HashiCorp Investor Day Presentation Deck

44

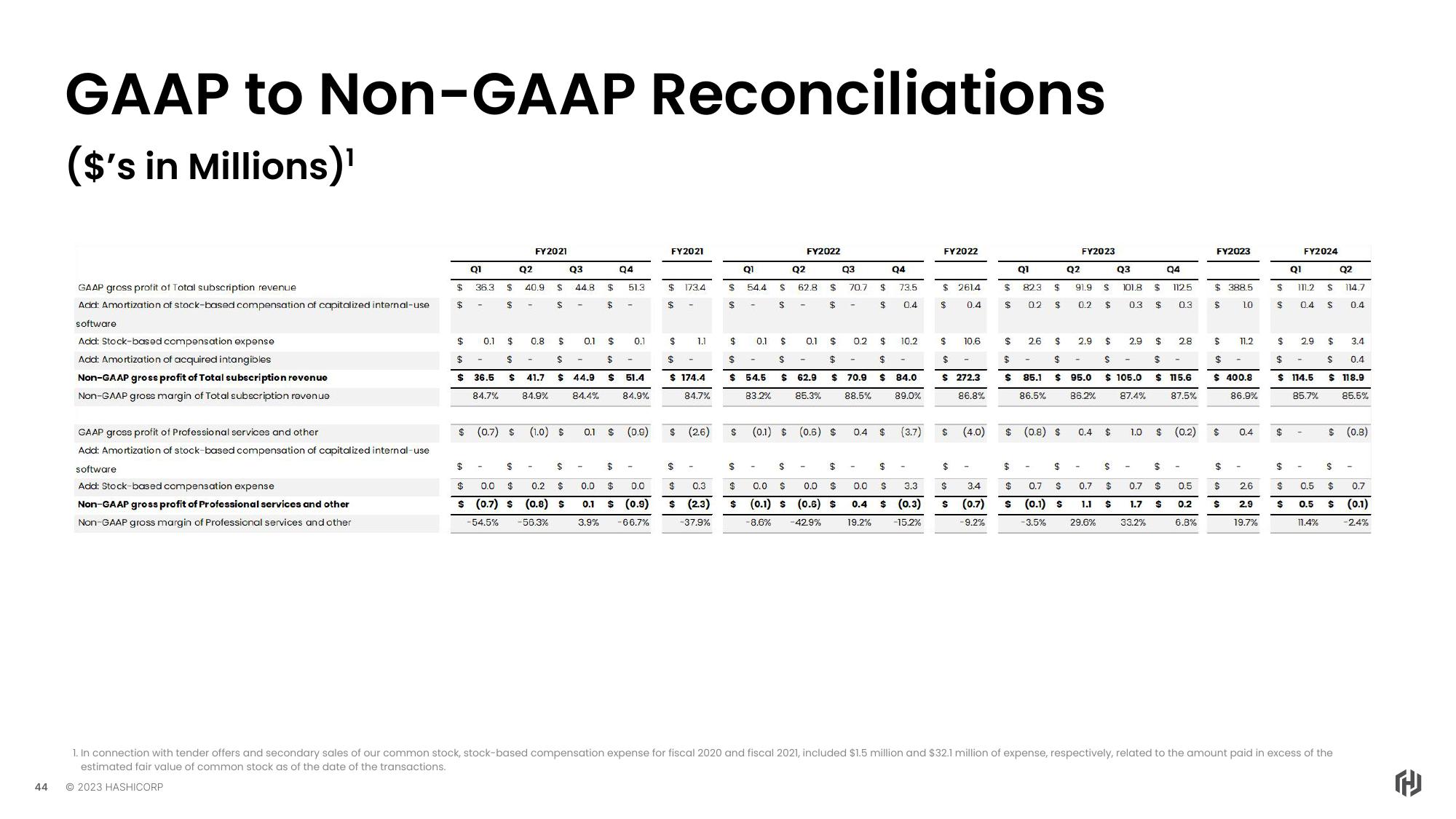

GAAP to Non-GAAP Reconciliations

($'s in Millions)¹

GAAP gross profit of Total subscription revenue

Add: Amortization of stock-based compensation of capitalized internal-use

software

Add: Stock-based compensation expense

Add: Amortization of acquired intangibles

Non-GAAP gross profit of Total subscription revenue

Non-GAAP gross margin of Total subscription revenue

GAAP gross profit of Professional services and other

Add: Amortization of stock-based compensation of capitalized internal-use

software

Add: Stock-based compensation expense

Non-GAAP gross profit of Professional services and other

Non-GAAP gross margin of Professional services and other

$

$

Q1

36.3 $

$

$

$

$ 36.5

$

0.1

84.7%

$ (0.7) $

Q2

$

40.9

S

$

$

S 41.7

FY2021

0.8

84.9%

-

S

$

$

$

$

(1.0) $

S

$

0.0 $

0.2 $

$ (0.7) $ (0.8) $

-54.5% -56.3%

Q3

Q4

44.8 $ 51.3

$

$

$

44.9 $ 51.4

84.4%

84.9%

0.1

0.1

0.1

$ (0.9)

$

0.0

$ 0.0

0.1 $ (0.9)

3.9% -66.7%

FY2021

$

$

$

173.4

1.1

$

$ 174.4

$

84.7%

$ (2.6)

0.3

$ (2.3)

-37.9%

01

$ 54.4

$

$

0.1 $

$

S

$ 54.5 $ 62.9

85.3%

83.2%

FY2022

Q2

$ 62.8 $

S

$

$ (0.1) $

0.1

(0.6) $

Q3

$

S

$

0.0 $

$ 0.0 $

$ (0.1) S (0.6) S

-8.6%

-42.9%

70.7

-

$

$

$ 70.9

$

$

88.5%

Q4

0.4 $

73.5

0.4

0.2 $ 10.2 $ 10.6 $ 2.6

$

$ 84.0

89.0%

FY2022

Q1

Q2

$ 261.4

$ 0.4

12

2.9 $ 2.9

$

$

$

$ 272.3

$ 85.1

86.8%

86.5%

86.2%

(3.7) $ (4.0)

$

0.0 $ 3.3

0.4 $ (0.3)

19.2%

-15.2%

$

$

3.4

S (0.7)

-9.2%

Q4

$ 823 $ 91.9 $ 101.8 $ 1125

$ 0.2 $ 0.2 $ 0.3 $

0.3

$ (0.8) $

FY2023

$

$

$ 0.7 $

$ (0.1) S

-3.5%

$

$

95.0 $ 105.0 $ 115.6

87.4%

87.5%

0.4

Q3

$

0.7 $

$

1.1

29.6%

$ 1.0 $ (0.2)

28

33.2%

$

FY2023

$ 388.5

$

10

$

$

0.7 $ 0.5 $

$

1.7 $ 0.2

6.8%

11.2

$

$ 400.8

86.9%

$ 0.4

2.6

2.9

19.7%

$

$

$

Q1

$

FY2024

Q2

111.2 $ 114.7

0.4 S

0.4

2.9 $

$

$ 114.5

85.7%

3.4

S 0.4

$ 118.9

85.5%

$ (0.8)

$

S

$

0.5 $ 0.7

$ 0.5 $ (0.1)

-2.4%

11.4%

1. In connection with tender offers and secondary sales of our common stock, stock-based compensation expense for fiscal 2020 and fiscal 2021, included $1.5 million and $32.1 million of expense, respectively, related to the amount paid in excess of the

estimated fair value of common stock as of the date of the transactions.

© 2023 HASHICORPView entire presentation