NioCorp Investor Presentation Deck

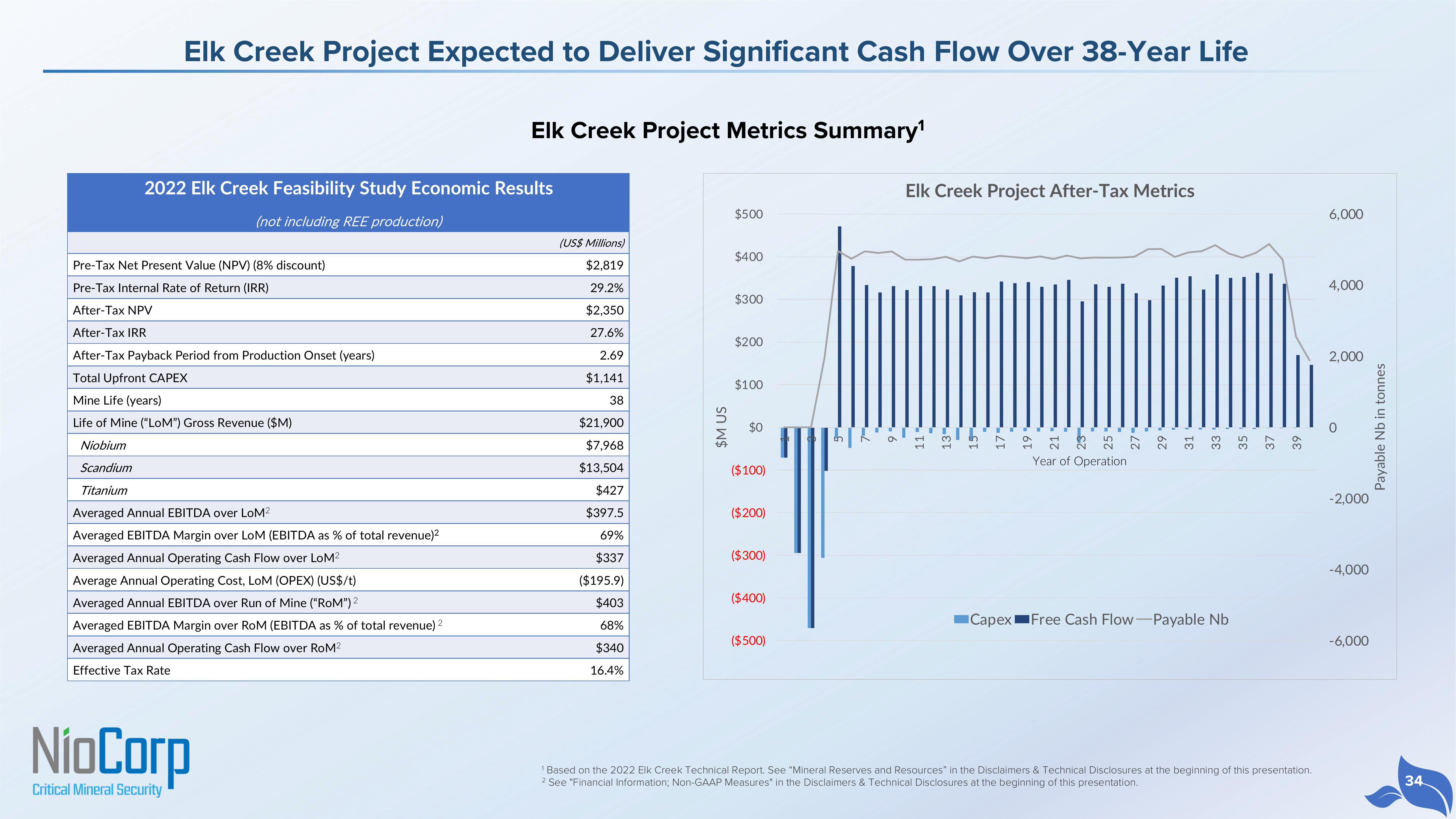

Elk Creek Project Expected to Deliver Significant Cash Flow Over 38-Year Life

2022 Elk Creek Feasibility Study Economic Results

(not including REE production)

Pre-Tax Net Present Value (NPV) (8% discount)

Pre-Tax Internal Rate of Return (IRR)

After-Tax NPV

After-Tax IRR

After-Tax Payback Period from Production Onset (years)

Total Upfront CAPEX

Mine Life (years)

Life of Mine ("LoM") Gross Revenue ($M)

Niobium

Scandium

Titanium

Averaged Annual EBITDA over LoM²

Averaged EBITDA Margin over LoM (EBITDA as % of total revenue)²

Averaged Annual Operating Cash Flow over LoM²

Average Annual Operating Cost, LOM (OPEX) (US$/t)

Averaged Annual EBITDA over Run of Mine ("RoM") ²

Averaged EBITDA Margin over RoM (EBITDA as % of total revenue) 2

Averaged Annual Operating Cash Flow over RoM²

Effective Tax Rate

Elk Creek Project Metrics Summary¹

NioCorp

Critical Mineral Security

(US$ Millions)

$2,819

29.2%

$2,350

27.6%

2.69

$1,141

38

$21,900

$7,968

$13,504

$427

$397.5

69%

$337

($195.9)

$403

68%

$340

16.4%

$M US

$500

$400

$300

$200

$100

$0

($100)

($200)

($300)

($400)

($500)

Elk Creek Project After-Tax Metrics

Year of Operation

Capex Free Cash Flow-Payable Nb

¹ Based on the 2022 Elk Creek Technical Report. See "Mineral Reserves and Resources" in the Disclaimers & Technical Disclosures at the beginning of this presentation.

2 See "Financial Information; Non-GAAP Measures" in the Disclaimers & Technical Disclosures at the beginning of this presentation.

6,000

4,000

2,000

0

-2,000

-4,000

-6,000

Payable Nb in tonnes

34View entire presentation