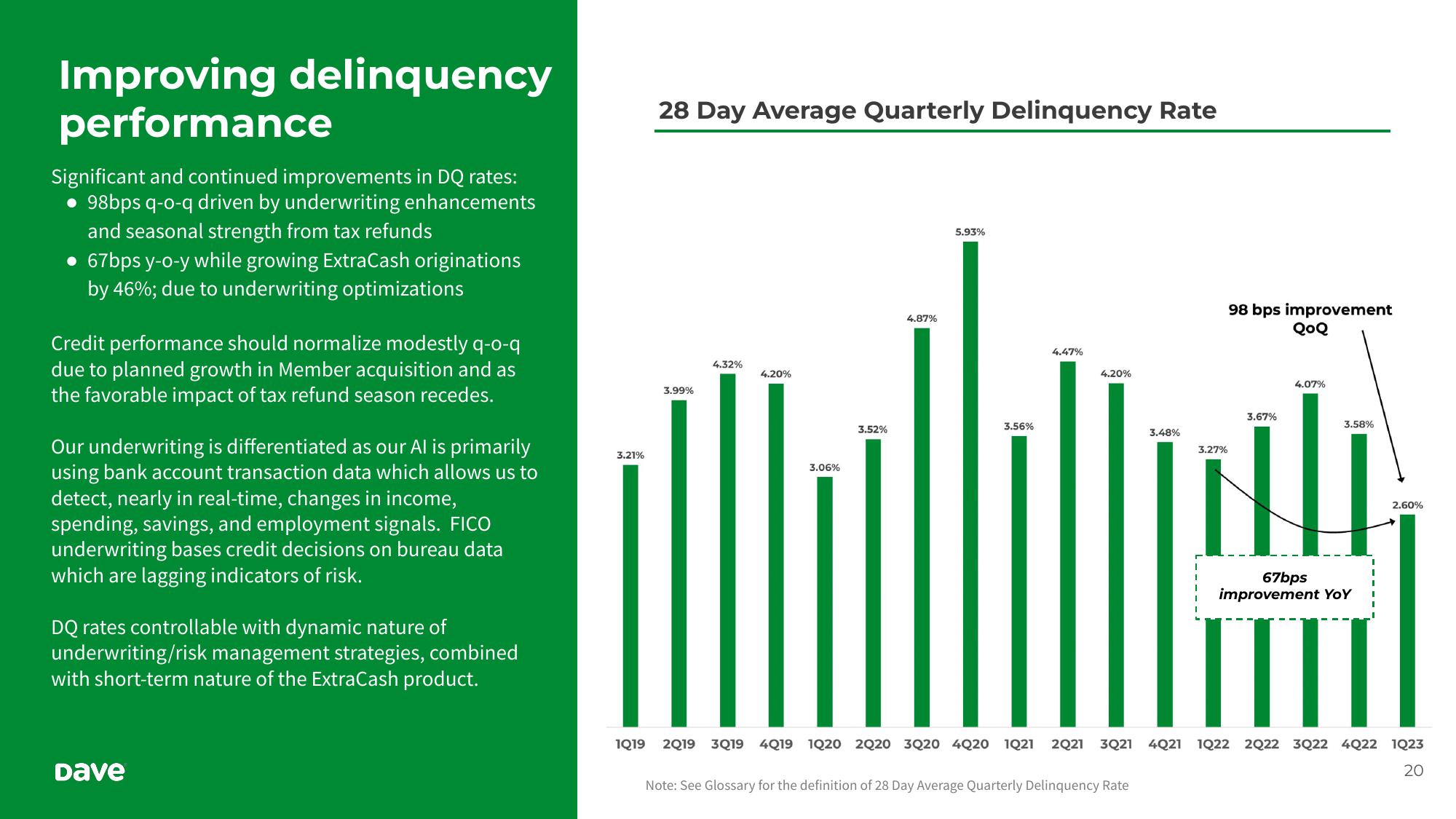

Significant and continued improvements in DQ rates:

98bps q-o-q driven by underwriting enhancements

and seasonal strength from tax refunds

• 67bps y-o-y while growing ExtraCash originations

by 46%; due to underwriting optimizations

Credit performance should normalize modestly q-o-q

due to planned growth in Member acquisition and as

the favorable impact of tax refund season recedes.

Our underwriting is differentiated as our Al is primarily

using bank account transaction data which allows us to

detect, nearly in real-time, changes in income,

spending, savings, and employment signals. FICO

underwriting bases credit decisions on bureau data

which are lagging indicators of risk.

DQ rates controllable with dynamic nature of

underwriting/risk management strategies, combined

with short-term nature of the ExtraCash product.

Dave

3.21%

1Q19

28 Day Average Quarterly Delinquency Rate

3.99%

4.32%

4.20%

3.06%

3.52%

4.87%

5.93%

3.56%

4.47%

4.20%

3.48%

Note: See Glossary for the definition of 28 Day Average Quarterly Delinquency Rate

3.27%

98 bps improvement

QoQ

4.07%

3.67%

3.58%

ili

67bps

improvement YoY

2.60%

III

LIITT

2Q19 3Q19 4Q19 1020 2020 3Q20 4020 1021 2Q21 3Q21 4Q21 1Q22 2022 3Q22 4Q22 1023

20View entire presentation