jetBlue Results Presentation Deck

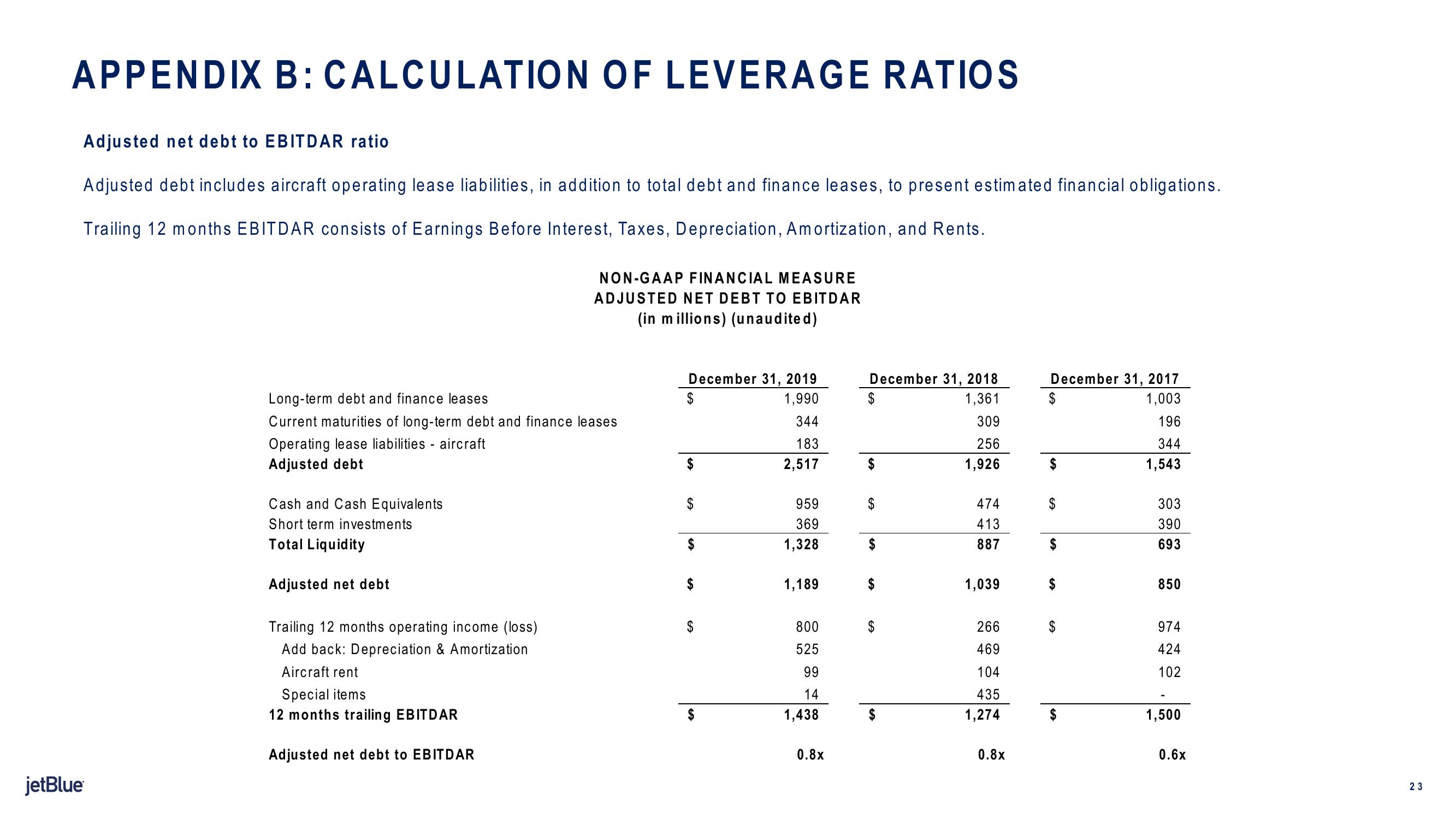

APPENDIX B: CALCULATION OF LEVERAGE RATIOS

Adjusted net debt to EBITDAR ratio

Adjusted debt includes aircraft operating lease liabilities, in addition to total debt and finance leases, to present estimated financial obligations.

Trailing 12 months EBITDAR consists of Earnings Before Interest, Taxes, Depreciation, Amortization, and Rents.

jetBlue

Long-term debt and finance leases

Current maturities of long-term debt and finance leases

Operating lease liabilities - aircraft

Adjusted debt

Cash and Cash Equivalents

Short term investments

Total Liquidity

Adjusted net debt

Trailing 12 months operating income (loss)

Add back: Depreciation & Amortization

Aircraft rent

Special items

12 months trailing EBITDAR

NON-GAAP FINANCIAL MEASURE

ADJUSTED NET DEBT TO EBITDAR

(in millions) (unaudited)

Adjusted net debt to EBITDAR

December 31, 2019

1,990

344

183

2,517

$

$

$

$

$

959

369

1,328

1,189

800

525

99

14

1,438

0.8x

December 31, 2018

1,361

309

256

1,926

$

474

413

887

1,039

266

469

104

435

1,274

0.8x

December 31, 2017

1,003

196

344

1,543

303

390

693

850

974

424

102

1,500

0.6x

23View entire presentation