Summer 2023 Solar Industry Update

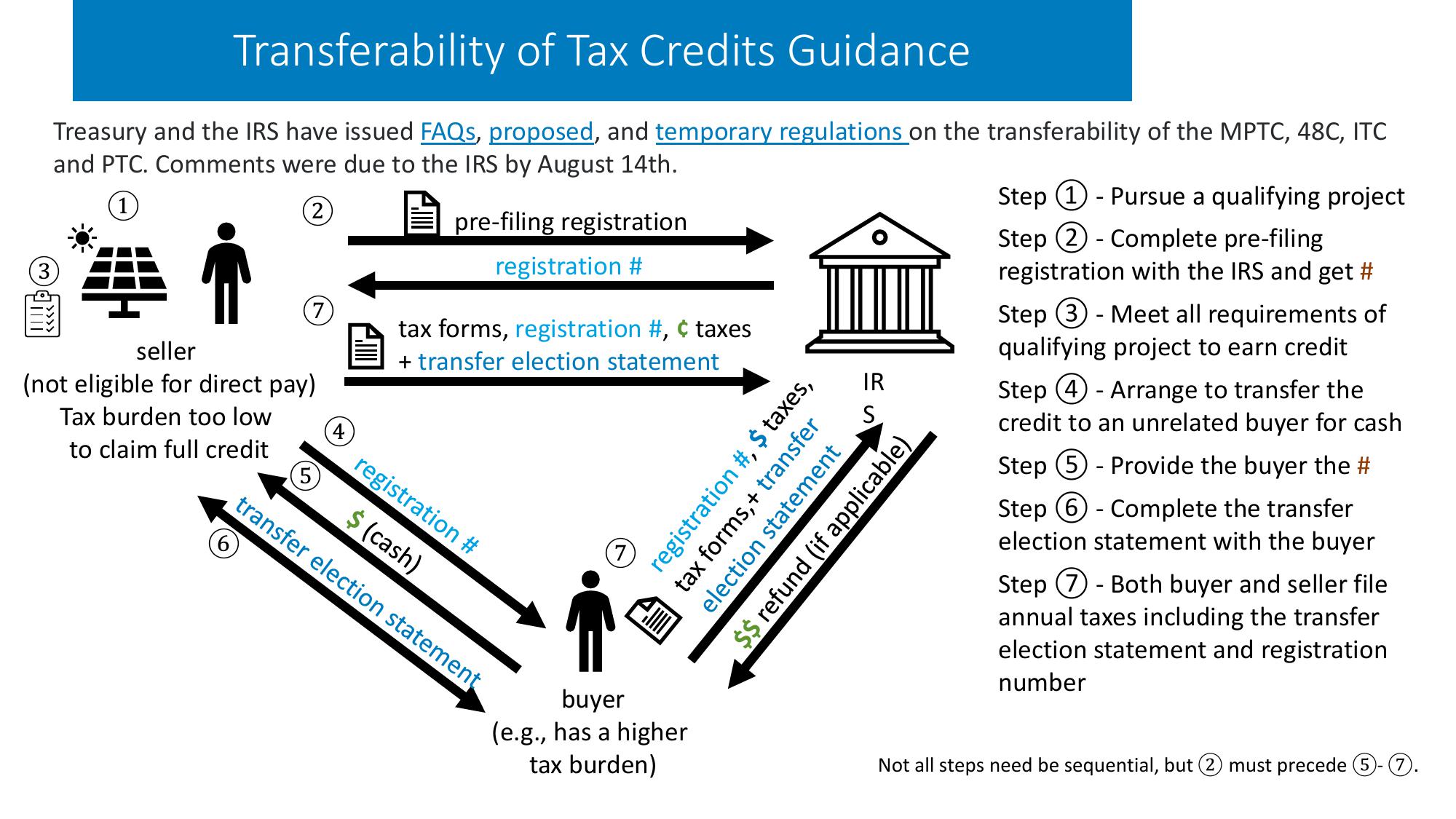

Transferability of Tax Credits Guidance

Treasury and the IRS have issued FAQs, proposed, and temporary regulations on the transferability of the MPTC, 48C, ITC

and PTC. Comments were due to the IRS by August 14th.

3

(1

seller

(2)

(not eligible for direct pay)

Tax burden too low

to claim full credit

5

4

pre-filing registration

registration #

tax forms, registration #, ¢ taxes

+ transfer election statement

registration #

$ (cash)

transfer election statement

IR

ES

registration #, $ taxes,

tax forms,+ transfer

election statement

$$ refund (if applicable)

buyer

(e.g., has a higher

tax burden)

Step ①- Pursue a qualifying project

Step 2 Complete pre-filing.

registration with the IRS and get #

Step ③Meet all requirements of

qualifying project to earn credit

Step ④Arrange to transfer the

credit to an unrelated buyer for cash

Step ⑤- Provide the buyer the #

Step ⑥- Complete the transfer

election statement with the buyer

Step ⑦- Both buyer and seller file

annual taxes including the transfer

election statement and registration

number

Not all steps need be sequential, but ② must precede ⑤- ⑦.View entire presentation