FlexJet SPAC Presentation Deck

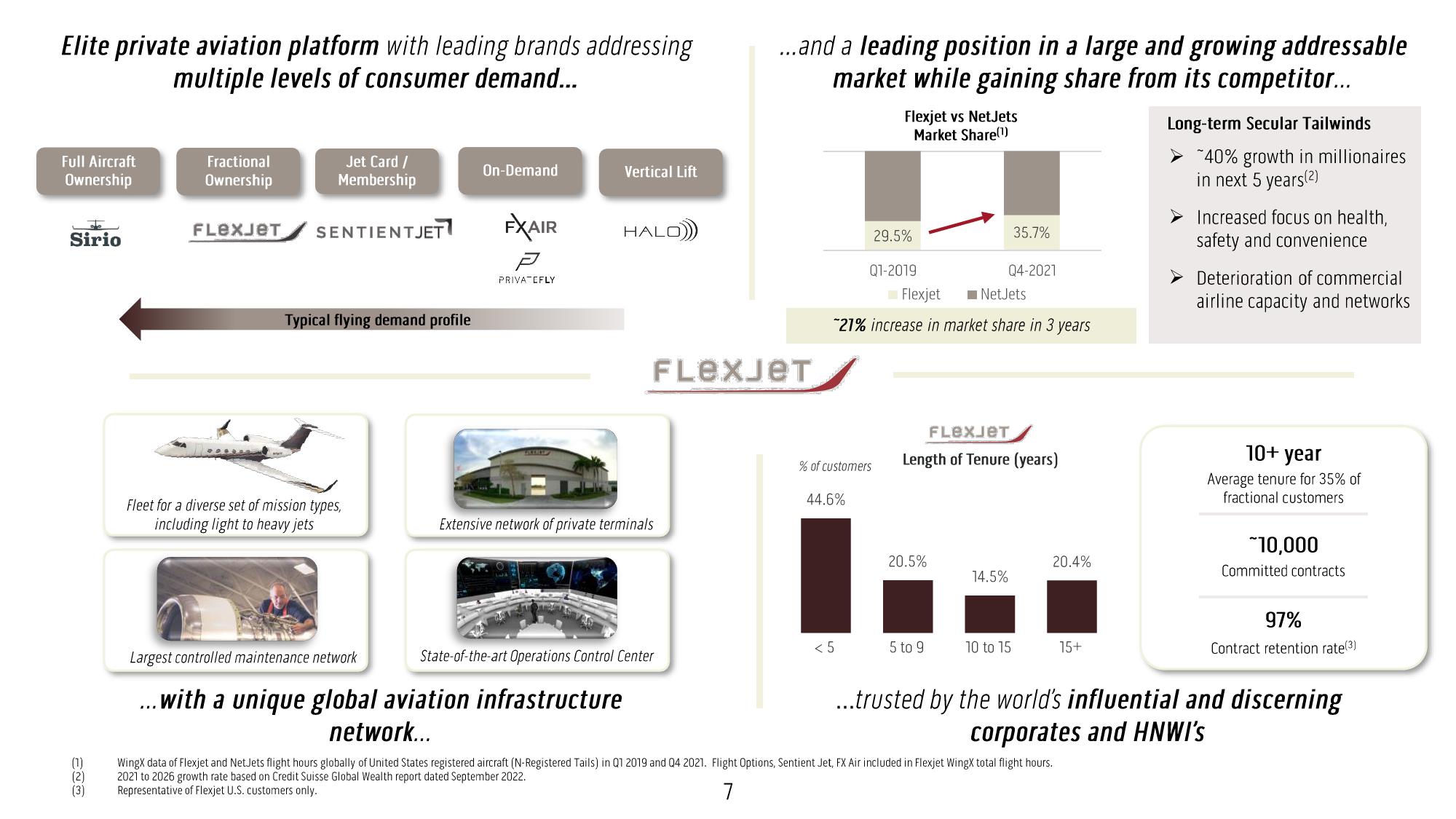

Elite private aviation platform with leading brands addressing

multiple levels of consumer demand...

Full Aircraft

Ownership

L

Sirio

(1)

(2)

(3)

Fractional

Ownership

Jet Card /

Membership

FLeXJET SENTIENTJET

Typical flying demand profile

Fleet for a diverse set of mission types,

including light to heavy jets

On-Demand

FXAIR

P

PRIVATEFLY

Vertical Lift

HALO

FLeXJET

Extensive network of private terminals

...and a leading position in a large and growing addressable

market while gaining share from its competitor...

Largest controlled maintenance network

State-of-the-art Operations Control Center

. with a unique global aviation infrastructure

% of customers

44.6%

Flexjet vs NetJets

Market Share(¹)

<5

29.5%

Q1-2019

Flexjet

NetJets

"21% increase in market share in 3 years

20.5%

FLEXJET

Length of Tenure (years)

5 to 9

35.7%

Q4-2021

14.5%

10 to 15

20.4%

15+

network...

Wingx data of Flexjet and NetJets flight hours globally of United States registered aircraft (N-Registered Tails) in Q1 2019 and Q4 2021. Flight Options, Sentient Jet, FX Air included in Flexjet WingX total flight hours.

2021 to 2026 growth rate based on Credit Suisse Global Wealth report dated September 2022.

Representative of Flexjet U.S. customers only.

7

Long-term Secular Tailwinds

~40% growth in millionaires

in next 5 years(²)

Increased focus on health,

safety and convenience

Deterioration of commercial

airline capacity and networks

10+ year

Average tenure for 35% of

fractional customers

~10,000

Committed contracts

97%

Contract retention rate(3)

...trusted by the world's influential and discerning

corporates and HNWI'sView entire presentation