Sonos Investor Presentation Deck

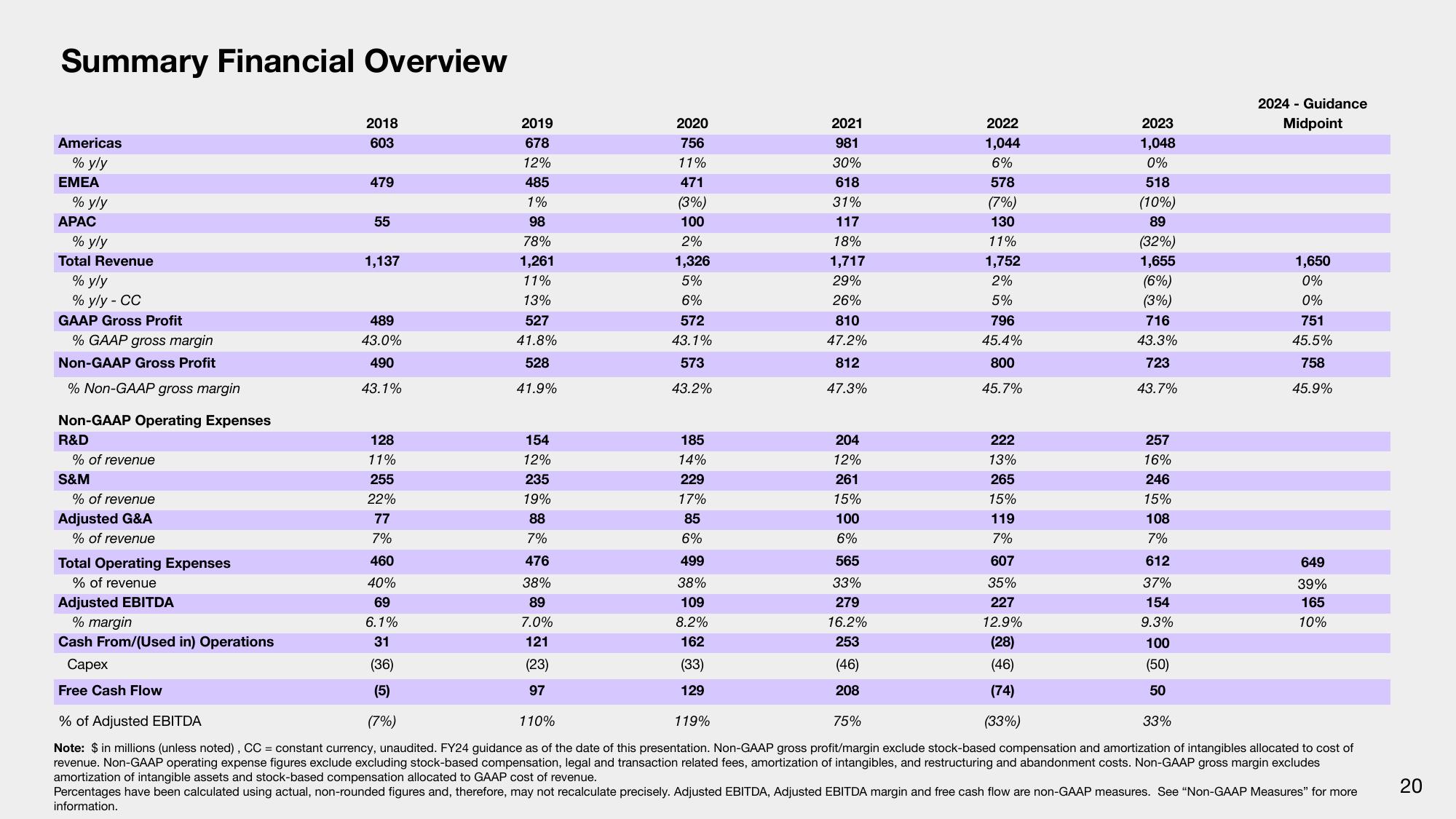

Summary Financial Overview

Americas

% y/y

EMEA

% y/y

APAC

% y/y

Total Revenue

% yly

% y/y - CC

GAAP Gross Profit

% GAAP gross margin

Non-GAAP Gross Profit

% Non-GAAP gross margin

Non-GAAP Operating Expenses

R&D

% of revenue

S&M

% of revenue

Adjusted G&A

% of revenue

Total Operating Expenses

% of revenue

Adjusted EBITDA

% margin

Cash From/(Used in) Operations

Capex

Free Cash Flow

2018

603

479

55

1,137

489

43.0%

490

43.1%

128

11%

255

22%

77

7%

460

40%

69

6.1%

31

(36)

(5)

(7%)

2019

678

12%

485

1%

98

78%

1,261

11%

13%

527

41.8%

528

41.9%

154

12%

235

19%

88

7%

476

38%

89

7.0%

121

(23)

97

2020

756

11%

471

(3%)

100

2%

1,326

5%

6%

572

43.1%

573

43.2%

185

14%

229

17%

85

6%

499

38%

109

8.2%

162

(33)

129

2021

981

30%

618

31%

117

18%

119%

1,717

29%

26%

810

47.2%

812

47.3%

204

12%

261

15%

100

6%

565

33%

279

16.2%

253

(46)

208

2022

1,044

6%

578

(7%)

130

11%

1,752

2%

5%

796

45.4%

800

45.7%

222

13%

265

15%

119

7%

607

35%

227

12.9%

(28)

(46)

(74)

(33%)

2023

1,048

0%

518

(10%)

89

(32%)

1,655

(6%)

(3%)

716

43.3%

723

43.7%

257

16%

246

15%

108

7%

612

37%

154

9.3%

100

(50)

50

2024 - Guidance

Midpoint

33%

1,650

0%

0%

751

45.5%

758

45.9%

110%

75%

% of Adjusted EBITDA

Note: $ in millions (unless noted), CC = constant currency, unaudited. FY24 guidance as of the date of this presentation. Non-GAAP gross profit/margin exclude stock-based compensation and amortization of intangibles allocated to cost of

revenue. Non-GAAP operating expense figures exclude excluding stock-based compensation, legal and transaction related fees, amortization of intangibles, and restructuring and abandonment costs. Non-GAAP gross margin excludes

amortization of intangible assets and stock-based compensation allocated to GAAP cost of revenue.

Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely. Adjusted EBITDA, Adjusted EBITDA margin and free cash flow are non-GAAP measures. See "Non-GAAP Measures" for more

information.

649

39%

165

10%

20View entire presentation