Silicon Valley Bank Results Presentation Deck

Securities balances declined as deposit net outflows limited securities purchases

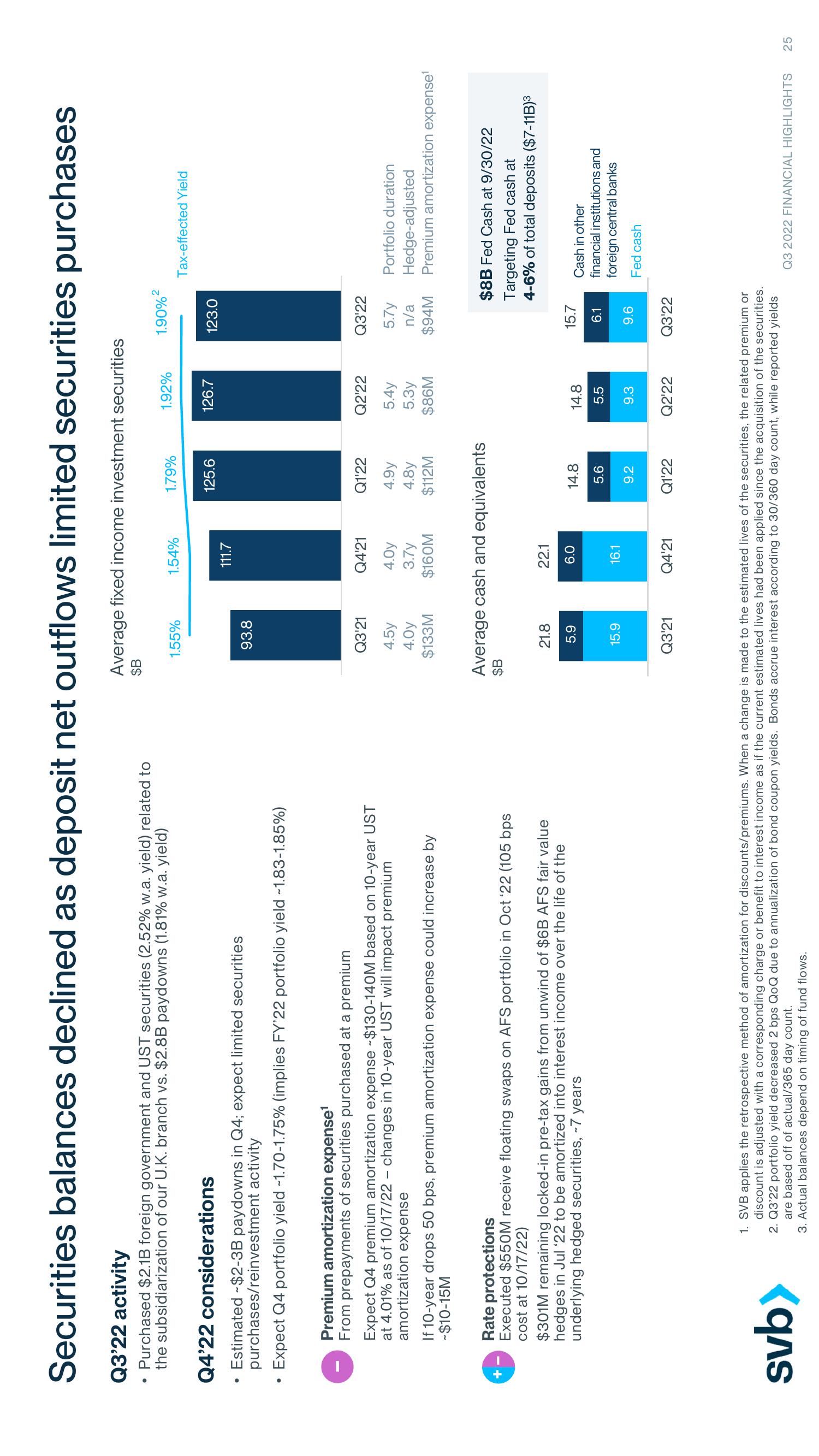

Q3'22 activity

Purchased $2.1B foreign government and UST securities (2.52% w.a. yield) related to

the subsidiarization of our U.K. branch vs. $2.8B paydowns (1.81% w.a. yield)

●

Q4'22 considerations

Estimated $2-3B paydowns in Q4; expect limited securities

purchases/reinvestment activity

• Expect Q4 portfolio yield ~1.70-1.75% (implies FY'22 portfolio yield ~1.83-1.85%)

Premium amortization expense¹

From prepayments of securities purchased at a premium

Expect Q4 premium amortization expense -$130-140M based on 10-year UST

at 4.01% as of 10/17/22 - changes in 10-year UST will impact premium

amortization expense

If 10-year drops 50 bps, premium amortization expense could increase by

~$10-15M

Rate protections

Executed $550M receive floating swaps on AFS portfolio in Oct 22 (105 bps

cost at 10/17/22)

$301M remaining locked-in pre-tax gains from unwind of $6B AFS fair value

hedges in Jul '22 to be amortized into interest income over the life of the

underlying hedged securities, ~7 years

svb>

Average fixed income investment securities

$B

1.55%

93.8

Q3'21

4.5y

4.0y

$133M

21.8

5.9

15.9

1.54%

Q3'21

111.7

Q4'21

4.0y

3.7y

$160M

Average cash and equivalents

$B

22.1

6.0

16.1

1.79%

Q4'21

125.6

Q1'22

4.9y

4.8y

$112M

14.8

5.6

9.2

Q1'22

1.92%

126.7

Q2'22

5.4y

5.3y

$86M

14.8

5.5

9.3

Q2'22

1.90%²

123.0

Q3'22

5.7y Portfolio duration

n/a

$94M

15.7

6.1

9.6

Tax-effected Yield

Q3'22

$8B Fed Cash at 9/30/22

Targeting Fed cash at

4-6% of total deposits ($7-11B)³

1. SVB applies the retrospective method of amortization for discounts/premiums. When a change is made to the estimated lives of the securities, the related premium or

discount is adjusted with a corresponding charge or benefit to interest income as if the current estimated lives had been applied since the acquisition of the securities.

2. Q3'22 portfolio yield decreased 2 bps QoQ due to annualization of bond coupon yields. Bonds accrue interest according to 30/360 day count, while reported yields

are based off of actual/365 day count.

3. Actual balances depend on timing of fund flows.

Hedge-adjusted

Premium amortization expense¹

Cash in other

financial institutions and

foreign central banks

Fed cash

Q3 2022 FINANCIAL HIGHLIGHTS 25View entire presentation