Perfect SPAC Presentation Deck

PERFECT

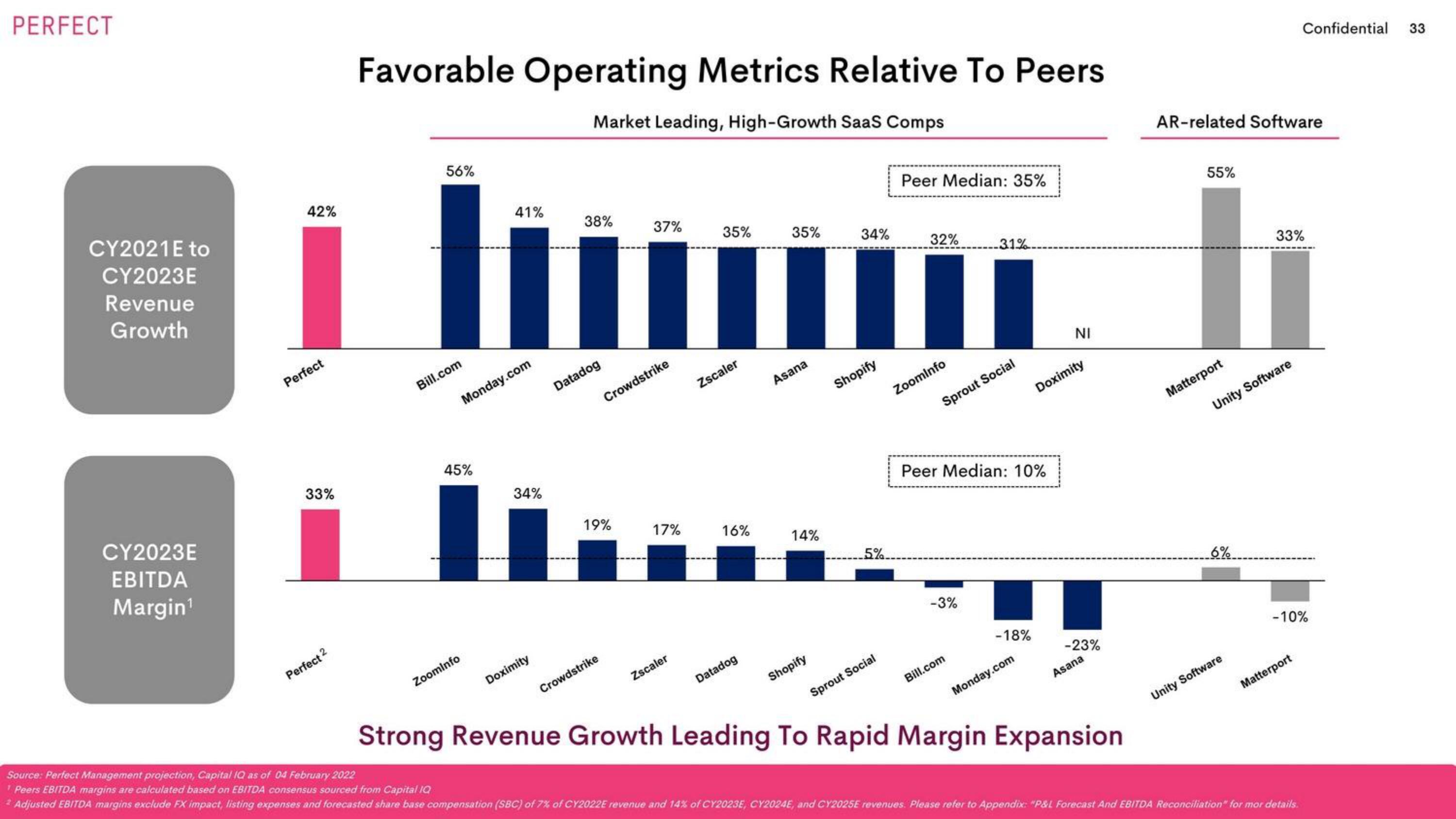

CY2021E to

CY2023E

Revenue

Growth

CY2023E

EBITDA

Margin¹

42%

Perfect

33%

Perfect 2

Favorable Operating Metrics Relative To Peers

Market Leading, High-Growth SaaS Comps

56%

Bill.com

Monday.com

45%

41%

Zoominfo

34%

Doximity

38%

Datadog

Crowdstrike

19%

37%

Crowdstrike

17%

Zscaler

35%

Zscaler

16%

Datadog

35%

Asana

14%

Shopify

34%

Shopify

5%.

Sprout Social

Peer Median: 35%

32%

Zoominfo

Sprout Social

31%.

-3%

Peer Median: 10%

Bill.com

-18%

Monday.com

NI

Doximity

-23%

Asana

Strong Revenue Growth Leading To Rapid Margin Expansion

AR-related Software

55%

Matterport

Unity Software

6%

Unity Software

33%

Confidential 33

-10%

Matterport

Source: Perfect Management projection, Capital IQ as of 04 February 2022

¹ Peers EBITDA margins are calculated based on EBITDA consensus sourced from Capital IQ

2 Adjusted EBITDA margins exclude FX impact, listing expenses and forecasted share base compensation (SBC) of 7% of CY2022E revenue and 14% of CY2023E, CY2024E, and CY2025E revenues. Please refer to Appendix: "P&L Forecast And EBITDA Reconciliation for mor details.View entire presentation