Masterworks Investor Update

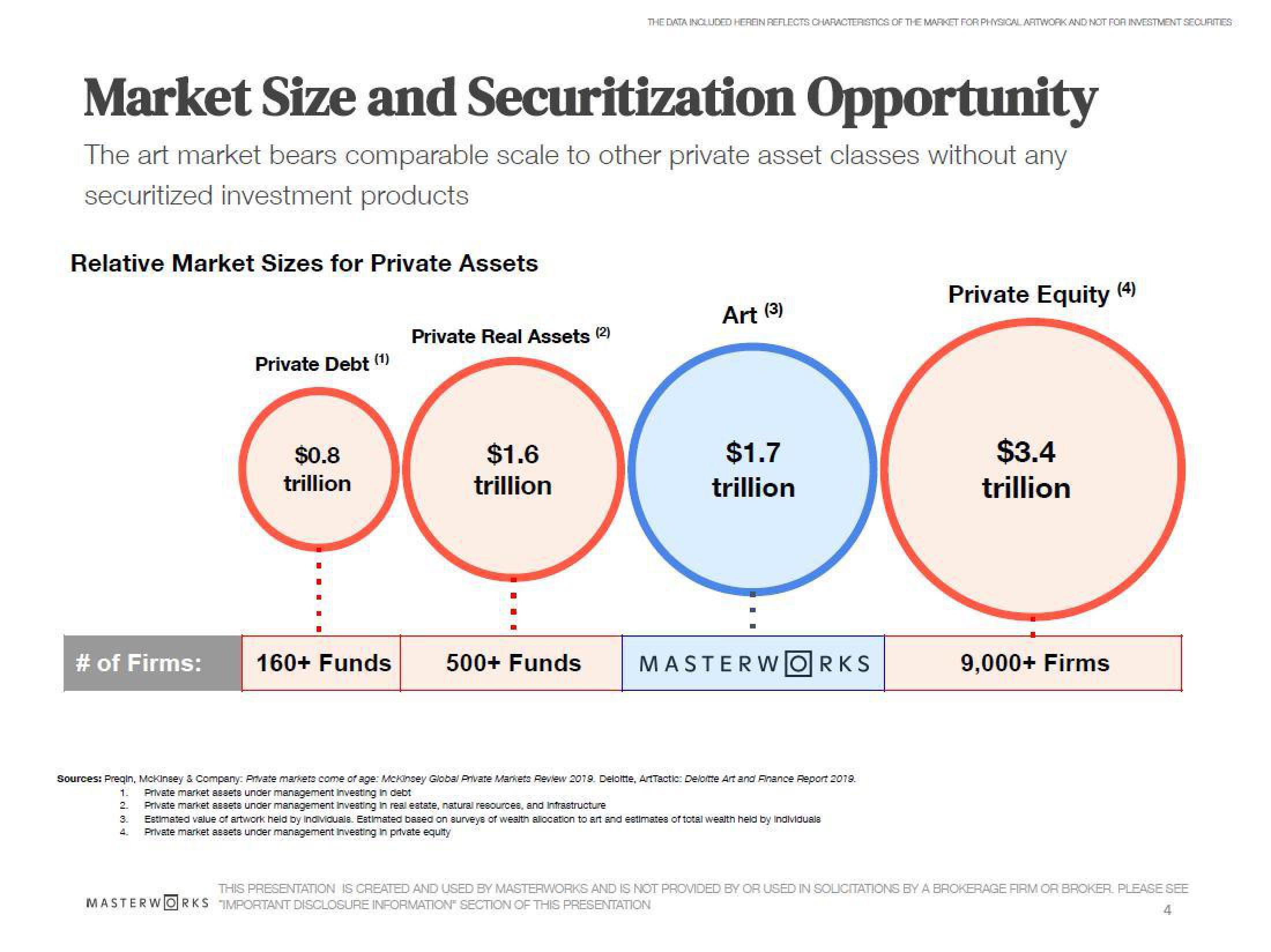

Market Size and Securitization Opportunity

The art market bears comparable scale to other private asset classes without any

securitized investment products

Relative Market Sizes for Private Assets

# of Firms:

3.

4.

Private Debt (1)

$0.8

trillion

THE DATA INCLUDED HEREIN REFLECTS CHARACTERISTICS OF THE MARKET FOR PHYSICAL ARTWORK AND NOT FOR INVESTMENT SECURITIES

Private Real Assets (2)

ⒸO

$1.6

$1.7

trillion

trillion

160+ Funds

500+ Funds

Art (3)

MASTERWORKS

Sources: Preqin, McKinsey & Company: Private markets come of age: McKinsey Global Private Markets Review 2019. Deloitte, ArtTactic: Deloitte Art and Finance Report 2019.

1. Private market assets under management Investing in debt

2.

Private market assets under management Investing in real estate, natural resources, and infrastructure

Estimated value of artwork held by individuals. Estimated based on surveys of wealth allocation to art and estimates of total wealth held by individuala

Private market assets under management Investing in private equity

Private Equity

$3.4

trillion

9,000+ Firms

(4)

THIS PRESENTATION IS CREATED AND USED BY MASTERWORKS AND IS NOT PROVIDED BY OR USED IN SOLICITATIONS BY A BROKERAGE FIRM OR BROKER. PLEASE SEE

MASTERWORKS IMPORTANT DISCLOSURE INFORMATION SECTION OF THIS PRESENTATION

4View entire presentation