Tesla Results Presentation Deck

7

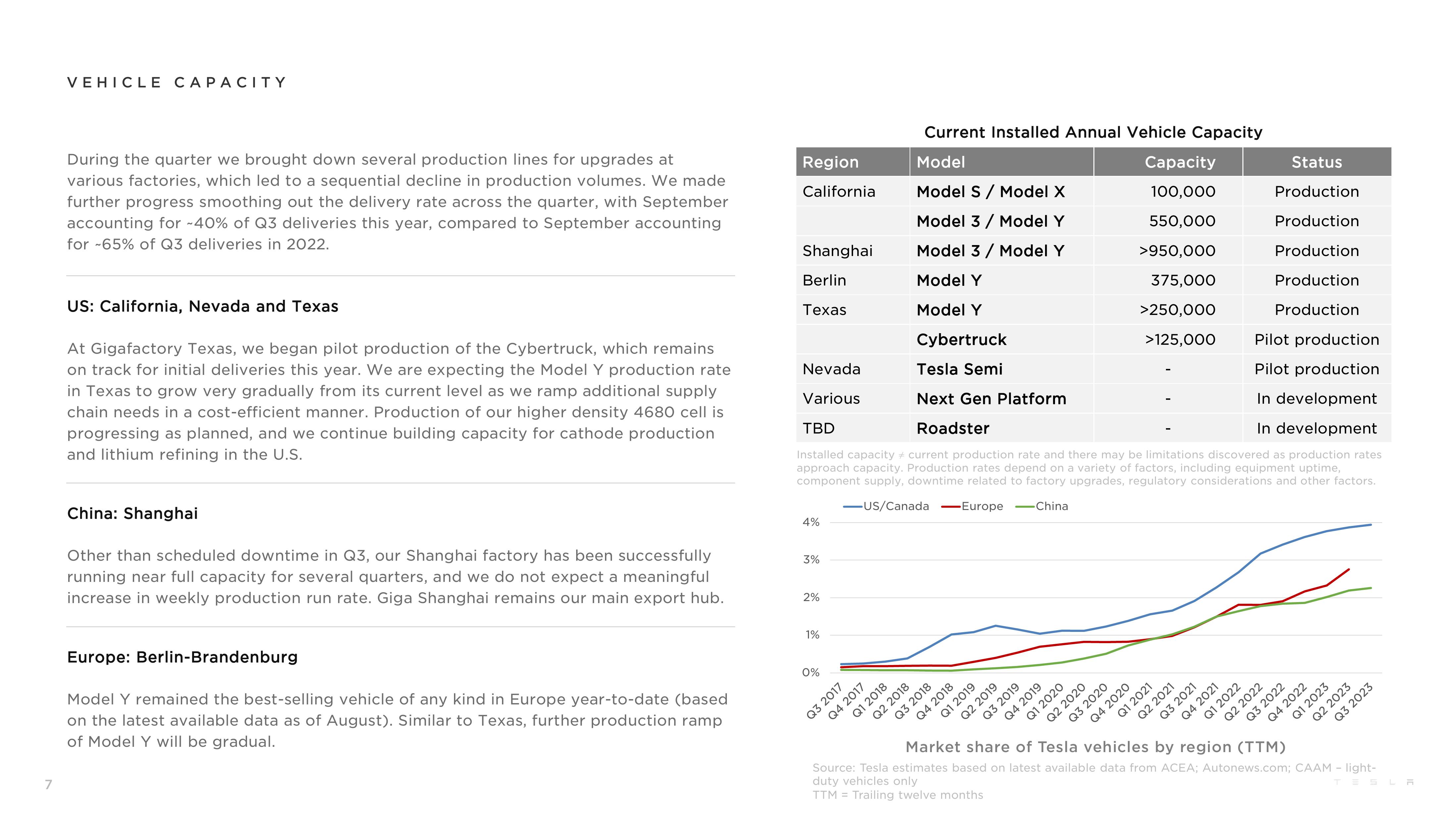

VEHICLE CAPACITY

During the quarter we brought down several production lines for upgrades at

various factories, which led to a sequential decline in production volumes. We made

further progress smoothing out the delivery rate across the quarter, with September

accounting for ~40% of Q3 deliveries this year, compared to September accounting

for -65% of Q3 deliveries in 2022.

US: California, Nevada and Texas

At Gigafactory Texas, we began pilot production of the Cybertruck, which remains

on track for initial deliveries this year. We are expecting the Model Y production rate

in Texas to grow very gradually from its current level as we ramp additional supply

chain needs in a cost-efficient manner. Production of our higher density 4680 cell is

progressing as planned, and we continue building capacity for cathode production

and lithium refining in the U.S.

China: Shanghai

Other than scheduled downtime in Q3, our Shanghai factory has been successfully

running near full capacity for several quarters, and we do not expect a meaningful

increase in weekly production run rate. Giga Shanghai remains our main export hub.

Europe: Berlin-Brandenburg

Model Y remained the best-selling vehicle of any kind in Europe year-to-date (based

on the latest available data as of August). Similar to Texas, further production ramp

of Model Y will be gradual.

Region

California

Shanghai

Berlin

Texas

Nevada

Various

4%

Pilot production

Pilot production

In development

In development

TBD

Installed capacity current production rate and there may be limitations discovered as production rates

approach capacity. Production rates depend on a variety of factors, including equipment uptime,

component supply, downtime related to factory upgrades, regulatory considerations and

other factors.

-US/Canada Europe -China

3%

2%

1%

0%

Q1 2018

Current Installed Annual Vehicle Capacity

Model

Model S / Model X

Model 3 / Model Y

Model 3 / Model Y

Model Y

Model Y

Cybertruck

Tesla Semi

Next Gen Platform

Roadster

Q2 2018

Q3 2018

Q4 2018

Q1 2019

Q2 2019

Q3 2019

Q4 2019

Q1 2020

Q2 2020

Capacity

100,000

550,000

>950,000

375,000

>250,000

>125,000

Q3 2020

Q1 2021

Q4 2020

Q2 2021

Q3 2021

Q4 2021

Q1 2022

Status

Production

Production

Production

Production

Production

Q2 2022

Q3 2022

Q4 2022

Q1 2023

Q2 2023

Q3 2023

vehicles

by region (TTM)

Market share of Tesla

Source: Tesla estimates based on latest available data from ACEA; Autonews.com; CAAM - light-

duty vehicles only

TTM = Trailing twelve monthsView entire presentation