Apollo Global Management Investor Day Presentation Deck

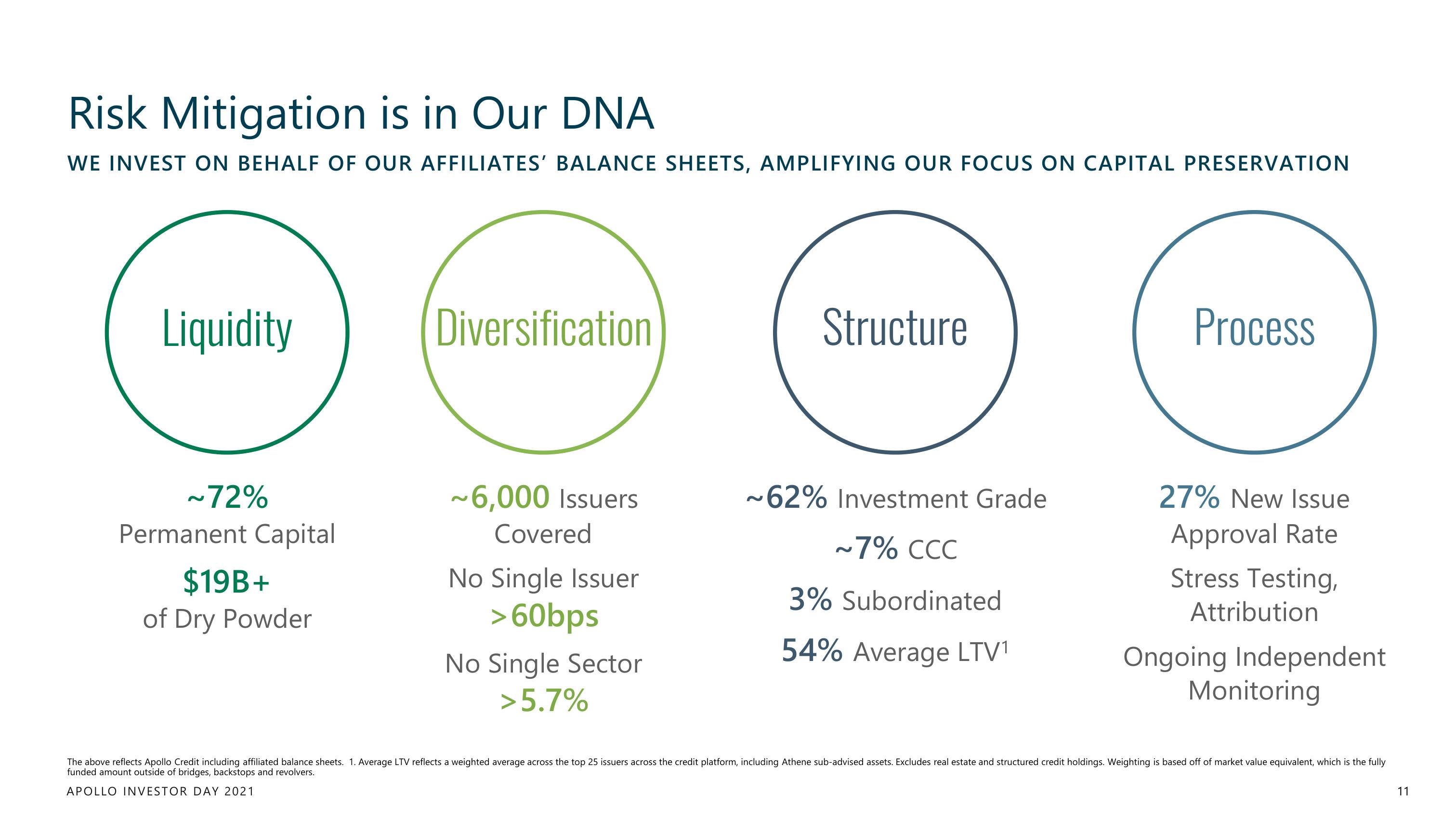

Risk Mitigation is in Our DNA

WE INVEST ON BEHALF OF OUR AFFILIATES' BALANCE SHEETS, AMPLIFYING OUR FOCUS ON CAPITAL PRESERVATION

Liquidity

~72%

Permanent Capital

$19B+

of Dry Powder

Diversification

~6,000 Issuers

Covered

No Single Issuer

>60bps

No Single Sector

> 5.7%

Structure

~62% Investment Grade

~7% CCC

3% Subordinated

54% Average LTV¹

Process

27% New Issue

Approval Rate

Stress Testing,

Attribution

Ongoing Independent

Monitoring

The above reflects Apollo Credit including affiliated balance sheets. 1. Average LTV reflects a weighted average across the top 25 issuers across the credit platform, including Athene sub-advised assets. Excludes real estate and structured credit holdings. Weighting is based off of market value equivalent, which is the fully

funded amount outside of bridges, backstops and revolvers.

APOLLO INVESTOR DAY 2021

11View entire presentation