LSE Results Presentation Deck

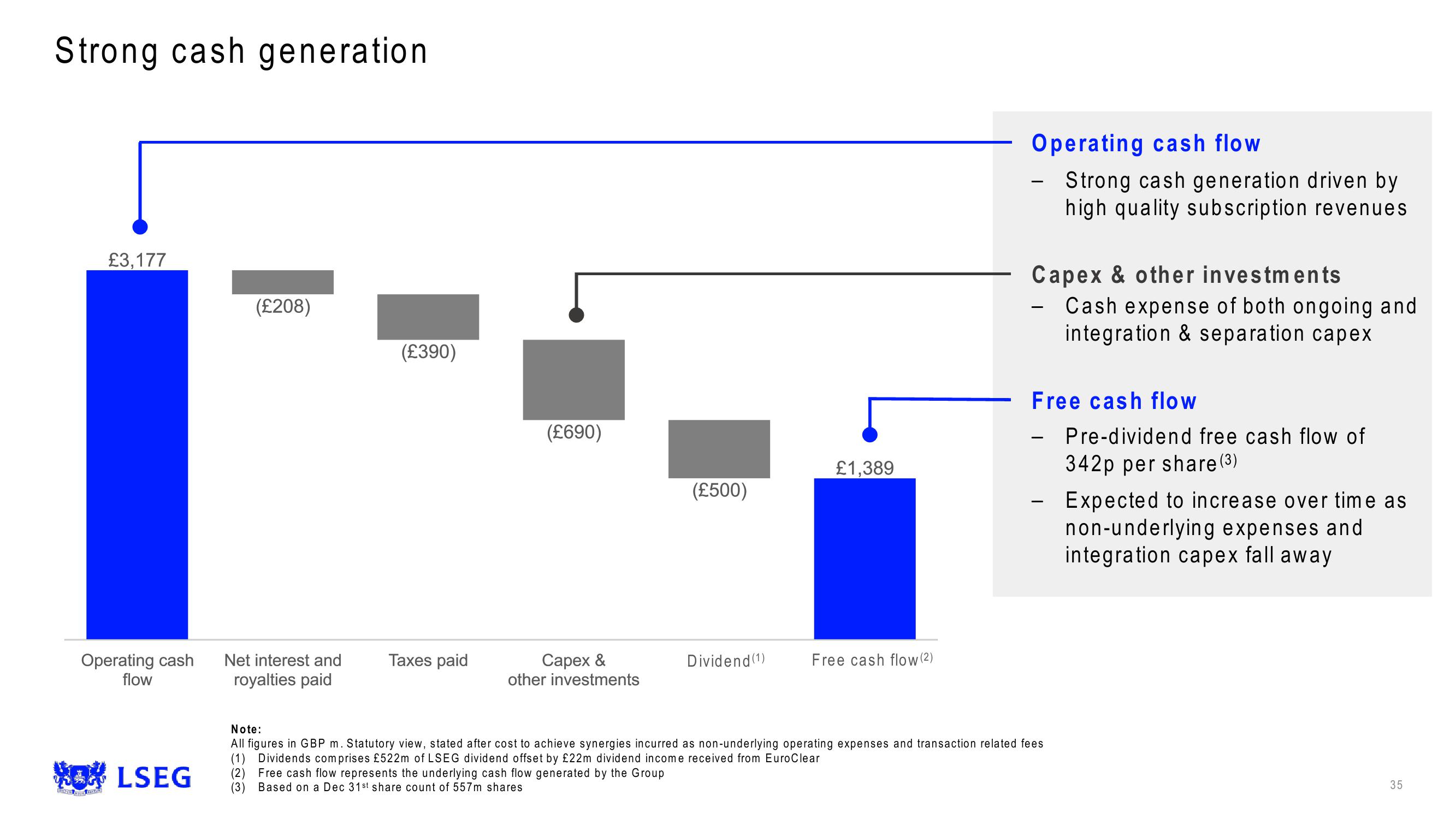

Strong cash generation

£3,177

Operating cash

flow

WOLSEG

(£208)

Net interest and

royalties paid

(£390)

Taxes paid

(£690)

Capex &

other investments

(£500)

(2) Free cash flow represents the underlying cash flow generated by the Group

(3) Based on a Dec 31st share count of 557m shares

Dividend (1)

£1,389

Free cash flow (2)

Operating cash flow

Strong cash generation driven by

high quality subscription revenues

Capex & other investments

- Cash expense of both ongoing and

integration & separation capex

Free cash flow

-

Note:

All figures in GBP m. Statutory view, stated after cost to achieve synergies incurred as non-underlying operating expenses and transaction related fees

(1) Dividends comprises £522m of LSEG dividend offset by £22m dividend income received from EuroClear

Pre-dividend free cash flow of

342p per share (3)

Expected to increase over time as

non-underlying expenses and

integration capex fall away

35View entire presentation